Get the free Manage Your MoneY - OSU Extension Perry County - The Ohio ... - perry osu

Show details

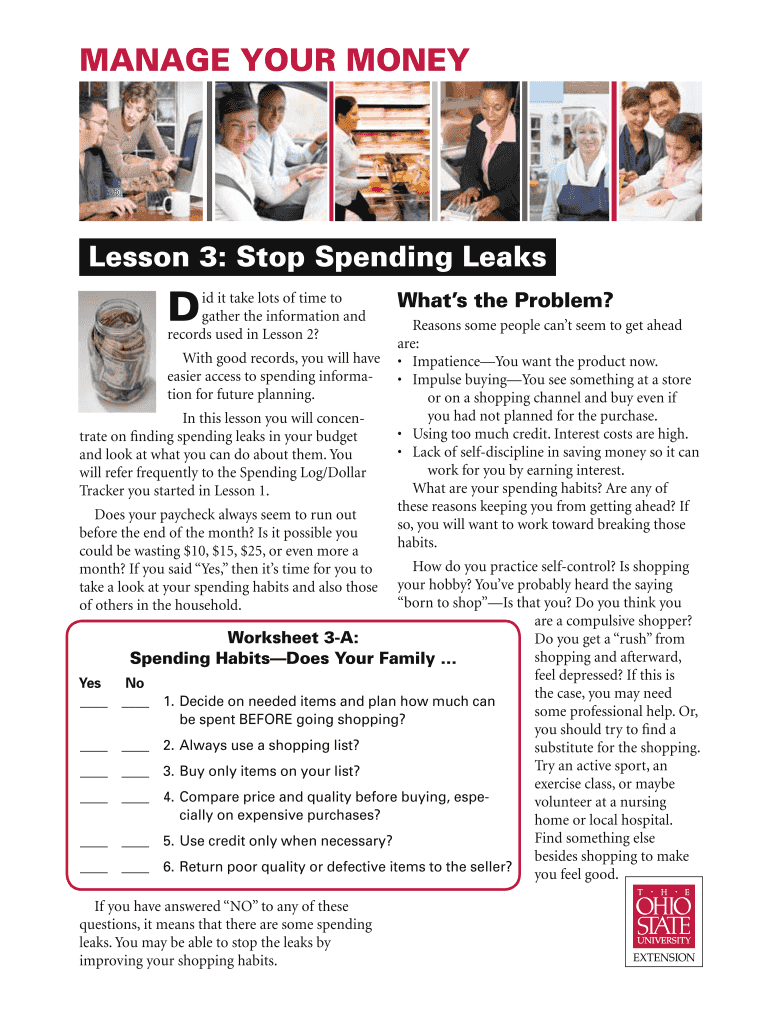

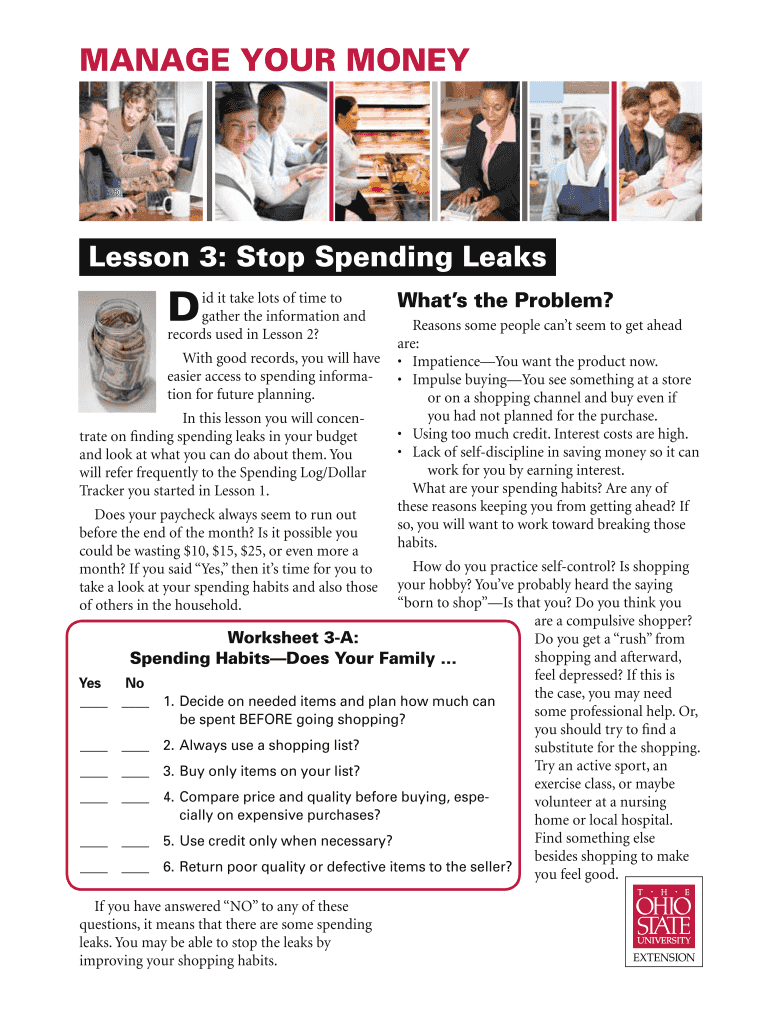

Manage Your Money Lesson 3: Stop Spending Leaks. D ID it takes lots of time to gather the information and records used in Lesson 2? With good records, you will have easier access to spending information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manage your money

Edit your manage your money form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manage your money form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manage your money online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit manage your money. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manage your money

How to Manage Your Money:

01

Start by creating a budget: Identify your income sources and track your expenses. This will give you a clear understanding of where your money is going and help you make necessary adjustments to meet your financial goals.

02

Track your expenses: Keep a record of all your purchases, bills, and expenditures. This will help you identify unnecessary expenses and find ways to cut back on them.

03

Set financial goals: Define your short-term and long-term financial goals. Whether it's saving for a vacation or planning for retirement, having specific goals will motivate you to manage your money effectively.

04

Prioritize your spending: Differentiate between needs and wants. Allocate your money towards essential expenses like housing, utilities, and groceries before indulging in discretionary spending.

05

Create an emergency fund: Set aside a portion of your income for unexpected expenses or emergencies. Aim to have at least three to six months' worth of living expenses saved in case of job loss or other unforeseen circumstances.

06

Save for the future: Invest in your future by setting aside a portion of your income for retirement savings. Consider consulting a financial advisor to help you make informed investment decisions.

07

Pay off debts: Prioritize paying off high-interest debts, such as credit card balances or personal loans. Make consistent payments to reduce your debt burden and improve your financial situation.

08

Explore additional income sources: Consider side jobs or freelancing opportunities to increase your income. This extra money can be directed towards savings, debt repayment, or fulfilling your financial goals.

Who Needs to Manage Their Money?

01

Individuals and families: Managing money is essential for individuals and families who want to lead a financially stable life. It helps in achieving financial independence, meeting financial goals, and reducing stress related to money matters.

02

Young adults: Starting early with money management enables young adults to build good financial habits and secure their future finances. Learning to manage money at a young age can prevent unnecessary debt and financial struggles later in life.

03

Entrepreneurs and business owners: Managing money is crucial for entrepreneurs and business owners to ensure the sustainability and growth of their ventures. Effective financial management helps in tracking expenses, managing cash flow, and making informed business decisions.

04

Students: Students also need to manage their money to cover their education expenses, avoid unnecessary debt, and develop good financial habits for the future. Learning money management skills early can set them up for financial success in their adult lives.

05

Retirees: Retirees need to manage their money prudently to ensure they have enough savings to sustain their desired lifestyle during retirement. Effective money management can help retirees make the most of their retirement funds and navigate financial challenges they may face.

By following these steps and recognizing the importance of managing money, anyone can improve their financial well-being and work towards a more secure financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send manage your money to be eSigned by others?

Once you are ready to share your manage your money, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in manage your money without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing manage your money and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit manage your money on an Android device?

The pdfFiller app for Android allows you to edit PDF files like manage your money. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is manage your money?

Manage your money is the process of handling your finances in a way that helps you achieve your financial goals.

Who is required to file manage your money?

Anyone who wants to effectively track their income, expenses, and savings is required to manage their money.

How to fill out manage your money?

You can fill out manage your money by creating a budget, tracking your expenses, setting financial goals, and regularly reviewing your financial situation.

What is the purpose of manage your money?

The purpose of manage your money is to improve your financial well-being, achieve financial goals, and maintain financial stability.

What information must be reported on manage your money?

Information such as income sources, expenses, savings, investments, debts, and financial goals must be reported on manage your money.

Fill out your manage your money online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manage Your Money is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.