Get the free Simple IRA Employer Guide Quik Form by Efficient Technology Inc

Show details

John Hancock Investments SIMPLE IRA Employer guide and adoption agreement A great retirement plan solution for small businesses EMPLOYER DOCUMENTS Simply put, it's a great retirement plan A SIMPLE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simple ira employer guide

Edit your simple ira employer guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simple ira employer guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit simple ira employer guide online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit simple ira employer guide. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simple ira employer guide

How to fill out Simple IRA employer guide:

01

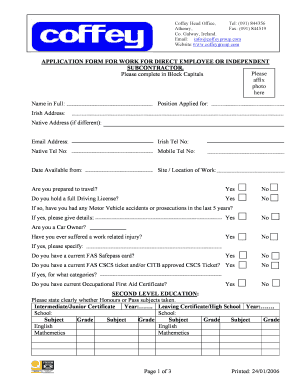

Start by gathering all the necessary information and documents required to set up a Simple IRA plan for your employees. This may include personal details, Social Security numbers, and employment information.

02

Review the guidelines provided in the Simple IRA employer guide thoroughly. Familiarize yourself with the eligibility requirements, contribution limits, and other important details outlined in the guide.

03

Determine the contribution rates for both yourself as the employer and your employees. This should be a percentage of each employee's salary, subject to the annual limits set by the IRS.

04

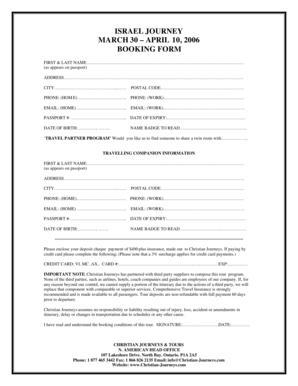

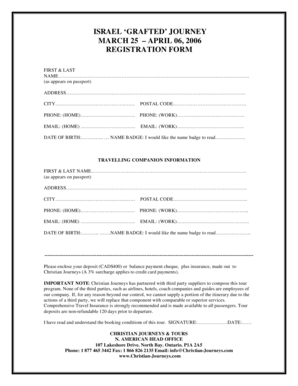

Complete the necessary paperwork, such as the IRS Form 5304-SIMPLE or 5305-SIMPLE, which serves as the plan document and the employee salary reduction agreement. Ensure accuracy and keep copies for your records.

05

Establish a Simple IRA account with a financial institution that offers this type of retirement plan. Provide all the required information and submit the necessary forms to open the account.

06

Obtain the consent of each eligible employee who wishes to participate in the Simple IRA plan. Distribute the necessary forms and ensure that each employee understands the benefits and obligations of the plan.

07

Once the accounts are set up and enrollment forms are collected, begin processing contributions. Deduct the agreed-upon percentage from each employee's salary and submit both the employee and employer contributions to the financial institution in a timely manner.

08

Keep accurate records of all contributions made and ensure that each employee's account is properly credited with the corresponding amounts.

09

Review the Simple IRA employer guide periodically to stay up to date with any changes or updates to the rules and regulations governing this retirement plan. Make necessary adjustments to your plan as needed.

Who needs Simple IRA employer guide?

01

Employers who want to offer a retirement plan to their employees but do not want the administrative complexity associated with traditional 401(k) plans may benefit from using a Simple IRA.

02

Small business owners looking for a cost-effective retirement savings option for themselves and their employees.

03

Employers who want to provide their employees with a simple and accessible way to save for retirement while receiving potential tax advantages.

04

Companies with fewer than 100 employees who meet the eligibility requirements laid out in the Simple IRA employer guide.

Remember, it is always advisable to consult with a financial advisor or retirement plan specialist to ensure compliance with all legal and regulatory requirements when setting up and administering a Simple IRA plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in simple ira employer guide?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your simple ira employer guide to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out simple ira employer guide using my mobile device?

Use the pdfFiller mobile app to complete and sign simple ira employer guide on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit simple ira employer guide on an iOS device?

Create, edit, and share simple ira employer guide from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is simple ira employer guide?

Simple IRA employer guide is a document that provides information and instructions for employers on setting up and managing a Simple IRA (Savings Incentive Match Plan for Employees Individual Retirement Account) for their employees.

Who is required to file simple ira employer guide?

Employers who offer a Simple IRA plan to their employees are required to file the Simple IRA employer guide.

How to fill out simple ira employer guide?

To fill out the Simple IRA employer guide, employers must provide information about the plan, including employee contributions, employer contributions, and investment options.

What is the purpose of simple ira employer guide?

The purpose of the Simple IRA employer guide is to help employers understand and comply with the rules and regulations governing Simple IRA plans.

What information must be reported on simple ira employer guide?

The Simple IRA employer guide must include information about employee contributions, employer contributions, investment options, and any other relevant plan details.

Fill out your simple ira employer guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Simple Ira Employer Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.