Get the free Miscellaneous Professional Liability Insurance Application

Show details

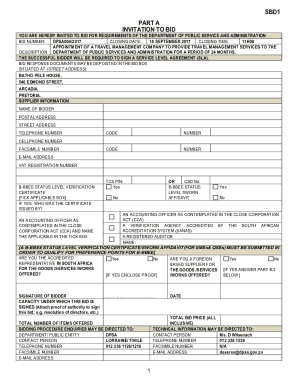

This document is an application for a claims made professional liability insurance policy, detailing the information required for underwriting and pricing evaluation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign miscellaneous professional liability insurance

Edit your miscellaneous professional liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your miscellaneous professional liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit miscellaneous professional liability insurance online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit miscellaneous professional liability insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out miscellaneous professional liability insurance

How to fill out Miscellaneous Professional Liability Insurance Application

01

Start by gathering all necessary business information, including your business name, address, and contact details.

02

Provide a detailed description of the services your business offers, as this helps to assess risks involved.

03

Indicate the years of experience in your profession and any relevant qualifications or certifications.

04

List any previous insurance policies you have held and their coverage amounts.

05

Answer questions regarding any past claims or incidents that may impact coverage.

06

Specify the limits of liability coverage you are seeking.

07

Review the application thoroughly to ensure all information is accurate and complete.

08

Sign and date the application before submission.

Who needs Miscellaneous Professional Liability Insurance Application?

01

Professionals offering services in areas such as consulting, legal, accounting, and healthcare.

02

Businesses that provide advice or solutions to clients and need protection against potential claims.

03

Freelancers and independent contractors in specialized fields who may face risks from client interactions.

04

Any organization that could be held liable for errors or omissions in the services rendered.

Fill

form

: Try Risk Free

People Also Ask about

What does a professional liability policy cover?

Professional liability policies typically cover legal defense costs associated with defending against claims of professional negligence. These costs can include attorney fees, court costs, and expert witness fees.

What is the meaning of MISC insurance?

Miscellaneous Insurance refers to contracts of insurance other than those of Life, Fire and Marine insurance. It covers a variety of risks, the chief of which are:- Personal Accident insurance.

What is a miscellaneous professional liability policy?

Although professional liability can help, MPL provides specific coverage for cases of negligence, errors, or omissions when performing professional services. While many professional lawsuits prove baseless, MPL insurance is a worthwhile product for clients at high risk of alleged professional negligence.

What is an example of a professional liability claim?

In general, most professional liability lawsuits arise from the professional's failure (real or alleged). This can vary widely across professions and industries. Mistakes, Errors, and Oversights: A tax preparer makes a mistake while preparing their client's federal return and miscalculates what the client owes.

What is miscellaneous professional liability?

Miscellaneous Professional Liability (MPL) is designed to equip service providers with comprehensive coverage and arm them with the knowledge needed to navigate common allegations, such as errors, omissions, and failure to meet customer expectations.

How is a professional liability policy written?

Professional liability insurance policies are generally set up based on a claims-made and reported basis, meaning that the policy covers only those claims made and reported to their carrier during the policy period.

Is MPL the same as E&O?

Miscellaneous Professional Liability (MPL) is a type of insurance that provides protection to individuals and businesses from lawsuits or claims arising from errors or omissions in their professional services. This type of insurance is often referred to as errors and omissions (E&O) insurance.

What does MPL insurance cover?

Miscellaneous Professional Liability (MPL) is a type of insurance that provides protection to individuals and businesses from lawsuits or claims arising from errors or omissions in their professional services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Miscellaneous Professional Liability Insurance Application?

Miscellaneous Professional Liability Insurance Application is a document used by professionals to apply for insurance coverage that protects against claims of negligence, errors, or omissions in the course of providing professional services.

Who is required to file Miscellaneous Professional Liability Insurance Application?

Professionals providing a variety of services, such as consultants, graphic designers, or IT specialists, may be required to file this application to secure liability coverage relevant to their specific profession.

How to fill out Miscellaneous Professional Liability Insurance Application?

To fill out the application, applicants should provide accurate information about their business, services offered, prior claims history, and any risk management practices in place, ensuring all sections are completed thoroughly.

What is the purpose of Miscellaneous Professional Liability Insurance Application?

The purpose of this application is to gather essential information that insurers use to assess risk and determine premiums for coverage against claims related to professional services.

What information must be reported on Miscellaneous Professional Liability Insurance Application?

Applicants must report information such as their business name, type of services provided, professional qualifications, experience, revenue projections, past claims, and any risk mitigation strategies implemented.

Fill out your miscellaneous professional liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Miscellaneous Professional Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.