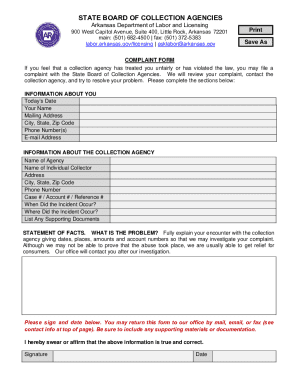

Get the free Complaint notice - Credit Union Department - Texas.gov - cud texas

Show details

Imprint Texas Credit Union Department Formulation de Queja Favor DE proportional today information possible en la form banjo, included duplicates (no Eve Los documents originals) de Los documents

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign complaint notice - credit

Edit your complaint notice - credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your complaint notice - credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit complaint notice - credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit complaint notice - credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out complaint notice - credit

How to fill out a complaint notice - credit:

01

Gather all relevant information: Start by collecting all the necessary details related to your credit complaint. This may include account numbers, dates of transactions, descriptions of the issue, and any supporting documents.

02

Identify the correct recipient: Determine who should receive your complaint notice. This can vary depending on the nature of the issue and the institution involved. It could be the credit card company, bank, or any other financial institution responsible for the credit in question.

03

Use a formal tone: When writing the complaint notice, maintain a polite and professional tone. Clearly explain the problem you encountered, providing specific details and supporting evidence if available. Avoid emotional language and focus on the facts.

04

Include relevant documentation: If you have any supporting documents such as billing statements, receipts, or correspondence related to the issue, make copies and include them with your complaint notice. This will help strengthen your case and provide evidence for your claims.

05

State your desired resolution: Clearly communicate what outcome you are seeking from your credit complaint. Whether it's a refund, correction of a mistake, or any other resolution, make sure to express it clearly in your notice.

06

Keep a copy and send it via certified mail: Make sure to keep a copy of your complaint notice for your records. Send the original notice via certified mail with a return receipt requested. This will provide proof that you submitted the complaint and ensure that it reaches the intended recipient.

Who needs a complaint notice - credit:

01

Individuals experiencing credit-related issues: Anyone who has encountered problems with their credit, such as unauthorized charges, billing errors, or incorrect information on their credit report may need to file a complaint notice.

02

Consumers seeking resolution or compensation: If you have tried to resolve a credit issue with the creditor or financial institution directly but have been unsuccessful, a complaint notice can be an effective way to escalate the matter and seek a resolution or compensation.

03

Individuals who want to protect their rights: Filing a complaint notice is an essential step for those who want to assert their rights as consumers. It allows you to formally document your concerns and seek assistance from regulatory bodies or consumer protection agencies if necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit complaint notice - credit from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your complaint notice - credit into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete complaint notice - credit online?

pdfFiller has made filling out and eSigning complaint notice - credit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit complaint notice - credit online?

With pdfFiller, it's easy to make changes. Open your complaint notice - credit in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is complaint notice - credit?

A complaint notice - credit is a formal document submitted by a consumer to report an issue or dispute related to a credit transaction.

Who is required to file complaint notice - credit?

Any consumer who has a credit transaction issue or dispute is required to file a complaint notice - credit.

How to fill out complaint notice - credit?

To fill out a complaint notice - credit, the consumer must provide their contact information, details of the credit transaction, and a description of the issue or dispute.

What is the purpose of complaint notice - credit?

The purpose of a complaint notice - credit is to formally document and report credit transaction issues or disputes for resolution.

What information must be reported on complaint notice - credit?

The consumer must report their contact information, details of the credit transaction, and a description of the issue or dispute on the complaint notice - credit.

Fill out your complaint notice - credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Complaint Notice - Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.