Get the free ASF Donation Form - Project No. 211045

Show details

A form for making donations to support the Australian sports development through the Australian Sports Foundation, specifically for the New South Wales Ski Association project.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign asf donation form

Edit your asf donation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your asf donation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing asf donation form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit asf donation form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out asf donation form

How to fill out ASF Donation Form - Project No. 211045

01

Start by downloading the ASF Donation Form for Project No. 211045 from the official website.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information, including your name, address, and contact details in the designated sections.

04

Specify the amount you wish to donate for Project No. 211045.

05

Indicate your preferred method of donation (e.g., credit card, bank transfer, etc.).

06

If applicable, include any relevant project references or details as requested.

07

Review the form for any errors or omissions.

08

Sign and date the form to confirm your donation.

09

Submit the filled-out form as instructed (e.g., via email, post, or online portal).

Who needs ASF Donation Form - Project No. 211045?

01

Individuals or organizations looking to support Project No. 211045.

02

Benefactors interested in contributing to the ASF's philanthropic initiatives.

03

Community members seeking to aid in development projects managed by the ASF.

04

Anyone who wants to make a positive impact through charitable donations.

Fill

form

: Try Risk Free

People Also Ask about

What does the ASF do?

The ASF is Australia's national non-profit sports fundraising organisation, and the only organisation in Australia to which donations for sport are tax-deductible.

What is the security transaction tax paid?

The tax rate for equity and index futures is 0.01% on the sell side of the transaction. For equity options, the rate is 0.0625% when the option is sold. If the option is exercised, the STT is 0.1% on the purchase side.

What is the special Defence tax?

The Special Defence Contribution is imposed on income from dividends, interest and rents received from tax residents whose home residence is in Cyprus. Persons who are not Cyprus tax residents are exempt from defence contribution.

What does AFS stand for in taxes?

Annual Financial Statements (AFS): These are formal, comprehensive reports prepared in accordance with recognised accounting standards (e.g. IFRS or IFRS for SMEs).

What is ASF tax?

The Australian Sports Foundation (ASF) is an item 1 Deductible Gift Recipient (DGR) specifically listed in the Income Tax Assessment Act 1997 (Subdivision 30-B, s30.

What is the purpose of the Foreign Account Tax Compliance Act?

The Foreign Account Tax Compliance Act (FATCA) is an important development in U.S. efforts to combat tax evasion by U.S. persons holding accounts and other financial assets offshore.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

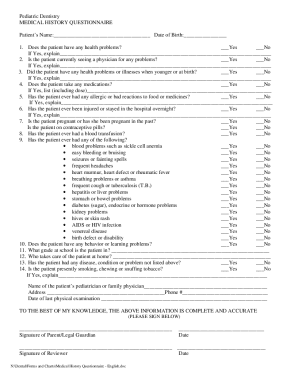

What is ASF Donation Form - Project No. 211045?

ASF Donation Form - Project No. 211045 is a document used to facilitate the reporting and tracking of donations made for a specific project under the ASF initiative.

Who is required to file ASF Donation Form - Project No. 211045?

Individuals or organizations that make contributions to Project No. 211045 are required to file the ASF Donation Form to ensure proper documentation and accountability of the donations.

How to fill out ASF Donation Form - Project No. 211045?

To fill out the ASF Donation Form, one must provide details including the donor's information, donation amount, date of donation, and any specific project allocations if applicable.

What is the purpose of ASF Donation Form - Project No. 211045?

The purpose of the ASF Donation Form is to document monetary or material contributions to Project No. 211045, ensuring transparency and proper management of funds received.

What information must be reported on ASF Donation Form - Project No. 211045?

The form must report the donor's name, contact information, donation amount, date of the contribution, and any conditions or instructions related to the donation.

Fill out your asf donation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Asf Donation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.