Get the free Flexible Spending Accounts - bmymchbborgb

Show details

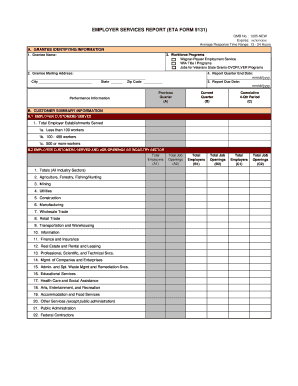

Flexible Spending Accounts What are they, and how do they work? Reimbursed Medical Account You can use pretax dollars to pay for your families expenses that are not reimbursed by your health insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible spending accounts

Edit your flexible spending accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible spending accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flexible spending accounts online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit flexible spending accounts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible spending accounts

How to fill out flexible spending accounts:

01

Gather necessary documents: Start by compiling all the required documents for filling out flexible spending accounts. This may include your medical receipts, eligible healthcare expenses, and any other relevant documents requested by your employer or the FSA provider.

02

Understand the eligible expenses: Familiarize yourself with the list of eligible expenses that can be paid for using flexible spending account funds. Common eligible expenses include medical and dental expenses, prescription medications, and certain over-the-counter items. Make sure you are aware of any restrictions or limitations that may apply.

03

Determine your contribution amount: Decide on the amount you want to contribute to your flexible spending account. This is usually done during your employer's open enrollment period. Consider your expected medical expenses for the year and select a contribution amount that aligns with your needs. Remember that any funds not used within the plan year may be forfeited, so try to estimate your expenses carefully.

04

Enroll in the flexible spending account: Once you have determined your contribution amount, follow your employer's instructions to enroll in the flexible spending account. This may involve filling out a form, accessing an online portal, or contacting the HR department. Provide all the necessary information accurately to ensure a smooth enrollment process.

05

Keep track of your expenses: Throughout the plan year, keep detailed records of your eligible expenses. This includes saving receipts and invoices, noting the date and purpose of each expense, and any other relevant documentation. Accurate record-keeping will help you when it comes time to submit reimbursement claims.

06

Submit reimbursement claims: When you have eligible expenses that need to be reimbursed, submit the reimbursement claim promptly. Follow the instructions provided by your employer or the FSA provider to complete the claim form. Make sure to attach all required documentation, such as receipts and invoices, to support your claim. Double-check everything before submitting to avoid any delays in the reimbursement process.

Who needs flexible spending accounts:

01

Individuals with regular medical expenses: Flexible spending accounts can be beneficial for individuals who have predictable medical expenses. If you frequently visit medical professionals, require prescription medications, or have ongoing treatments or therapies, having a flexible spending account can help you save on out-of-pocket costs.

02

Families with dependents: Families with children or other dependents may find flexible spending accounts advantageous. From routine check-ups to orthodontic treatments, childcare expenses to vision care, having a flexible spending account can help reduce the financial burden associated with healthcare costs for dependents.

03

Individuals planning for major medical procedures: If you are anticipating a major medical procedure or surgery in the near future, having a flexible spending account can help mitigate the costs. By contributing to the account throughout the plan year, you can use those funds to pay for medical expenses before meeting your insurance deductible or for any other eligible expenses related to the procedure.

04

Employees looking to lower taxable income: Contributions made to flexible spending accounts are typically made on a pre-tax basis, meaning they can help lower your taxable income. This can be particularly beneficial for employees who want to reduce their overall tax liability while also managing their healthcare expenses.

05

Individuals who value flexibility and control: Flexible spending accounts allow you to have more control over your healthcare expenses and provide flexibility in how you spend the allocated funds. With a wide range of eligible expenses, you have the freedom to use the funds on various medical and healthcare-related costs throughout the plan year.

In conclusion, filling out flexible spending accounts requires gathering the necessary documents, understanding eligible expenses, determining a contribution amount, enrolling in the account, keeping track of expenses, and submitting reimbursement claims. Flexible spending accounts are beneficial for individuals with regular medical expenses, families with dependents, those planning for major medical procedures, employees looking to lower taxable income, and individuals who value flexibility and control over their healthcare expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify flexible spending accounts without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your flexible spending accounts into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in flexible spending accounts?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your flexible spending accounts and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out flexible spending accounts on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your flexible spending accounts. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is flexible spending accounts?

Flexible spending accounts (FSAs) are accounts that allow employees to set aside pre-tax dollars for eligible medical expenses and dependent care expenses.

Who is required to file flexible spending accounts?

Employees who have opted to contribute to a flexible spending account through their employer's benefits package are required to file flexible spending accounts.

How to fill out flexible spending accounts?

Employees can fill out flexible spending accounts by documenting their eligible expenses and submitting receipts to their employer or the third-party administrator of the FSA.

What is the purpose of flexible spending accounts?

The purpose of flexible spending accounts is to help employees save money on eligible medical and dependent care expenses by using pre-tax dollars.

What information must be reported on flexible spending accounts?

Employees must report their eligible expenses, including medical bills and dependent care costs, on flexible spending accounts.

Fill out your flexible spending accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Spending Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.