Get the free Claim for Travelling Expenses

Show details

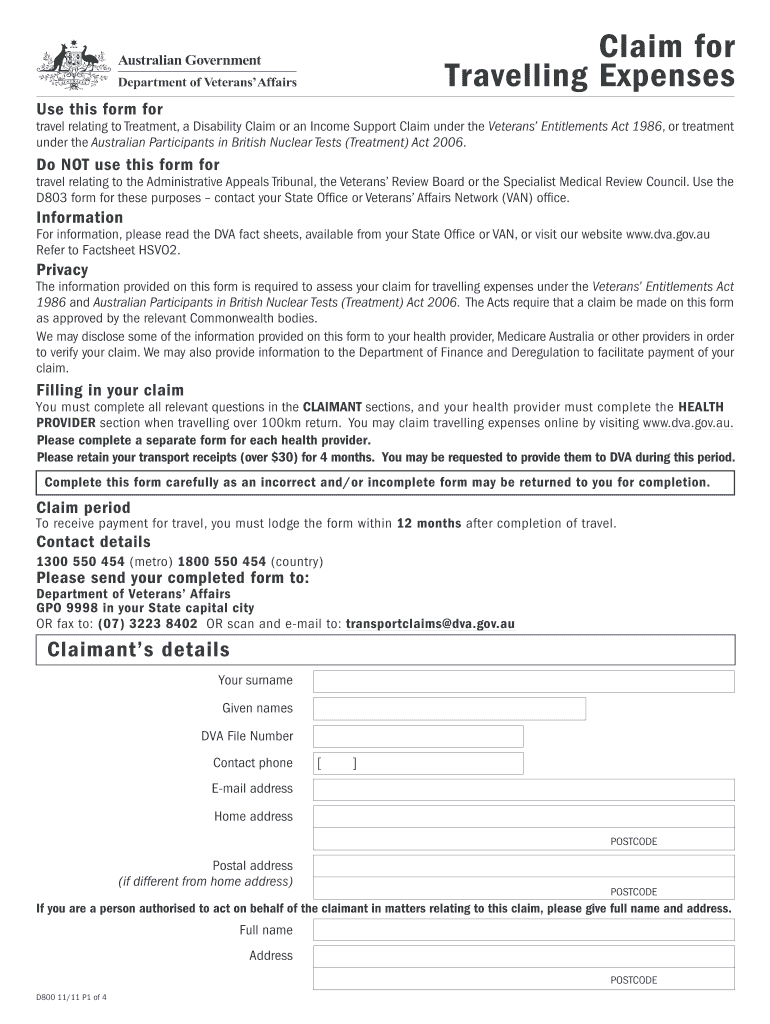

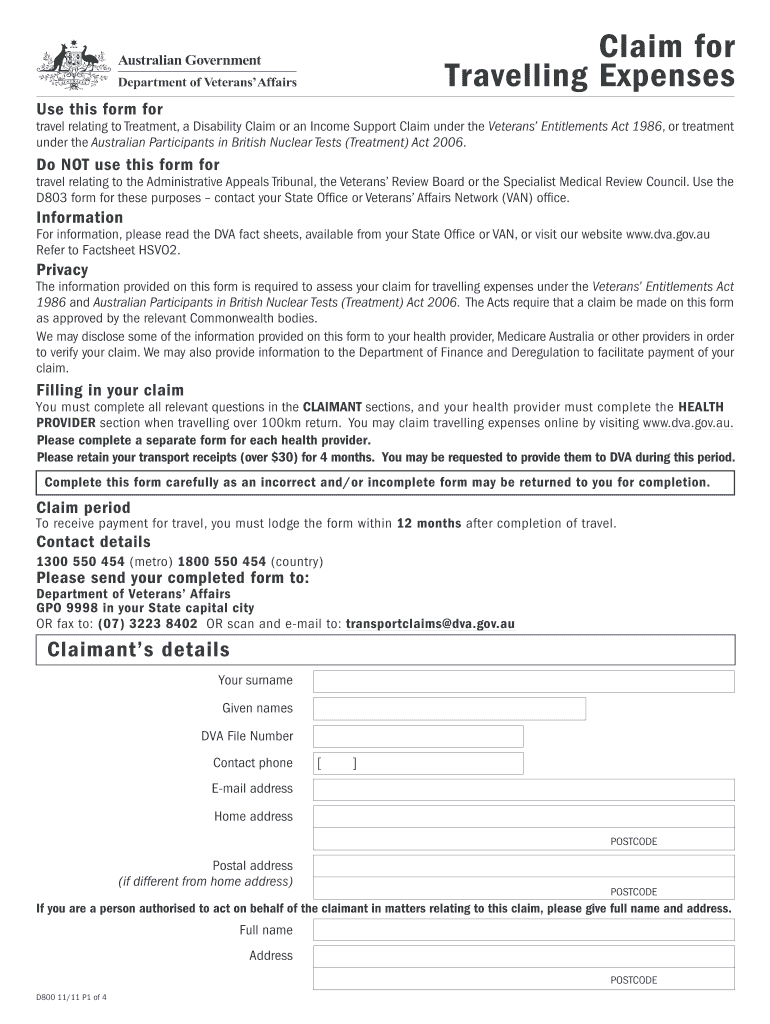

This form is used to claim travelling expenses related to treatment, disability claims, or income support claims under specific Acts. It provides guidelines on the use of the form, privacy information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for travelling expenses

Edit your claim for travelling expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for travelling expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for travelling expenses online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claim for travelling expenses. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for travelling expenses

How to fill out Claim for Travelling Expenses

01

Gather all necessary documentation, including receipts for travel expenses.

02

Obtain a Claim for Travelling Expenses form from your employer or the relevant administrative office.

03

Fill in your personal information at the top of the form, including your name, department, and employee ID.

04

List each travel expense separately, including the date of travel, purpose, destination, and amount spent.

05

Attach all relevant receipts to support your claims, ensuring they are organized and clearly labeled.

06

Calculate the total amount of expenses claimed and write it in the designated section of the form.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form along with all attachments to your supervisor or designated department for approval.

Who needs Claim for Travelling Expenses?

01

Employees who travel for work-related purposes and incur expenses for transportation, lodging, or meals.

02

Contractors or freelancers who are reimbursed for business travel by their clients.

03

Individuals attending conferences, training sessions, or business meetings that require travel.

Fill

form

: Try Risk Free

People Also Ask about

What is a travel claim?

The travel claim provides appropriate documentation that the travel occurred; enables the traveller to claim reimbursement of additional travel expenses; and, should the travel advance have exceeded the amount of reimbursable expenses, enables the traveller to repay the amount of overpayment.

How to account for travel expenses?

After the trip Collect and categorize receipts. Keep all receipts for flights, hotels, meals, and other business-related expenses incurred during the trip. Reconcile expenses with estimates. Compare your actual spending against the pre-trip estimates you made. Use a travel expense management software.

How to ask for reimbursement of travel expenses?

You should simply contact the person (or people) who is responsible for travel and expense reimbursements and ask them if there is anything that you can do to assist in processing your expense report.

What is a travel expense claim?

Travel expense reimbursement is the process by which companies pay back their employees for the charges they incur while traveling for business. These charges, typically categorized as T&E expenses, include airfare, hotel rooms, rental cars, rideshares, meals, client entertainment, and other travel arrangements.

What is the meaning of travel expense?

Travel Expenses refers to any cost that is paid for the purpose of traveling in order to carry out any business, profession or employment. Usually, a company pays the employees any travel expenses incurred while traveling for the purpose of work.

What falls under T&E?

T&E means "travel and expense" or "travel and entertainment." It refers to the expenses that arise while employees are traveling for business or entertaining clients. Common T&E expenses include meals, hotel bookings, and transportation costs such as flights, car rentals, and ride shares.

Can you claim travel costs?

Transport expenses: Public transport, taxis, and motor vehicle expenses when travelling between work sites. Accommodation costs: If your work requires you to stay overnight away from home, you can claim these costs. Meal expenses: Reasonable amounts spent on meals during overnight stays for work are deductible.

What is an example of an expense claim?

It could be for travel, food, or other business-related expenses. The employee collects receipts, tickets, and bills during the trip as proof of expense. These proofs could be flight tickets, food bills, hotel receipts, etc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Travelling Expenses?

A Claim for Travelling Expenses is a formal request for reimbursement of expenses incurred while traveling for business purposes, including transportation, accommodation, meals, and other travel-related costs.

Who is required to file Claim for Travelling Expenses?

Employees who incur expenses during business travel on behalf of their employer are typically required to file a Claim for Travelling Expenses to receive reimbursement.

How to fill out Claim for Travelling Expenses?

To fill out a Claim for Travelling Expenses, an individual must complete the designated expense report form, providing details such as travel dates, destinations, the purpose of the trip, itemized expenses, and attach relevant receipts.

What is the purpose of Claim for Travelling Expenses?

The purpose of a Claim for Travelling Expenses is to ensure that employees are reimbursed for necessary costs incurred while conducting business activities away from their regular workplace.

What information must be reported on Claim for Travelling Expenses?

The information that must be reported includes the traveler's name, dates of travel, locations, purpose of the trip, itemized list of expenses (e.g., transportation, lodging, meals), and corresponding receipts for verification.

Fill out your claim for travelling expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Travelling Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.