Get the free Income Tax Checklist

Show details

A checklist for gathering necessary information and documentation for income tax preparation, including personal information, dependents, estimated tax payments, income from various forms, and other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax checklist

Edit your income tax checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

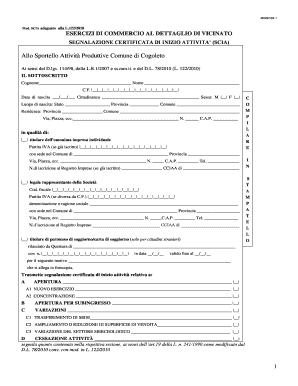

Editing income tax checklist online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income tax checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax checklist

How to fill out Income Tax Checklist

01

Gather all necessary documents including W-2s, 1099s, and receipts for deductible expenses.

02

Review the previous year's tax return for any consistent information.

03

Organize documents by category such as income, deductions, and credits.

04

Ensure you have personal information ready, including Social Security numbers for you and your dependents.

05

Check for any tax law changes that may affect deductions or credits.

06

List any additional income sources not covered by standard forms.

07

Calculate estimated deductions and take note of any available tax credits.

08

Fill out the checklist systematically, ensuring each item is addressed.

09

Keep copies of all completed forms and the checklist for your records.

Who needs Income Tax Checklist?

01

Individuals filing their own income taxes.

02

Small business owners reporting income and expenses.

03

Freelancers and gig workers who need to track their earnings.

04

Families claiming dependents and tax credits.

05

Anyone seeking to ensure they don't miss important tax-related documents or deductions.

Instructions and Help about income tax checklist

Fill

form

: Try Risk Free

People Also Ask about

How do I pay my income tax by check?

Mail the payment (check, cashier's check, or money order) to the U.S. Treasury with the completed Form 1040-V. Enter the amount on the payment method using all numbers, including cents. Include your full legal name, your address, daytime phone number, Social Security number, and tax year.

What must you list as income on your tax return?

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What are the 7 income tax brackets?

In the U.S., there are seven federal income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates will remain the same for both 2024 and 2025 because of the Tax Cuts and Jobs Act (TCJA). Contrary to popular belief, your income isn't generally taxed at a flat rate.

What are 5 things you will need to file your taxes?

Things to remember when filing 2023 tax returns Social Security numbers for everyone listed on the tax return. Bank account and routing numbers. Various tax forms such as W-2s, 1099s, 1098s and other income documents or records of digital asset transactions. Form 1095-A, Health Insurance Marketplace statement.

How do I write an income tax check?

Make the check or money order payable to the United States Treasury and provide the following information on the front of your payment: name. address. daytime phone number. taxpayer identification number. tax year, and. form or notice number (for example, 2024 Form 1040)

Who do I write the check out to for IRS?

Make your check or money order payable to “United States Treasury.” Don't send cash. If you want to pay in cash, in person, see Pay by cash, later. Make sure your name and address appear on your check or money order.

How do I send money to the IRS for taxes?

Other ways you can pay Same-day wire — Bank fees may apply. Check or money order — Through U.S. mail. Cash — Through a retail partner and other methods. Electronic funds withdrawal — During e-filing only.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my income tax checklist directly from Gmail?

income tax checklist and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send income tax checklist to be eSigned by others?

Once you are ready to share your income tax checklist, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete income tax checklist on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your income tax checklist, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

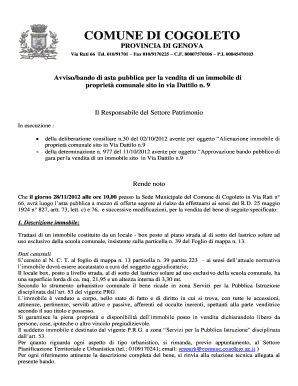

What is Income Tax Checklist?

An Income Tax Checklist is a document or list that helps individuals and businesses gather and organize the necessary information, documents, and forms required to accurately complete their income tax returns.

Who is required to file Income Tax Checklist?

Individuals and businesses that earn taxable income are generally required to file an Income Tax Checklist. This includes employees, self-employed individuals, freelancers, and corporations, depending on the local tax laws and income thresholds.

How to fill out Income Tax Checklist?

To fill out an Income Tax Checklist, gather all relevant financial documents, such as W-2 forms, 1099 forms, receipts for deductible expenses, and any other necessary paperwork. Then, systematically complete each section of the checklist to ensure all required information is documented.

What is the purpose of Income Tax Checklist?

The purpose of an Income Tax Checklist is to streamline the tax filing process by helping taxpayers ensure that they have all the required information and documents ready, which can prevent errors and minimize the risk of audits.

What information must be reported on Income Tax Checklist?

The information that must be reported on an Income Tax Checklist typically includes personal identification information, income sources, deductions, credits, and any other relevant financial details. This may also include details about property, investments, and health insurance coverage.

Fill out your income tax checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.