Get the free Financial Literacy Training - Prosper Canada

Show details

Financial Literacy Program

Consent and Release

(customize for your organization) is a charitable organization that works with community groups across Canada

to provide information, training, and supports

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial literacy training

Edit your financial literacy training form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial literacy training form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial literacy training online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial literacy training. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial literacy training

How to fill out financial literacy training?

01

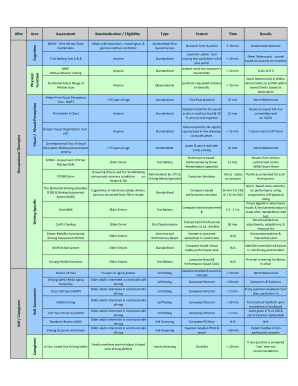

Start by identifying your goals and objectives for financial literacy training. Determine what specific topics or areas you want to focus on, such as budgeting, saving, investing, or debt management.

02

Research different options for financial literacy training. Look for courses, workshops, online resources, or educational programs that align with your goals. Consider factors such as the credibility of the provider, the format of the training (in-person or online), and the cost involved.

03

Register for the chosen financial literacy training program. Follow the instructions provided by the provider to sign up and pay for the training. Make sure to check any prerequisites or requirements that may be necessary for participation.

04

Attend the financial literacy training sessions or complete the online modules as instructed. Take notes, ask questions, and actively engage with the material to maximize your learning experience.

05

Participate in any practical exercises or activities included in the financial literacy training. These may involve creating a budget, analyzing your spending habits, or practicing investment strategies. Apply what you learn to real-life scenarios to enhance your understanding and proficiency.

06

Seek additional resources or support if needed. If you encounter complex concepts or have specific questions, don't hesitate to reach out to the training provider or seek guidance from financial professionals. Utilize books, articles, forums, or online communities that offer valuable insights and information about financial literacy.

07

Evaluate your progress and track your improvement throughout the training. Reflect on how the training has helped you in achieving your initial goals and adjust your approach if necessary.

Who needs financial literacy training?

01

Individuals who want to improve their financial knowledge and skills. Financial literacy training is beneficial for anyone who wants to strengthen their understanding of personal finance, money management, and financial decision-making.

02

Young adults and students who are transitioning into independence. Financial literacy training can equip them with the necessary skills to effectively manage their money, make informed financial decisions, and avoid potential pitfalls such as debt or financial instability.

03

Business owners and entrepreneurs. Financial literacy training can help them gain a deeper understanding of financial statements, cash flow management, and investment planning. This knowledge can contribute to more effective business strategies and decision-making.

04

Individuals facing financial challenges or seeking financial stability. Financial literacy training can provide them with tools and strategies to address debt, create and stick to a budget, manage their expenses, and work towards their financial goals.

05

Parents and caregivers who want to teach their children about financial responsibility. Financial literacy training can help them provide the necessary guidance and support to ensure their children develop healthy money habits from an early age.

In summary, financial literacy training is essential for individuals of all backgrounds and ages who want to enhance their financial knowledge and skills. By following the outlined steps and considering who can benefit from such training, individuals can make informed decisions about pursuing financial literacy education.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial literacy training?

Financial literacy training is a program designed to teach individuals how to manage their finances effectively.

Who is required to file financial literacy training?

Financial literacy training is typically required for professionals in the financial industry or those serving in a financial capacity.

How to fill out financial literacy training?

Financial literacy training can be filled out by attending workshops, seminars, or courses that cover topics related to financial management.

What is the purpose of financial literacy training?

The purpose of financial literacy training is to educate individuals on how to make informed and effective financial decisions.

What information must be reported on financial literacy training?

Information reported on financial literacy training may include topics covered, duration of training, and any certifications obtained.

How can I get financial literacy training?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific financial literacy training and other forms. Find the template you need and change it using powerful tools.

How do I execute financial literacy training online?

Easy online financial literacy training completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out financial literacy training on an Android device?

Complete financial literacy training and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your financial literacy training online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Literacy Training is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.