Get the free Hartford’s ERISA Bond Application Price Reference Sheet

Show details

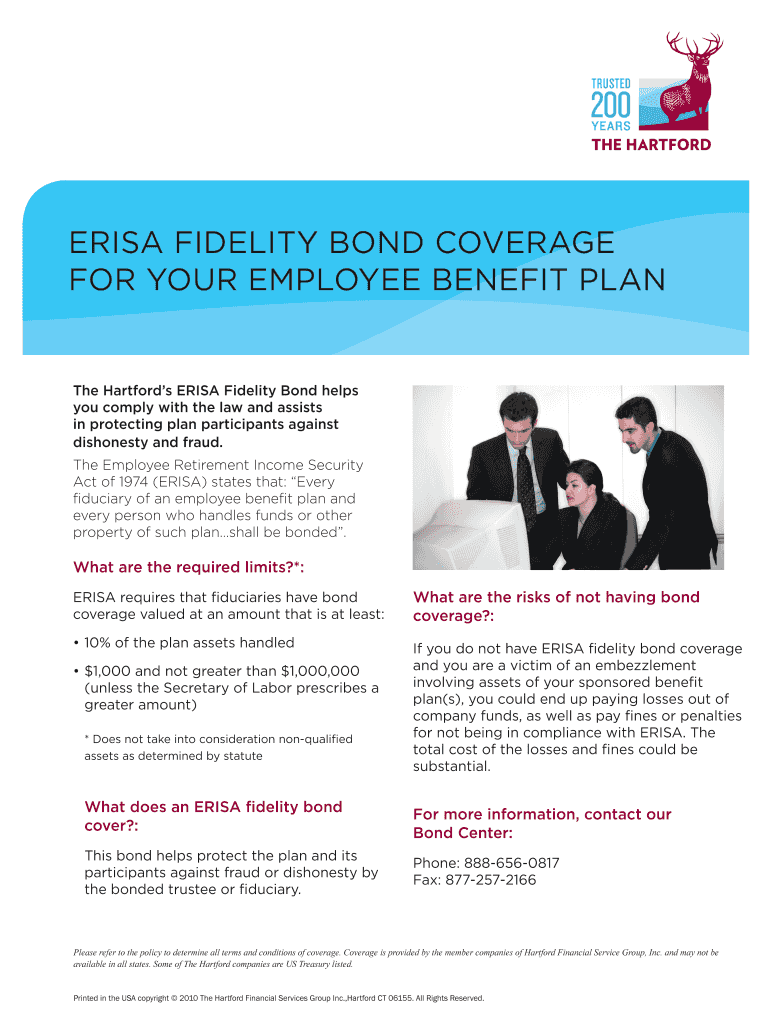

This document provides information about the ERISA Fidelity Bond, its requirements, coverage details, and premium rates for different bond limits, including contact information for further inquiries.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hartfords erisa bond application

Edit your hartfords erisa bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hartfords erisa bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hartfords erisa bond application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit hartfords erisa bond application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hartfords erisa bond application

How to fill out Hartford’s ERISA Bond Application Price Reference Sheet

01

Start by gathering all necessary business information including the applicant's name and address.

02

Provide details about the type of ERISA bond being applied for.

03

Fill in the estimated amount of the bond based on the value of the plan assets.

04

Indicate the duration for which the bond is required.

05

Include any additional information requested in the application form.

06

Review all entries for accuracy before submission.

07

Submit the completed application along with any required fees.

Who needs Hartford’s ERISA Bond Application Price Reference Sheet?

01

Employees of companies that manage employee benefit plans under ERISA.

02

Employers seeking to protect their employee benefit plans from potential fraud or dishonesty.

03

Insurance agents and brokers facilitating the ERISA bond application process.

Fill

form

: Try Risk Free

People Also Ask about

What are the rates for ERISA Bonds?

Retirement And/Or Health Plans With Company Securities Bond AmountSurety Bond RatePrice You Pay $100,000 1% $1,000 $100,000 1.5% $1,500 $100,000 2% $2,000 $100,000 2.5% $2,5002 more rows

Is Erisa Bond the same as fidelity bond?

ERISA states that all fiduciaries of employee benefits plans, and every person who comes into contact with plan assets, be bonded. ERISA fidelity bonds (also referred to as surety or fiduciary bonds) are required by law and, if invoked, cover any plan losses that result from fraud or dishonesty.

What is the minimum Erisa bond requirement?

A fidelity bond protects the assets in the plan from misuse or misappropriation by the plan fiduciaries. The bond must be equal to 10% of the value of the total plan assets, with a minimum bond value of $1,000 and a maximum bond value of $500,000.

How much ERISA bond do I need?

Under ERISA, each person must be bonded for at least 10% of the $1 million or $100,000. (Note: Bonds covering more than one plan may be required to be over $500,000 to meet the ERISA requirement because persons covered by a bond may handle funds or other property for more than one plan.)

How much is the Erisa bond?

Under ERISA, each person must be bonded for at least 10% of the $1 million or $100,000. (Note: Bonds covering more than one plan may be required to be over $500,000 to meet the ERISA requirement because persons covered by a bond may handle funds or other property for more than one plan.)

How are ERISA bonds calculated?

ERISA bonding requirements A plan official must be bonded for at least 10% of the amount of funds handled, subject to a minimum bond amount of $1,000 per plan. In most instances, the maximum bond amount that can be required under ERISA with respect to any one plan official is $500,000 per plan.

What happens if you don't have an ERISA bond?

What Happens if There's No ERISA Bond Coverage for the Plan? If a loss occurs due to a fiduciary's criminal act, such as fraud or theft, the person with fiduciary responsibilities will have to pay out-of-pocket for the losses. In other words, they will become personally liable for the losses.

How is fidelity bond coverage calculated?

3. How much fidelity bond coverage is required? At the beginning of each plan year, the coverage amount of the bond must be at least 10 percent of the amount of funds handled. The minimum bond amount is $1,000 and, in most cases, is not required to be more than $500,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Hartford’s ERISA Bond Application Price Reference Sheet?

Hartford’s ERISA Bond Application Price Reference Sheet is a document that outlines the pricing structure for ERISA bonds, providing essential details and guidelines for applicants.

Who is required to file Hartford’s ERISA Bond Application Price Reference Sheet?

Employers or plan administrators who are required to obtain ERISA bonds for their employee benefit plans must file Hartford’s ERISA Bond Application Price Reference Sheet.

How to fill out Hartford’s ERISA Bond Application Price Reference Sheet?

To fill out Hartford’s ERISA Bond Application Price Reference Sheet, applicants should provide completed information regarding their company, the type of ERISA bond being requested, and any necessary financial details as specified in the application.

What is the purpose of Hartford’s ERISA Bond Application Price Reference Sheet?

The purpose of Hartford’s ERISA Bond Application Price Reference Sheet is to facilitate the application process for obtaining ERISA bonds by providing a clear pricing reference and requirements for potential applicants.

What information must be reported on Hartford’s ERISA Bond Application Price Reference Sheet?

The information that must be reported includes the applicant's business details, the type and amount of the ERISA bond required, and any relevant financial data necessary for underwriting.

Fill out your hartfords erisa bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hartfords Erisa Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.