Get the free Your Professional Indemnity Insurance Policy is issued on a CLAIMS MADE basis

Show details

PROPOSAL FORM: PROFESSIONAL INDEMNITY INSURANCE IMPORTANT NOTICE PLEASE READ THE FOLLOWING ADVICE BEFORE COMPLETING THIS PROPOSAL From Your Professional Indemnity Insurance Policy is issued on a CLAIMS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your professional indemnity insurance

Edit your your professional indemnity insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your professional indemnity insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing your professional indemnity insurance online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit your professional indemnity insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

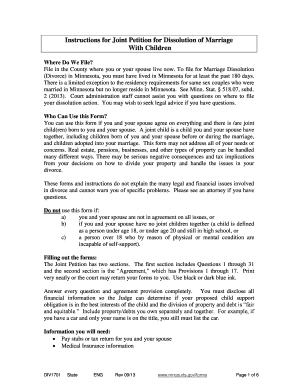

How to fill out your professional indemnity insurance

How to fill out your professional indemnity insurance:

01

Gather necessary information: Before filling out your professional indemnity insurance, gather all the relevant information you'll need. This includes details about your business, such as its name, address, and the services you provide. Additionally, you may need to provide information about your professional qualifications, any claims or incidents you've had in the past, and the coverage limits you require.

02

Choose the right insurer: Research and compare different insurance providers to find the one that offers the best professional indemnity insurance for your specific needs. Consider factors such as the insurer's reputation, coverage options, price, and customer service.

03

Complete the application form: Once you've selected an insurer, you'll need to fill out the application form for professional indemnity insurance. Provide accurate and detailed information in each section of the form. Double-check all the information you've entered to ensure its accuracy.

04

Provide supporting documents: In some cases, insurers may require supporting documents along with the application form. These documents could include any relevant contracts or agreements, financial statements, certificates of professional qualifications, or claims history reports. Make sure to provide these documents if requested.

05

Review and understand the policy terms: Carefully read through the policy terms and conditions provided by the insurer. Understand the coverage limits, exclusions, deductibles, and any additional clauses that may apply. If there are any uncertainties, seek clarification from the insurer before finalizing the application.

06

Pay the premium: Once you've completed the application form and reviewed the policy terms, you'll need to pay the premium for your professional indemnity insurance. The premium amount will depend on various factors, including the nature of your business, coverage limits, and claims history.

07

Keep copies for your records: Make copies of all the documents you've submitted, including the completed application form, supporting documents, and the payment receipt. These copies will be useful for future reference and in case you need to make any amendments to your policy.

Who needs professional indemnity insurance?

Professional indemnity insurance is essential for various professionals and businesses, including:

01

Accountants and financial advisors: Professionals providing financial advice or handling clients' financial accounts can benefit from professional indemnity insurance to protect against claims of negligence or errors in their services.

02

Architects and engineers: Professionals in the construction and design industry can face claims related to design flaws, errors, or omissions. Professional indemnity insurance can offer financial protection in such cases.

03

Legal professionals: Lawyers, solicitors, and law firms should have professional indemnity insurance to safeguard against claims arising from negligent advice or breaches of professional duty.

04

Medical practitioners: Doctors, surgeons, dentists, and other healthcare providers need professional indemnity insurance to protect against claims of medical negligence, malpractice, or errors in treatment.

05

IT consultants: Professionals providing computer programming, software development, or IT consultancy services can benefit from professional indemnity insurance to mitigate risks associated with data breaches, system failures, or copyright infringements.

06

Consultants and advisors in various industries: Professionals offering their expertise, advice, or consultancy services across different sectors, such as marketing, management, or human resources, can protect themselves from claims related to alleged failures or inadequate performance.

It is important to note that the need for professional indemnity insurance may vary depending on the specific risks associated with your profession or industry. It is advisable to consult with an insurance broker or expert to determine the appropriate coverage for your business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send your professional indemnity insurance to be eSigned by others?

Once you are ready to share your your professional indemnity insurance, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit your professional indemnity insurance in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your your professional indemnity insurance, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the your professional indemnity insurance in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your your professional indemnity insurance in minutes.

What is your professional indemnity insurance?

Professional indemnity insurance is a type of liability insurance that helps protect individuals and companies providing professional advice and services from bearing the full cost of defending against a negligence claim made by a client, and damages awarded in such a civil lawsuit.

Who is required to file your professional indemnity insurance?

Professionals such as doctors, lawyers, accountants, architects, engineers, and consultants are typically required to have professional indemnity insurance.

How to fill out your professional indemnity insurance?

You can fill out your professional indemnity insurance by providing accurate information about your professional practice, past claims history, coverage limits, and other relevant details requested by the insurance provider.

What is the purpose of your professional indemnity insurance?

The purpose of professional indemnity insurance is to protect professionals and their businesses from the financial consequences of negligence claims or allegations of professional misconduct made by clients.

What information must be reported on your professional indemnity insurance?

Information required on professional indemnity insurance typically includes details about the insured professional's practice, claims history, coverage limits, policy endorsements, and any other relevant information requested by the insurer.

Fill out your your professional indemnity insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Professional Indemnity Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.