Get the free Assurity Life Insurance Application

Show details

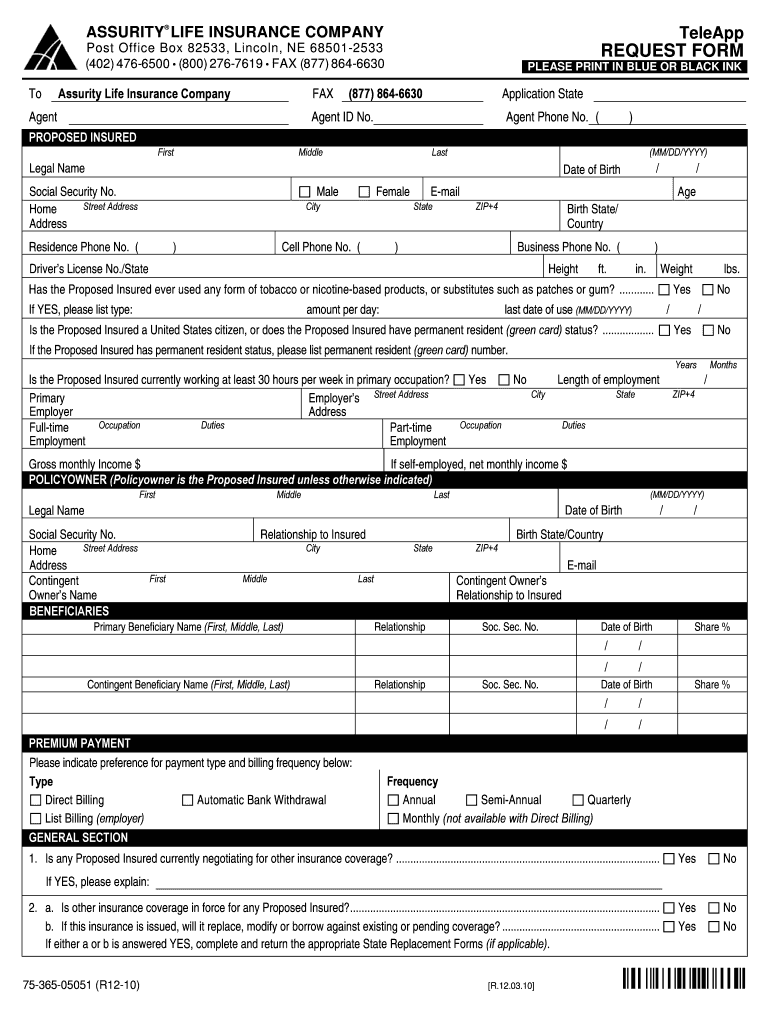

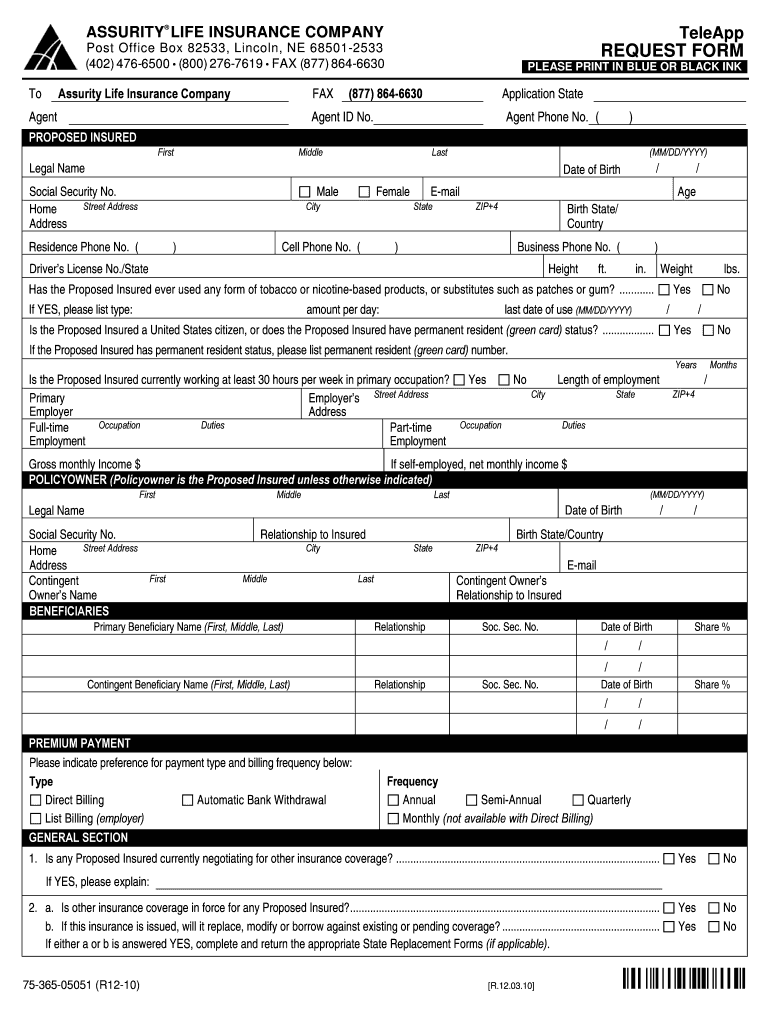

This document outlines the steps to apply for insurance coverage, including the information required, interview scheduling, and the application process for Assurity Life Insurance Company.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assurity life insurance application

Edit your assurity life insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assurity life insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit assurity life insurance application online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit assurity life insurance application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assurity life insurance application

How to fill out Assurity Life Insurance Application

01

Gather necessary personal information such as your name, address, and Social Security number.

02

Provide details about your employment, including your occupation and employer's name.

03

Disclose your medical history, including any past illnesses, surgeries, or medications.

04

Indicate your lifestyle habits, such as smoking or alcohol consumption.

05

Specify the coverage amount and type of policy you are applying for.

06

Review the application for accuracy and completeness before submitting.

07

Sign and date the application to validate your information.

Who needs Assurity Life Insurance Application?

01

Individuals seeking financial security for their beneficiaries in the event of their death.

02

Families wanting to cover final expenses or outstanding debts.

03

People looking to supplement existing life insurance policies.

04

Individuals in need of a safety net for dependents or loved ones.

05

Anyone planning for specific financial goals related to life insurance.

Fill

form

: Try Risk Free

People Also Ask about

Can life insurance be rejected?

Your term insurance claim might get rejected due to false information, policy lapse, undisclosed medical history, inaccurate information about policies, nonpayment of premiums, and more. Insurers rely on the details you provide to measure risk and assess coverage accurately.

How to get life insurance step by step?

How to buy life insurance Determine if you need to buy life insurance. Decide how you want to buy life insurance. Know what to look for when buying life insurance. Figure out which type of life insurance you need. Determine how much of a death benefit you need. Fill out and submit your application.

How honest should I be for life insurance?

When it comes to life insurance, don't lie. They will find your secret from a Facebook picture or something and then not pay a cent. If you are truthful, you may get denied or premiums raised, but they'll pay out if you speak truths.

What to ask when applying for life insurance?

Common Life Insurance Questions Do I really need life insurance? How do I buy life insurance? What is the “free to look” period? Is it true that some companies won't turn applicants down? What's the difference between term and permanent life insurance? What does “fully paid up” mean on a permanent life insurance policy?

What not to say when applying for life insurance?

One of the biggest mistakes applicants make is misrepresenting their health status. Whether it's omitting medical conditions, downplaying treatments, or skipping details about medications, insurers have ways of verifying your health history through medical exams and records.

Is Assurity a good life insurance company?

Stable and secure When you choose a company committed to long-term stability — not short-term gains — you can rely on us when it matters most. We're rated A- (Excellent) by AM Best.

What are the 4 P's of life insurance?

The document outlines the 4 P's of life insurance marketing: Product, Price, Placement, and Promotion. It emphasizes the importance of understanding different policy types, factors affecting premiums, choosing the right distribution channels, and implementing effective marketing strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Assurity Life Insurance Application?

The Assurity Life Insurance Application is a document that individuals fill out to apply for life insurance coverage offered by Assurity Life Insurance Company.

Who is required to file Assurity Life Insurance Application?

Individuals seeking life insurance coverage from Assurity Life Insurance Company are required to file the Assurity Life Insurance Application.

How to fill out Assurity Life Insurance Application?

To fill out the Assurity Life Insurance Application, applicants should provide personal information, including name, contact details, health history, and lifestyle information as requested in the application form.

What is the purpose of Assurity Life Insurance Application?

The purpose of the Assurity Life Insurance Application is to collect necessary information from applicants to assess their eligibility for life insurance and determine the premium rates.

What information must be reported on Assurity Life Insurance Application?

The information that must be reported on the Assurity Life Insurance Application includes personal identification details, health history, details of any existing insurance, and lifestyle choices such as smoking or hazardous activities.

Fill out your assurity life insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assurity Life Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.