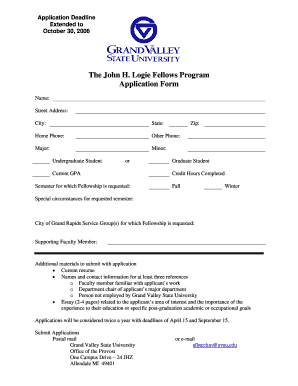

ANSC Descriptive listing Catalog 2013 free printable template

Show details

AUXILIARY NATIONAL SUPPLY CENTER DESCRIPTIVE LISTING CATALOG WITH CROSS-INDEX AND REVISION DATES FAX: 618-452-4249 ON-LINE SEE: CHIEF DIRECTOR AUXILIARY DIVISION (CG-5421) http://www.uscg.mil/auxiliary/publications/default.asp

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign online filling coastguard 2013

Edit your online filling coastguard 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online filling coastguard 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing online filling coastguard 2013 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit online filling coastguard 2013. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ANSC Descriptive listing Catalog Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out online filling coastguard 2013

How to fill out ANSC Descriptive listing Catalog

01

Gather all necessary information about the items you want to list, including descriptions, specifications, and images.

02

Access the ANSC Descriptive Listing Catalog online or obtain a physical copy.

03

Fill out the required fields for each item, ensuring accuracy and completeness.

04

Use clear and concise language in the descriptions to make items easily understandable.

05

Include relevant keywords to enhance searchability in the catalog.

06

Review the filled-out information for any errors or omissions.

07

Submit the completed catalog for review or publication as per the guidelines provided.

Who needs ANSC Descriptive listing Catalog?

01

Manufacturers and suppliers who wish to promote their products.

02

Retailers looking to stock new items and require detailed descriptions.

03

Consumers seeking comprehensive product information for informed purchasing decisions.

04

Regulatory bodies needing information on product specifications for compliance.

Fill

form

: Try Risk Free

People Also Ask about

Where does 8949 go on 1040?

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

How do I report money to the IRS?

A person must file Form 8300 within 15 days after the date the person received the cash. If a person receives multiple payments toward a single transaction or two or more related transactions, the person should file Form 8300 when the total amount paid exceeds $10,000.

Is a W-2 the same as a w9?

A W-9 is for newly hired independent contractors and gives the business the tax information you need to file a wage statement at the end of the tax year. A W-2 is a wage and tax statement for employees that the business fills out and files with the government at the end of each tax year.

Who must file IRS form 8300?

The law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing IRS/FinCEN Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF. Transactions that require Form 8300 include, but are not limited to: Escrow arrangement contributions.

Is form 8949 an income?

IRS Form 8949 is used to report capital gains and losses from investments for tax purposes. The form segregates short-term capital gains and losses from long-term ones. Filing this form also requires a Schedule D and a Form 1099-B, which is provided by brokerages to taxpayers.

How much money before I report to IRS?

Federal law requires a person to report cash transactions of more than $10,000 to the IRS.

Do you have to report all money to IRS?

Taxpayers must report all income from any source and any country unless it is explicitly exempt under the U.S. tax code. There may be taxable income from certain transactions even if no money changes hands.

What is a form 8300 with the IRS?

The Form 8300, Report of Cash Payments Over $10,000 in a Trade or Business, provides valuable information to the Internal Revenue Service and the Financial Crimes Enforcement Network (FinCEN) in their efforts to combat money laundering.

Is there a new W-2 form for 2022?

The 2022 Form W-2 was not substantially changed from the draft issued Dec. 17. Forms W-3, Transmittal of Wage and Tax Statements, and W-3SS, Transmittal of Wage and Tax Statements, also were released for 2022. The 2022 employer instructions for the forms have not been released.

How do I report 8949?

If you e-file your return but choose not to report each transaction on a separate row on the electronic return, you must either (a) include Form 8949 as a PDF attachment to your return, or (b) attach Form 8949 to Form 8453 (or the appropriate form in the Form 8453 series) and mail the forms to the IRS.

Should I worry about form 8300?

Yes. Once the dealership receives cash exceeding $10,000, a Form 8300 must be filed. The deal not going through may in fact be an attempt to launder illegal funds. If $10,000 or less was received by the dealer and the deal was cancelled, the dealer may voluntarily file a Form 8300 if the transaction appears suspicious.

Where do I enter form 8949?

You will report the totals of Form 8949 on Schedule D of Form 1040. Here is more information on how Tax Form 8949 is used from the IRS: If you receive Forms 1099-B or 1099-S (or substitute statements), always report the proceeds (sales price) shown on the form (or statement) in column (d) of Form 8949.

Where does form 8949 go on tax return?

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

Do I have to report form 8949?

Anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete Form 8949. Both short-term and long-term transactions must be documented on the form.

Can you snitch to the IRS for money?

An award worth between 15 and 30 percent of the total proceeds that IRS collects could be paid, if the IRS moves ahead based on the information provided. Under the law, these awards will be paid when the amount identified by the whistleblower (including taxes, penalties and interest) is more than $2 million.

How to read W-2 form 2022?

Understanding the W-2 The left side of the form reports the personal information of the taxpayer such as social security number, employer EIN, and employer address. The right side of the form reports employee earnings and federal tax information. The bottom of the form reports state and local tax information.

Why would I get a W 2C form?

A W-2C is a form used to make corrections on previously issued wage/tax information (W-2s) from current or prior years. Like Form W-2, it is a multi-use form used to report corrected wages to the IRS (Internal Revenue Service), FTB (Franchise Tax Board), and SSA (Social Security Administration).

What is a dw2 form?

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck.

What to do if you receive a form 8300?

You must file the form within 15 days of the payment that causes the additional payments to total more than $10,000. If you are already required to file Form 8300 and you receive additional payments within the 15 days before you must file, you can report all the payments on one form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit online filling coastguard 2013 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing online filling coastguard 2013 right away.

How do I edit online filling coastguard 2013 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share online filling coastguard 2013 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit online filling coastguard 2013 on an Android device?

You can edit, sign, and distribute online filling coastguard 2013 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is ANSC Descriptive listing Catalog?

The ANSC Descriptive Listing Catalog is a document that provides a comprehensive description of products, services, or items that are being offered, including specific details necessary for classification and analysis.

Who is required to file ANSC Descriptive listing Catalog?

Organizations and individuals who manufacture, distribute, or sell products that fall under the ANSC regulations are required to file the ANSC Descriptive Listing Catalog.

How to fill out ANSC Descriptive listing Catalog?

To fill out the ANSC Descriptive Listing Catalog, one must gather all relevant product information, complete the required forms accurately, and include detailed descriptions, specifications, and any other necessary documentation as per the guidelines provided by ANSC.

What is the purpose of ANSC Descriptive listing Catalog?

The purpose of the ANSC Descriptive Listing Catalog is to ensure proper classification, regulation, and compliance of products with the applicable standards, thereby facilitating safety and quality assurance.

What information must be reported on ANSC Descriptive listing Catalog?

The information that must be reported on the ANSC Descriptive Listing Catalog includes product names, descriptions, specifications, manufacturing details, compliance certifications, and any other relevant data that supports product classification.

Fill out your online filling coastguard 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Filling Coastguard 2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.