Get the free Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insu...

Show details

This document provides information about the new applications and forms for Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance specifically for the state of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gold series whole life

Edit your gold series whole life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gold series whole life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gold series whole life online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gold series whole life. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gold series whole life

How to fill out Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance Applications and Forms

01

Gather necessary personal information such as name, address, date of birth, and Social Security number.

02

Provide information about your income, employment, and financial status.

03

Select the type of policy you are applying for: Gold Series Whole Life Insurance or Gold Series Fixed Indexed 7 Pay Whole Life Insurance.

04

Fill out the health questionnaire accurately, disclosing any pre-existing conditions.

05

Specify the coverage amount you desire.

06

Sign and date the application to confirm the information is correct.

07

Submit the application along with any required documents and payment for the initial premium.

Who needs Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance Applications and Forms?

01

Individuals seeking a stable and predictable investment options.

02

People looking for lifelong insurance coverage with potential cash value accumulation.

03

Those interested in a policy that can be utilized for borrowing or as a financial asset.

04

Clients aiming for structured savings over seven years with fixed indexed growth.

05

Families wanting to ensure financial security for dependents in the event of an unexpected death.

Fill

form

: Try Risk Free

People Also Ask about

What are the three types of whole life insurance?

Whole life insurance provides lifelong coverage with fixed premiums and a cash value component. It includes variations like traditional, variable, and universal whole life, each offering different levels of flexibility and investment options.

Is IUL better than whole life?

Wealth Accumulation: If you want to maximize your cash value growth potential, IUL may be more appealing due to its higher return potential. Guaranteed Protection: Whole Life might be a better fit if you prioritize a guaranteed death benefit and stable cash value growth.

What is gold premium in insurance?

Gold insurance premiums are based on how much the object is worth and how the market is doing. Customised gold insurance policies may cost more than general jewellery insurance policies, but their benefits often compensate for the extra money.

What does "indexed" mean in life insurance?

Indexed universal life is a form of permanent life insurance that (like universal life) allows for flexible premiums and possibly a flexible death benefit. IUL insurance policies can track a number of well-known equity indexes, such as the S&P 500 or the Nasdaq-100, to earn interest credits.

What does indexed whole life insurance mean?

Indexed Whole Life insurance is a variation of traditional whole life insurance that combines the guaranteed death benefit and cash value accumulation features of whole life policies with the potential for additional returns based on the performance of a specific market index, often the S&P 500.

What's the difference between whole life and indexed universal life?

IUL offers higher potential returns linked to market performance, while Whole Life guarantees steady but lower returns. IUL allows for adjustable premiums and death benefits, while Whole Life provides fixed terms. IUL involves some market risk, while Whole Life is conservative and predictable.

What is indexed whole life insurance?

Indexed Whole Life Insurance Defined Indexed whole life is a type of permanent life insurance that offers level premiums for life, which helps protect against rising costs. A portion of your premium funds the cost of insurance (the death benefit plus administrative fees).

What are the pros and cons of indexed whole life insurance?

What are the pros and cons of indexed whole life insurance? Indexed whole life insurance combines insurance coverage with investment potential. Advantages include cash value growth linked to market indices and protection against market downturns. Drawbacks include higher premiums and capped growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance Applications and Forms?

Gold Series Whole Life Insurance is a type of permanent life insurance that provides coverage for the insured's entire life with a guaranteed death benefit and cash value accumulation. Gold Series Fixed Indexed 7 Pay Whole Life Insurance is a similar product but is designed to be paid up in seven years, with cash value linked to a stock market index for potential growth. The Applications and Forms are necessary documents used to apply for these insurance products.

Who is required to file Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance Applications and Forms?

Individuals or businesses looking to purchase Gold Series Whole Life Insurance or Gold Series Fixed Indexed 7 Pay Whole Life Insurance are required to file the respective Applications and Forms. This typically includes the applicant and any additional insured parties.

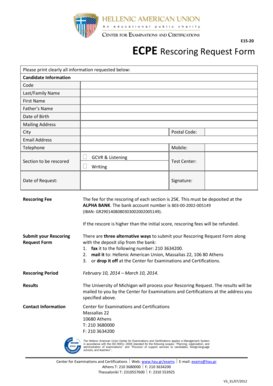

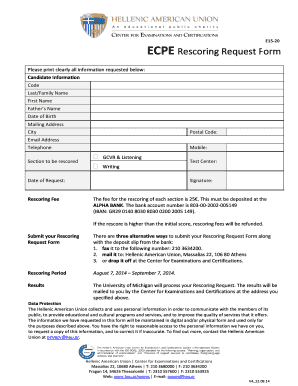

How to fill out Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance Applications and Forms?

To fill out the Applications and Forms, individuals should provide accurate personal information such as name, address, date of birth, and Social Security number. They must also disclose health and lifestyle information, choose coverage options, and indicate payment methods. It is recommended to read the instructions carefully and seek assistance if needed.

What is the purpose of Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance Applications and Forms?

The purpose of the Applications and Forms is to collect necessary information from applicants to assess eligibility, determine coverage amounts, and facilitate the underwriting process. It ensures that the insurance company has all relevant details to provide an accurate policy.

What information must be reported on Gold Series Whole Life Insurance and Gold Series Fixed Indexed 7 Pay Whole Life Insurance Applications and Forms?

The information that must be reported includes personal identity details (name, address, date of birth), health history, medical conditions, lifestyle habits (such as smoking), coverage preferences, and beneficiary information. Additional details about financial status or existing insurance may also be required.

Fill out your gold series whole life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gold Series Whole Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.