Get the free TAX CREDIT REGULATORY AGREEMENT AND DECLARATION OF RESTRICTIVE COVENANTS A1029245-2D...

Show details

TAX CREDIT REGULATORY AGREEMENT AND DECLARATION OF RESTRICTIVE COVENANTS THIS TAX CREDIT REGULATORY AGREEMENT AND DECLARATION OF RESTRICTIVE COVENANTS (this Agreement) is made and entered into as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax credit regulatory agreement

Edit your tax credit regulatory agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax credit regulatory agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax credit regulatory agreement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax credit regulatory agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

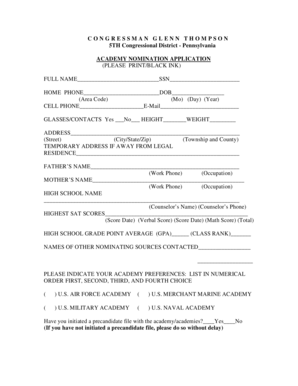

How to fill out tax credit regulatory agreement

How to Fill Out Tax Credit Regulatory Agreement:

01

Start by reviewing the tax credit regulatory agreement form carefully. Read all the instructions and requirements thoroughly to ensure you understand what needs to be filled out.

02

Provide your personal information, such as your name, address, contact details, and social security number. This information is essential for identifying the taxpayer.

03

Include the tax credit program details. Specify the type of tax credit you are applying for, the program name, and any other relevant information requested. This section helps determine eligibility.

04

Fill in the project information. This may include the project name, location, and description. Provide details on the property or business for which you are seeking tax credits.

05

Provide financial information. This section usually requires you to list your income, expenses, and financial projections. Include accurate and up-to-date figures to support your application.

06

Specify the amount of tax credits you are requesting. This can be a fixed amount or a percentage of the eligible expenses. Make sure to calculate this accurately and provide supporting documentation if required.

07

Include any additional information or documentation requested. Sometimes, supporting documents such as financial statements, business plans, or tax returns need to be attached to the form. Follow the instructions and provide the necessary paperwork.

08

Review your completed tax credit regulatory agreement form. Double-check for any errors or missing information. Ensure that all the sections are properly filled out, and all the required signatures are obtained.

09

Submit the form according to the instructions provided. This could involve mailing it to the appropriate tax authority or submitting it online through a designated portal. Keep copies of the completed form and any supporting documents for your records.

Who Needs Tax Credit Regulatory Agreement:

01

Individuals or businesses seeking financial incentives or tax benefits for certain activities, such as investing in low-income housing, renewable energy projects, or historic preservation, may need to fill out a tax credit regulatory agreement.

02

Developers or owners of affordable housing projects may be required to submit this agreement as part of the qualification process to receive tax credits.

03

Businesses involved in specific industries, such as film production or research and development, may need to complete a tax credit regulatory agreement to claim the available tax benefits.

04

Non-profit organizations engaged in eligible activities, like providing healthcare services or education, may also need to fill out this agreement to access tax credits.

05

It is important to note that the specific requirements for who needs a tax credit regulatory agreement may vary depending on the jurisdiction and the particular tax credit program in question. Always consult the relevant tax authority or program guidelines for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax credit regulatory agreement?

Tax credit regulatory agreement is an agreement between the government and a taxpayer that outlines the terms and conditions for receiving tax credits.

Who is required to file tax credit regulatory agreement?

Tax credit regulatory agreement is typically required to be filed by businesses or individuals who are claiming tax credits for specific activities or investments.

How to fill out tax credit regulatory agreement?

Tax credit regulatory agreement can be filled out by providing all necessary information and documentation as outlined in the agreement form provided by the government.

What is the purpose of tax credit regulatory agreement?

The purpose of tax credit regulatory agreement is to ensure that tax credits are being claimed and used appropriately, in accordance with government regulations and policies.

What information must be reported on tax credit regulatory agreement?

Information such as the type of tax credit being claimed, the amount of credit being claimed, and any supporting documentation required by the government must be reported on the tax credit regulatory agreement.

How can I edit tax credit regulatory agreement from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax credit regulatory agreement into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get tax credit regulatory agreement?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the tax credit regulatory agreement in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my tax credit regulatory agreement in Gmail?

Create your eSignature using pdfFiller and then eSign your tax credit regulatory agreement immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your tax credit regulatory agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Credit Regulatory Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.