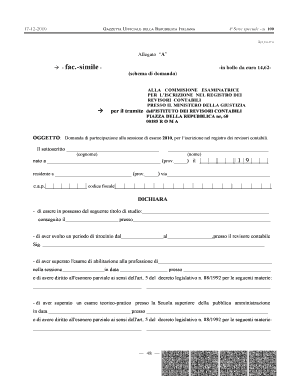

Get the free VAT-5

Show details

This form is used to apply for amendments in the registration details under the VAT Act, including changes in business name, address, constitution, and other related details. Supporting documents

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vat-5

Edit your vat-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat-5 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit vat-5. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vat-5

How to fill out VAT-5

01

Obtain the VAT-5 form from the relevant tax authority's website or office.

02

Fill in your personal or business details at the top of the form.

03

Provide your VAT registration number and any other required identification.

04

Clearly state the period for which you are submitting the VAT return.

05

Calculate the total VAT due by adding up the sales and purchases.

06

Ensure that all calculations are accurate and double-check your entries.

07

Sign and date the form at the end.

08

Submit the form to the relevant tax authority either electronically or by post.

Who needs VAT-5?

01

Any individual or business that is registered for VAT and is required to report their VAT obligations.

02

Businesses that have VAT taxable sales or purchases exceeding the threshold set by the tax authority.

03

Accountants or tax professionals managing VAT returns for clients.

Fill

form

: Try Risk Free

People Also Ask about

What is VAT in English?

VAT is a tax that is added to the price of goods or services. VAT is an abbreviation for ' value added tax'.

What is 5% VAT?

Reduced rate VAT You may be able to charge the reduced rate of 5% for some types of work if it meets certain conditions, including: installing energy saving products and certain work for people over 60. converting a building into a house or flats or from one residential use to another. renovating an empty house or flat.

What is the VAT code for 5%?

Common UK VAT codes and their meanings VAT codeDescriptionVAT rate T2 Zero-rated supply 0% T3 Exempt supply 0% T4 Outside the scope of VAT N/A T5 Reduced rate supply 5%1 more row • May 22, 2025

What is the 5.5 VAT in France?

The second reduced VAT rate (5.5%) applies to food, gas, electricity, art, cinema and sporting event tickets, services for elderly. The super-reduced VAT rate (2.1%) applies to some medicine, newspapers and magazines. French zero-rated goods and services include intra-community and international transport.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VAT-5?

VAT-5 is a tax return form used for reporting Value Added Tax (VAT) liabilities and payments to the tax authorities.

Who is required to file VAT-5?

Any business entity that is registered for VAT and has taxable transactions must file VAT-5, including sole proprietors, partnerships, and corporations.

How to fill out VAT-5?

To fill out VAT-5, a taxpayer must provide information about their VAT registration number, taxable sales, VAT charged on sales, input VAT, and any adjustments, ensuring accurate calculations of total VAT due or refundable.

What is the purpose of VAT-5?

The purpose of VAT-5 is to report VAT obligations to the tax authorities, allowing for the calculation of VAT payable or refundable based on a business's sales and purchases.

What information must be reported on VAT-5?

VAT-5 must include details such as the tax period, VAT registration number, total sales, VAT collected, total purchases, input VAT, and calculations of net VAT payable or refundable.

Fill out your vat-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vat-5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.