Get the free Bankruptcy Fundamentals - Nebraska State Bar Association

Show details

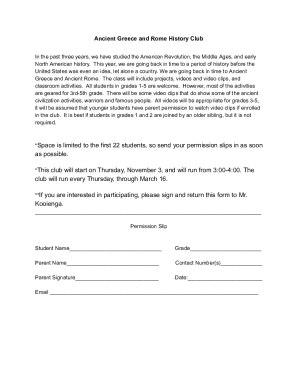

Bankruptcy Fundamentals Erin M. McCartney John T. Turbo & Associates, P.C., L.L.O., Omaha August 11, 2015, University of Nebraska College of Law, Lincoln This page intentionally left blank. 8×4/2015

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bankruptcy fundamentals - nebraska

Edit your bankruptcy fundamentals - nebraska form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy fundamentals - nebraska form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bankruptcy fundamentals - nebraska online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bankruptcy fundamentals - nebraska. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bankruptcy fundamentals - nebraska

How to Fill Out Bankruptcy Fundamentals - Nebraska:

01

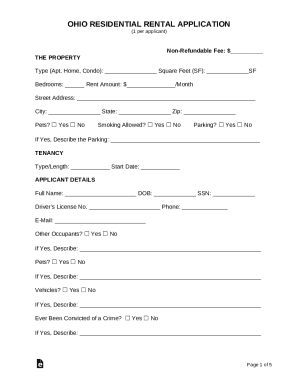

Gather all necessary documents: Before starting the bankruptcy process in Nebraska, it is important to gather all the required documents. This may include financial statements, income records, tax returns, and a list of assets and liabilities.

02

Choose the appropriate bankruptcy chapter: Determine whether you are eligible for Chapter 7 or Chapter 13 bankruptcy. Each chapter has different requirements and implications, so it is crucial to understand which one aligns with your specific financial situation.

03

Complete the necessary forms: Fill out the bankruptcy forms required by the Nebraska bankruptcy court. These forms typically include the petition, schedules, and various statements. Carefully review the instructions for each form and provide accurate and honest information.

04

Attend a credit counseling course: Nebraska, like many other states, requires individuals filing for bankruptcy to complete a credit counseling course from an approved agency. Once completed, you will receive a certificate which must be filed with the court.

05

File the bankruptcy petition: Submit the completed bankruptcy forms along with the necessary filing fee to the Nebraska bankruptcy court. Ensure that all documents are properly organized and organized according to the court's guidelines.

06

Attend the meeting of creditors: After filing your bankruptcy petition, you will be scheduled to attend a meeting of creditors. This meeting provides an opportunity for creditors to ask you questions about your financial situation. It is important to be honest and cooperate during this meeting.

07

Complete additional requirements: Depending on the chapter of bankruptcy you have filed, there may be additional requirements such as financial management courses or repayment plans. Be sure to comply with these requirements to successfully complete the bankruptcy process.

Who Needs Bankruptcy Fundamentals - Nebraska:

01

Individuals struggling with overwhelming debt: Bankruptcy fundamentals in Nebraska are essential for individuals who find themselves burdened with excessive debt that they cannot repay. It is a legal alternative to help individuals get a fresh financial start and relieve the pressure of unbearable debt.

02

Individuals facing potential foreclosure or repossession: Bankruptcy can provide relief for individuals who are at risk of losing their homes to foreclosure or their assets to repossession. By filing for bankruptcy, individuals can potentially halt these processes and work towards a solution.

03

Those seeking protection from creditor harassment: Bankruptcy offers protection from creditor harassment, including collection calls, lawsuits, and wage garnishment. By filing for bankruptcy, individuals can gain relief from the constant pressure caused by creditors.

04

Individuals with limited income and resources: Bankruptcy is not limited to those with high incomes. It is also available to individuals with limited income and resources who are struggling to meet their financial obligations. Eligibility for specific chapters of bankruptcy will depend on income and other factors.

05

Individuals seeking a fresh financial start: Bankruptcy can provide individuals with the opportunity to start anew financially. It can eliminate or reduce certain debts, allowing individuals to rebuild their credit and work towards a more stable financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify bankruptcy fundamentals - nebraska without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including bankruptcy fundamentals - nebraska. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send bankruptcy fundamentals - nebraska to be eSigned by others?

Once your bankruptcy fundamentals - nebraska is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit bankruptcy fundamentals - nebraska on an Android device?

With the pdfFiller Android app, you can edit, sign, and share bankruptcy fundamentals - nebraska on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is bankruptcy fundamentals - nebraska?

Bankruptcy fundamentals in Nebraska refer to the basic principles and laws surrounding bankruptcy in the state.

Who is required to file bankruptcy fundamentals - nebraska?

Individuals or businesses facing financial difficulties and seeking debt relief may be required to file bankruptcy fundamentals in Nebraska.

How to fill out bankruptcy fundamentals - nebraska?

Bankruptcy fundamentals in Nebraska can be filled out with the assistance of a bankruptcy attorney or by following the instructions provided by the bankruptcy court.

What is the purpose of bankruptcy fundamentals - nebraska?

The purpose of bankruptcy fundamentals in Nebraska is to provide a legal process for individuals and businesses to resolve their debts and get a fresh financial start.

What information must be reported on bankruptcy fundamentals - nebraska?

Bankruptcy fundamentals in Nebraska typically require information about the debtor's assets, liabilities, income, expenses, and recent financial transactions.

Fill out your bankruptcy fundamentals - nebraska online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy Fundamentals - Nebraska is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.