Get the free 6012rv13 Anmlan om verltelseskatt

Show details

Tm blanket ten Ifyllningsanvisningar A ANM LAN OM VERLTELSESKATT Daren for ganderttens verging (DDM) Daren for KP elder byte (DDM) Forbade vrdepapper Saunders name Former Antennas number Saunders

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 6012rv13 anmlan om verltelseskatt

Edit your 6012rv13 anmlan om verltelseskatt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 6012rv13 anmlan om verltelseskatt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

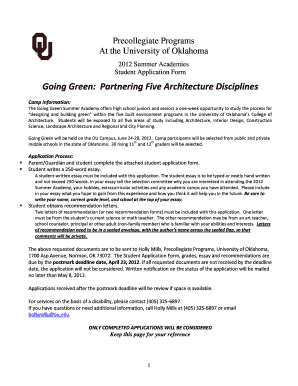

How to edit 6012rv13 anmlan om verltelseskatt online

To use the professional PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 6012rv13 anmlan om verltelseskatt. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

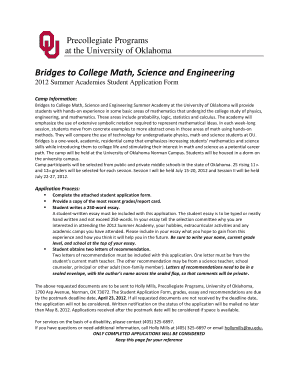

How to fill out 6012rv13 anmlan om verltelseskatt

01

To fill out the 6012rv13 anmlan om verltelseskatt form, you will need to gather all the necessary information and supporting documents. This includes details about your personal income, expenses, and any deductions or exemptions you may qualify for.

02

Start by reviewing the form and reading the instructions carefully. Familiarize yourself with the required sections and the information you need to provide. It's essential to understand the purpose of each section to accurately fill out the form.

03

Begin by entering your personal information, such as your name, address, and social security number. Ensure that all the information provided is accurate and up-to-date.

04

Move on to the income section of the form. Here, you will need to report your earnings from various sources, such as employment, self-employment, investments, and rental properties. Make sure to include all relevant income details, such as the amounts earned and any associated taxes or deductions.

05

Next, you will need to list your expenses. These may include business expenses for self-employment, mortgage interest, property taxes, and other deductible expenses. Remember to only include expenses that are eligible for deductions as per the tax regulations in your jurisdiction.

06

If you qualify for any specific deductions or exemptions, make sure to accurately fill out the corresponding sections. These could include deductions related to childcare costs, education expenses, or medical expenses. Consult the instructions or seek professional advice to determine which deductions or exemptions apply to your situation.

07

Attach any necessary supporting documents, such as receipts, invoices, or certificates, to validate the information provided on the form. Keep copies of these documents for your records.

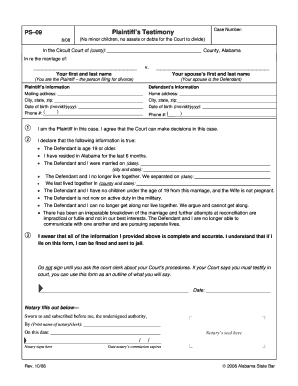

Now, let's answer the question related to who needs the 6012rv13 anmlan om verltelseskatt form.

01

The 6012rv13 anmlan om verltelseskatt form is typically required for individuals who have earned income and are subject to the verltelseskatt, or wealth tax, in their jurisdiction. This tax is often imposed on individuals with significant assets or net worth above a certain threshold.

02

Individuals who own property, investments, or other valuable assets may be required to fill out this form to report their wealth and calculate the applicable wealth tax. It is important to check the specific requirements and regulations in your country or region to determine if you need to submit this form.

03

Additionally, individuals who have received a notice or request from the tax authorities to fill out the 6012rv13 anmlan om verltelseskatt form must comply with the instructions provided. Failure to do so may result in penalties or legal consequences.

Remember, it is always recommended to consult with a tax professional or seek advice from the relevant tax authority to ensure that you accurately complete and submit the 6012rv13 anmlan om verltelseskatt form based on your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

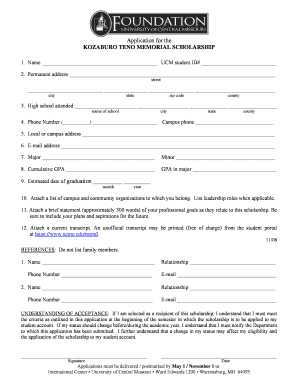

What is 6012rv13 anmlan om verltelseskatt?

6012rv13 anmlan om verltelseskatt is a tax return form used to report inheritance tax in certain countries.

Who is required to file 6012rv13 anmlan om verltelseskatt?

Individuals who have received an inheritance or gift above a certain threshold are required to file 6012rv13 anmlan om verltelseskatt.

How to fill out 6012rv13 anmlan om verltelseskatt?

6012rv13 anmlan om verltelseskatt can usually be filled out online or through a paper form provided by the tax authority. It requires information about the value of the inheritance or gift, the relationship between the donor and recipient, and any applicable exemptions.

What is the purpose of 6012rv13 anmlan om verltelseskatt?

The purpose of 6012rv13 anmlan om verltelseskatt is to calculate and collect inheritance tax from individuals who have received assets or money through inheritance or gift.

What information must be reported on 6012rv13 anmlan om verltelseskatt?

Information such as the value of the inherited assets, the relationship between the donor and recipient, any exemptions or deductions claimed, and details of any previous gifts or inheritances received.

How can I get 6012rv13 anmlan om verltelseskatt?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the 6012rv13 anmlan om verltelseskatt in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I fill out 6012rv13 anmlan om verltelseskatt on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your 6012rv13 anmlan om verltelseskatt, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit 6012rv13 anmlan om verltelseskatt on an Android device?

The pdfFiller app for Android allows you to edit PDF files like 6012rv13 anmlan om verltelseskatt. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your 6012rv13 anmlan om verltelseskatt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

6012Rv13 Anmlan Om Verltelseskatt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.