Get the free EContributions Services Employer Application Required form for use by third-party pl...

Show details

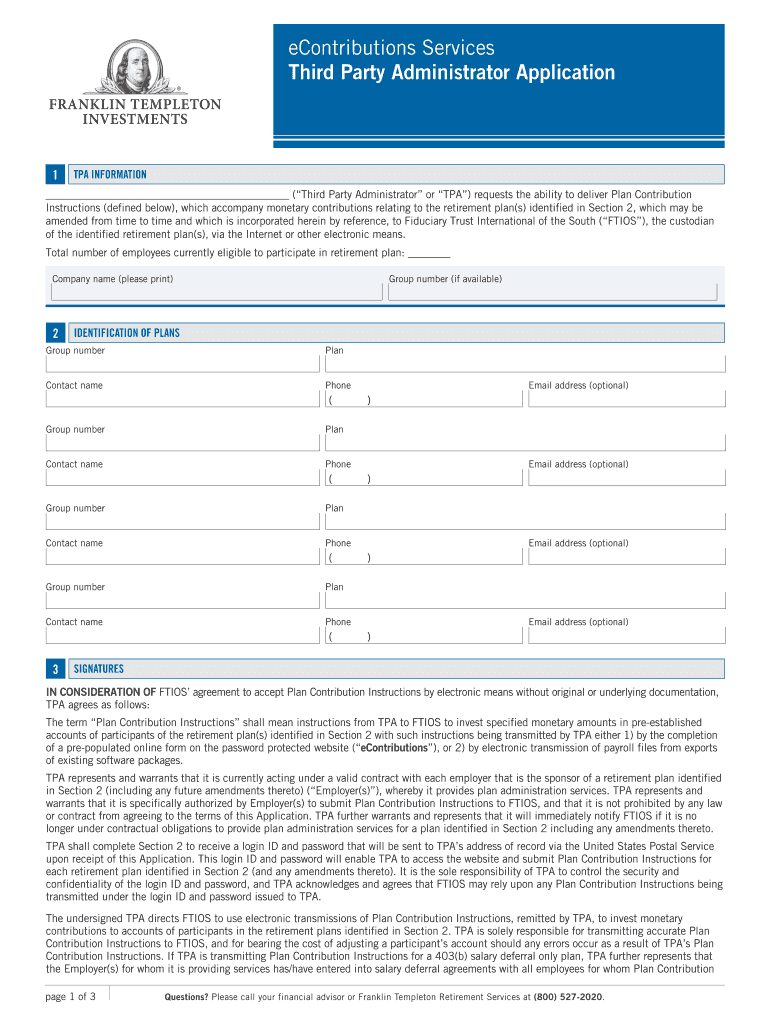

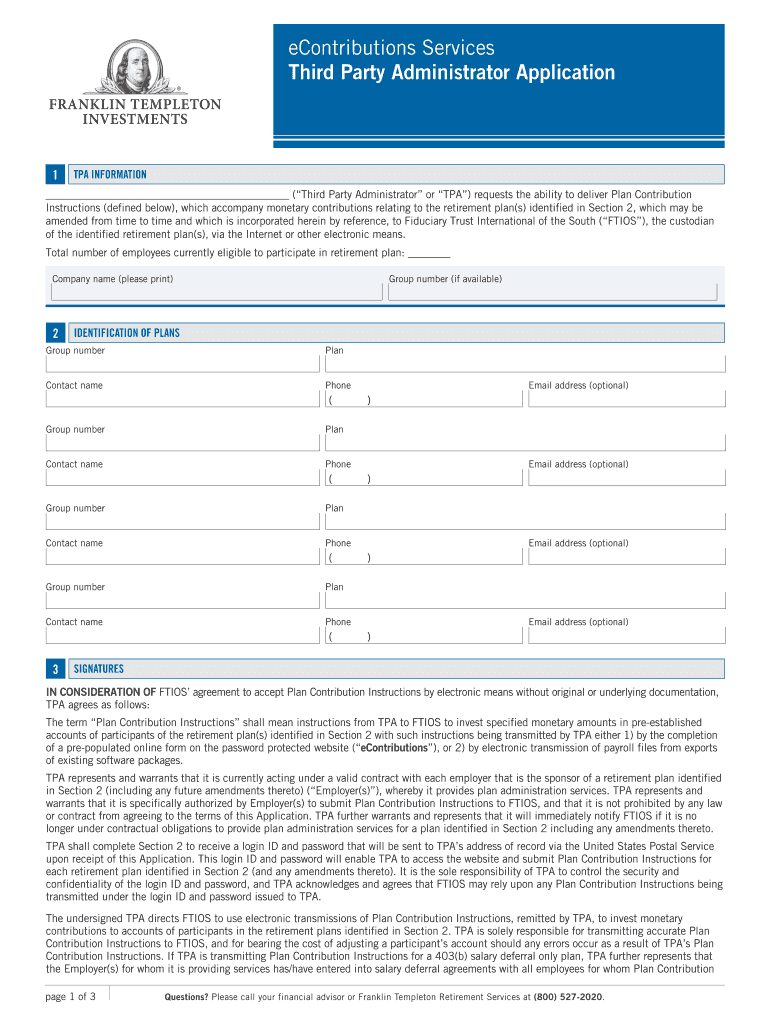

Contribution Services Third Party Administrator Application 1 TPA INFORMATION (Third Party Administrator or TPA) requests the ability to deliver Plan Contribution Instructions (defined below×, which

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign econtributions services employer application

Edit your econtributions services employer application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your econtributions services employer application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit econtributions services employer application online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit econtributions services employer application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out econtributions services employer application

Point by point, here is how to fill out the econtributions services employer application:

01

Start by accessing the official website of the econtributions service provider. Most providers will have an online portal where you can find the employer application form.

02

Look for the section or tab labeled "Employer Application" or something similar. Click on it to proceed with filling out the application.

03

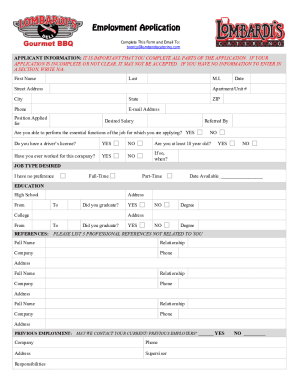

Begin by providing your basic information, such as your name, company name, address, contact details, and any other required information. Make sure to enter the information accurately and double-check for any typos or errors.

04

The application may require you to provide your employer identification number (EIN) or tax identification number (TIN). This is important for tax purposes and to ensure that the contributions are properly attributed to your company.

05

You may be asked to specify the type of employer you are, such as whether you are a corporation, partnership, sole proprietorship, etc. Select the appropriate option based on your business structure.

06

Some applications may also require you to provide information about your current payroll system or software, such as the provider or platform you use. This helps the econtributions service provider understand how to integrate their services with your existing payroll processes.

07

You may also be asked to indicate whether you want to set up automatic contributions for your employees or if you prefer to make manual contributions on a regular basis. Consider your preferences and the needs of your employees before making a decision.

08

Finally, review all the information you have entered to ensure accuracy. Submit the application, either online or by following the specified submission process provided by the econtributions service provider.

Who needs econtributions services employer application?

01

Small business owners who want to offer retirement or savings plans to their employees may need the econtributions services employer application. This application allows them to set up automatic contributions or manage manual contributions for their employees, ensuring smooth and efficient retirement savings.

02

Larger companies or organizations that already have an established payroll system may also find the econtributions services employer application useful. Integrating the econtributions services with their existing payroll processes can streamline the contribution process and simplify administrative tasks.

03

Employers who want to ensure compliance with retirement savings regulations and avoid the hassle of manually managing contributions may also benefit from the econtributions services employer application.

Overall, the econtributions services employer application is relevant for any employer seeking to provide retirement or savings plans for their employees and wants to simplify the contribution process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send econtributions services employer application to be eSigned by others?

Once your econtributions services employer application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the econtributions services employer application in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your econtributions services employer application.

How do I edit econtributions services employer application straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing econtributions services employer application.

What is econtributions services employer application?

Econtributions services employer application is a form used by employers to report their employees' contributions to various services.

Who is required to file econtributions services employer application?

All employers who have employees contributing to services are required to file econtributions services employer application.

How to fill out econtributions services employer application?

Econtributions services employer application can be filled out online through the designated portal or submitted in physical form to the relevant authority.

What is the purpose of econtributions services employer application?

The purpose of econtributions services employer application is to accurately report and track employees' contributions to services for proper documentation and accountability.

What information must be reported on econtributions services employer application?

Information such as employee names, contribution amounts, services contributed to, and relevant dates must be reported on econtributions services employer application.

Fill out your econtributions services employer application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Econtributions Services Employer Application is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.