IRS 575E 2007-2025 free printable template

Show details

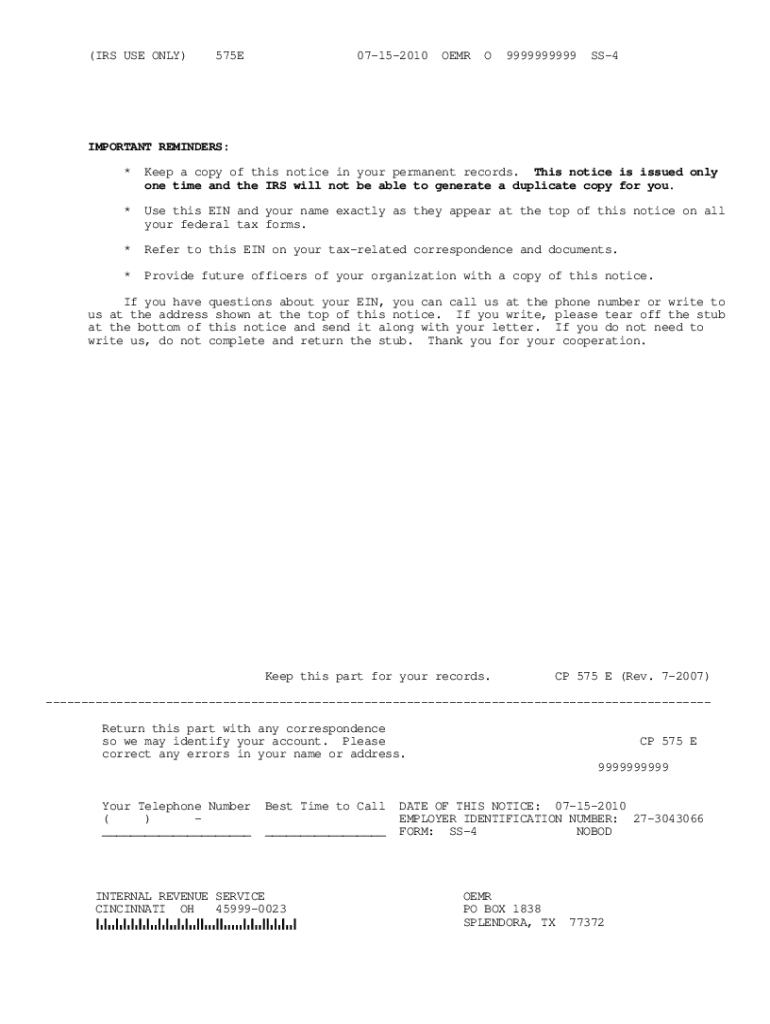

DEPARTMENT OF THE TREASURY INTERNAL REVENUE SERVICE CINCINNATI OH 459990023 Date of this notice: 08152008 Employer Identification Number: 263180268 Form: SS4 Number of this notice: WILD GOOSE CREATIVE

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 575E

How to edit IRS 575E

How to fill out IRS 575E

Instructions and Help about IRS 575E

How to edit IRS 575E

To edit IRS 575E, first download the form from the IRS website or access it through a specific platform like pdfFiller. Utilize pdfFiller’s editing tools to make any necessary changes, ensuring compliance with IRS guidelines. After editing, save the updated document for submission or printing.

How to fill out IRS 575E

Filling out IRS 575E involves providing specific information about the payments made to contractors and how these amounts meet IRS reporting requirements. Start by entering the payer’s name, address, and taxpayer identification number (TIN). Then, detail the amount paid and check the appropriate boxes that apply to the transaction type. Review the completed form for accuracy before submission.

Latest updates to IRS 575E

Latest updates to IRS 575E

As of October 2023, there have been no significant updates to IRS 575E. However, filers should stay informed about any changes in reporting thresholds and requirements that may affect their obligations.

All You Need to Know About IRS 575E

What is IRS 575E?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 575E

What is IRS 575E?

IRS 575E is an information return used by businesses to report payments made to independent contractors. This form helps the IRS track income earned by contractors and ensure proper tax reporting compliance.

What is the purpose of this form?

The purpose of IRS 575E is to report payments made to non-employees, specifically contractors, who provide goods or services in the course of business. This form is essential for both the payer and the recipient, as it allows for accurate reporting of income and proper tracking by the IRS.

Who needs the form?

Businesses or individuals who pay independent contractors for services rendered during the tax year must file IRS 575E. This includes various professions such as freelancers, consultants, and service providers. It's crucial that any entity making payments reports these amounts to maintain compliance and avoid penalties.

When am I exempt from filling out this form?

You may be exempt from filing IRS 575E if the payments made are below the $600 threshold for the year. Additionally, payments made to corporations, unless for legal services, are generally exempt from this reporting requirement.

Components of the form

The main components of IRS 575E include the payer's information, recipient's information, payment amounts, and the nature of the services provided. It is vital to ensure that all sections are completed accurately to avoid delays or penalties.

What are the penalties for not issuing the form?

Failing to issue IRS 575E can lead to significant penalties. The penalties can vary based on how late the form is filed, and the IRS could impose fines that start at $50 for each form not filed within 30 days, increasing for delays beyond certain thresholds.

What information do you need when you file the form?

When filing IRS 575E, you will need the payer's name, address, and TIN, as well as the recipient's name and TIN, and the total amount paid during the year. Accurate and complete information is critical to ensure the form is processed without issues.

Is the form accompanied by other forms?

IRS 575E may need to be submitted alongside other forms, depending on specific reporting requirements. For instance, if additional compensation or accrued payments exist, it may be beneficial to include form 1099-MISC or other related forms for comprehensive reporting.

Where do I send the form?

IRS 575E must be sent to the appropriate IRS address based on the payer's location. Generally, forms can be mailed to the designated PO Box or submitted electronically through platforms that support IRS filings, which is often more efficient and secure.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Great product! I use it for filling out my forms all the time. It makes for clear and professional looking documents for my business.

once you get navigation mastered it works but filters could be bette

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.