Get the free Mutual Fund B or C Share Purchase Discussion Form

Show details

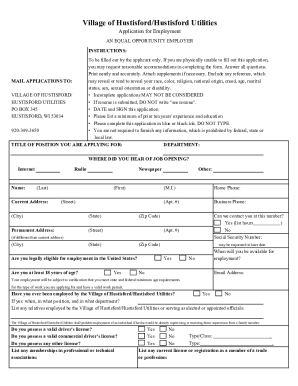

Please Check One: Direct Account NFS Account (or Social Security) # Mutual Fund B and C Share Purchase Discussion Form This form is intended to show the difference in expenses between the share class×BS)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual fund b or

Edit your mutual fund b or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual fund b or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mutual fund b or online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mutual fund b or. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual fund b or

How to Fill Out Mutual Fund B or:

01

Begin by gathering all the necessary documents and information. This includes your personal identification, contact details, social security number, and bank account information.

02

Research and select the mutual fund company that offers Mutual Fund B or. It is important to choose a reputable and well-established company with a good track record.

03

Familiarize yourself with the prospectus of Mutual Fund B or. The prospectus contains detailed information about the fund's investment objectives, risks, fees, and performance history. Read it carefully to ensure you understand the fund's goals and policies.

04

Determine the amount you want to invest in Mutual Fund B or. Consider factors such as your financial goals, risk tolerance, and investment horizon when deciding on the investment amount.

05

Fill out the application form provided by the mutual fund company. Make sure to provide accurate and complete information, as any mistakes or missing details can delay the processing of your application.

06

Select the investment options that align with your investment goals. Mutual Fund B or may offer various investment strategies, such as equity funds, bond funds, or a combination of both. Choose the options that suit your risk profile and investment objectives.

07

Decide if you want to set up automatic investments or make additional contributions in the future. Some mutual funds offer automatic investment plans that allow you to regularly invest a fixed amount without manual intervention.

08

Review the terms and conditions of joining Mutual Fund B or. Understand any fees, charges, or redemption rules associated with the fund. This information will help you make an informed decision and avoid any surprises later on.

09

Sign and date the application form, and submit it along with any required supporting documents. Ensure that all the required fields are completed accurately.

10

Keep a copy of the filled application form for your records. After submitting the application, it may take some time for the mutual fund company to process your application and confirm your investment. Be patient and wait for the confirmation before making any further decisions.

Who Needs Mutual Fund B or:

01

Individuals looking to diversify their investment portfolio. Mutual Fund B or can provide exposure to a variety of asset classes, such as stocks, bonds, and commodities, helping investors spread their risk across different sectors.

02

Investors seeking professional management of their investments. Mutual funds are managed by experienced professionals who research and analyze market trends, making it suitable for individuals who prefer to rely on experts to make investment decisions.

03

Those looking for convenient and accessible investment options. Mutual funds offer a hassle-free way to invest, as they handle all administrative tasks like record-keeping, tax reporting, and dividend reinvestment on behalf of investors.

04

Investors with different risk tolerances. Mutual Fund B or may offer various investment options catering to different risk profiles. Conservative investors can opt for bond funds, while more aggressive investors can choose equity funds.

05

Individuals planning for long-term financial goals. Mutual Fund B or can be a suitable investment vehicle for retirement planning, education funding, or other long-term financial objectives, as it allows for potentially higher returns over an extended period.

By following the step-by-step process outlined above, individuals can easily fill out Mutual Fund B or while understanding the target audience who might benefit from such investment options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mutual fund b or directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your mutual fund b or along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find mutual fund b or?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the mutual fund b or. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the mutual fund b or electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your mutual fund b or and you'll be done in minutes.

What is mutual fund b or?

Mutual fund b or is a form used to report information about mutual funds to the IRS.

Who is required to file mutual fund b or?

Investment companies and trust entities are required to file mutual fund b or.

How to fill out mutual fund b or?

Mutual fund b or can be filled out online or through a paper form provided by the IRS.

What is the purpose of mutual fund b or?

The purpose of mutual fund b or is to report income, gains, losses, and other financial information related to mutual funds.

What information must be reported on mutual fund b or?

Information such as dividends, capital gains, and expenses related to mutual funds must be reported on mutual fund b or.

Fill out your mutual fund b or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Fund B Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.