Millennium Trust Company IRA Distribution Request 2012 free printable template

Show details

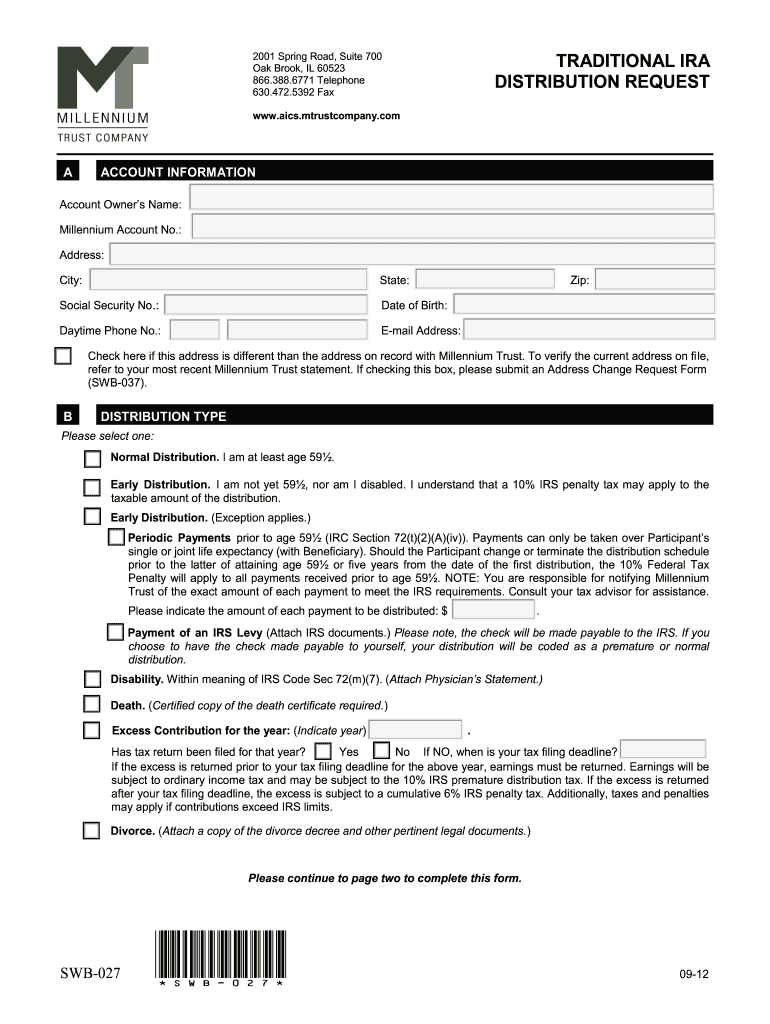

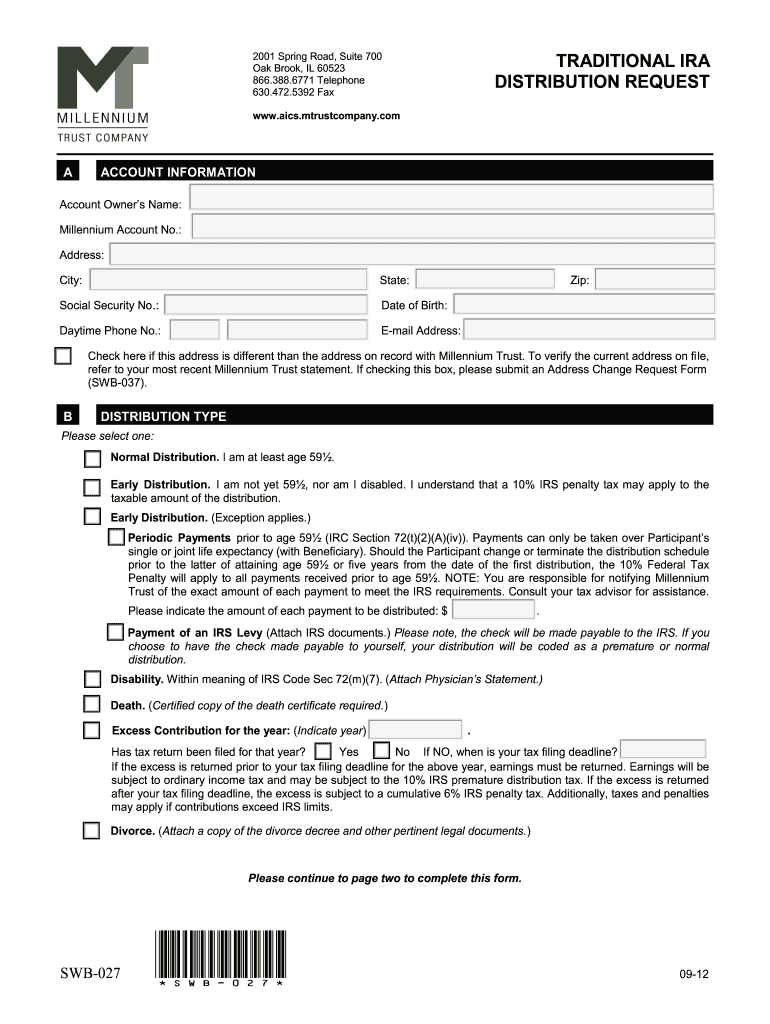

Millennium Trust Company LLC is not responsible if the asset has its own required delivery method. D SYSTEMATIC PAYMENTS NOTE Only complete this section if you checked Systematic Payment box in Section C. This distribution form needs to be received 15 days prior to the date of the first systematic payment. 2001 Spring Road Suite 700 Oak Brook IL 60523 866. 388. 6771 Telephone 630. 472. 5392 Fax TRADITIONAL IRA DISTRIBUTION REQUEST www. aics. mtrustcompany. com A ACCOUNT INFORMATION Account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Millennium Trust Company IRA Distribution Request

Edit your Millennium Trust Company IRA Distribution Request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Millennium Trust Company IRA Distribution Request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Millennium Trust Company IRA Distribution Request online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Millennium Trust Company IRA Distribution Request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Millennium Trust Company IRA Distribution Request Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Millennium Trust Company IRA Distribution Request

How to fill out Millennium Trust Company IRA Distribution Request

01

Obtain the Millennium Trust Company IRA Distribution Request form from their website or contact customer service.

02

Fill in your personal information including your name, address, and Social Security number.

03

Indicate the type of distribution you are requesting (e.g., full distribution, partial distribution, or rollover).

04

Specify the amount you wish to distribute and the method of payment (e.g., check, electronic transfer).

05

Provide any necessary documentation that supports your request, if applicable.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to Millennium Trust Company as per their submission guidelines (fax, mail, or online).

Who needs Millennium Trust Company IRA Distribution Request?

01

Individuals who have a retirement account managed by Millennium Trust Company and wish to take a distribution.

02

Retirees looking to access their funds from an IRA account.

03

Individuals performing a rollover to another retirement account.

04

Beneficiaries of deceased account holders needing to claim distributions.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get your money from Millennium Trust?

Closing 30-45 Days Do the Math1-2 Business DaysAccount Funding1-4 WeeksLocate Property & Make OfferDays to MonthsNon-recourse Loan Processing30-45 DaysClosing30-45 Days1 more row

How to get an account statement from Millennium Trust Company?

If your new custodian requires a statement to complete your transfer, you can download one within the MTC Investment Platform by selecting Account Details > Account Documents.

How do I contact the Millennium Trust Company?

Questions? Call Millennium Trust Company at 800.258. 7878.

Can I take my money out of Millennium Trust Company?

If you need to withdraw money from your account, we can process a distribution for you. Keep in mind a withdrawal may lead to taxes and penalties, so you may want to consult with a tax or financial advisor before requesting a distribution.

Is Millennium Trust a real company?

Welcome. Millennium Trust is a growing retirement services company with over 1.2 million client accounts.

What is the penalty for early withdrawal?

Generally, the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called ”early” or ”premature” distributions. Individuals must pay an additional 10% early withdrawal tax unless an exception applies.

Can you withdraw from Millennium Trust Company?

Withdraw your money If you need to withdraw money from your account, we can process a distribution for you. Keep in mind a withdrawal may lead to taxes and penalties, so you may want to consult with a tax or financial advisor before requesting a distribution.

What is the penalty for early withdrawal from Millennium Trust?

Reason #1: You may face a 10% early withdrawal penalty.

What bank does Millennium Trust use?

Deposit and Credit products are offered by Fifth Third Bank. Member FDIC.

How long does it take to get withdrawal from Millennium Trust Company?

Closing 30-45 Days Do the Math1-2 Business DaysAccount Funding1-4 WeeksLocate Property & Make OfferDays to MonthsNon-recourse Loan Processing30-45 DaysClosing30-45 Days1 more row

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Millennium Trust Company IRA Distribution Request in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your Millennium Trust Company IRA Distribution Request as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I sign the Millennium Trust Company IRA Distribution Request electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your Millennium Trust Company IRA Distribution Request in minutes.

How do I fill out the Millennium Trust Company IRA Distribution Request form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Millennium Trust Company IRA Distribution Request and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is Millennium Trust Company IRA Distribution Request?

The Millennium Trust Company IRA Distribution Request is a form used by account holders to request distributions from their Individual Retirement Accounts (IRAs) held with Millennium Trust Company.

Who is required to file Millennium Trust Company IRA Distribution Request?

Account holders who wish to withdraw funds from their IRA with Millennium Trust Company are required to file the IRA Distribution Request.

How to fill out Millennium Trust Company IRA Distribution Request?

To fill out the request, account holders need to provide their personal information, account number, the amount to be distributed, and the reason for the distribution, along with any required signatures.

What is the purpose of Millennium Trust Company IRA Distribution Request?

The purpose of the IRA Distribution Request is to formally initiate the withdrawal of funds from the IRA account and to ensure compliance with IRS regulations regarding retirement account distributions.

What information must be reported on Millennium Trust Company IRA Distribution Request?

The required information includes the account holder's name, account number, requested distribution amount, distribution type, and any supporting documents as necessary.

Fill out your Millennium Trust Company IRA Distribution Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Millennium Trust Company IRA Distribution Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.