Get the free Tax Treaty Benefits for Workers, Trainees, Students, and Researchers

Show details

This document provides an overview of how income tax treaties reduce U.S. income taxes and the administrative rules employers, payers, and taxpayers must follow to claim treaty benefits for foreign

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax treaty benefits for

Edit your tax treaty benefits for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax treaty benefits for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax treaty benefits for online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax treaty benefits for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

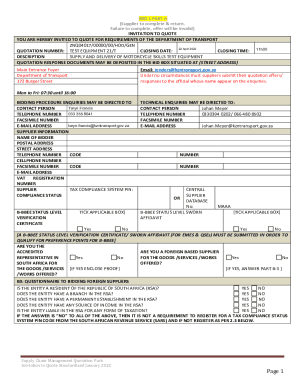

How to fill out tax treaty benefits for

How to fill out Tax Treaty Benefits for Workers, Trainees, Students, and Researchers

01

Determine eligibility: Verify if you are a resident of a country that has a tax treaty with the host country.

02

Gather necessary documentation: Collect all relevant documents including your passport, visa, and proof of residency.

03

Complete Form 8833: Fill out IRS Form 8833, which is used to claim tax treaty benefits.

04

Provide identification: Include your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on the form.

05

Specify the treaty: Indicate the specific tax treaty article that applies to your case in Form 8833.

06

Submit the form: File Form 8833 with your tax return or submit it separately if already filed.

07

Keep copies: Retain copies of all submitted forms and supporting documents for your records.

Who needs Tax Treaty Benefits for Workers, Trainees, Students, and Researchers?

01

Workers and employees from a treaty country who are working temporarily in another country.

02

Trainees participating in internship or training programs under a tax treaty.

03

Students studying abroad who qualify for tax benefits under a tax treaty.

04

Researchers or scholars who are conducting research or teaching in a foreign country.

Fill

form

: Try Risk Free

People Also Ask about

Can an international student get a tax refund in the US?

While filing your tax return may sound difficult, there are a number of benefits to doing so other than it's the law: You might get a refund - Some international students will qualify for a refund due to tax treaties and a lack of serious income if they've earned income in the US.

What are the benefits of the w8ben treaty?

The W-8BEN form lets you benefit from the US Internal Revenue Service (IRS) treaty rate with the UK. This lowers the withholding tax for qualifying dividends and interest from US shares from 30% to 15%.

What are the tax treaties with Brazil?

Brazil signed tax treaties to avoid double taxation with the following countries: Argentina, Austria, Belgium, Canada, Chile, China, Colombia (*), Czech Republic, Denmark, Ecuador, Finland, France, Hungary, India, Israel, Italy, Japan, Luxembourg, Mexico, Netherlands, Norway, Paraguay (*), Peru, Philippines, Portugal,

Who qualifies for US tax treaty benefits?

Therefore, a U.S. citizen or U.S. treaty resident who receives income from a treaty country and who is subject to taxes imposed by foreign countries may be entitled to certain credits, deductions, exemptions, and reductions in the rate of taxes of those foreign countries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Treaty Benefits for Workers, Trainees, Students, and Researchers?

Tax Treaty Benefits for Workers, Trainees, Students, and Researchers refer to the exemptions or reductions in income tax that may apply to individuals from certain countries under bilateral tax treaties. These treaties are designed to promote cross-border education and employment by reducing the likelihood of double taxation.

Who is required to file Tax Treaty Benefits for Workers, Trainees, Students, and Researchers?

Individuals who are non-residents and are receiving income in the host country under the provisions of a tax treaty are generally required to file for Tax Treaty Benefits. This may include foreign workers, trainees, students, and researchers who qualify under the terms of their respective tax treaties.

How to fill out Tax Treaty Benefits for Workers, Trainees, Students, and Researchers?

To fill out the Tax Treaty Benefits form, individuals must provide personal information, details about their residency, the specific tax treaty article being invoked, and any supporting documentation required, such as proof of residency in the foreign country or confirmation of the nature of their income.

What is the purpose of Tax Treaty Benefits for Workers, Trainees, Students, and Researchers?

The purpose of Tax Treaty Benefits is to avoid double taxation, facilitate international mobility and collaborations, and encourage educational and professional exchanges by allowing eligible individuals to minimize their tax liabilities while working or studying abroad.

What information must be reported on Tax Treaty Benefits for Workers, Trainees, Students, and Researchers?

Individuals must report their name, address, taxpayer identification number, the country of residence, the nature and amount of income being earned, the relevant tax treaty provisions being claimed, and any other required documentation that supports their claim for benefits.

Fill out your tax treaty benefits for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Treaty Benefits For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.