Get the free grantor letter example

Fill out, sign, and share forms from a single PDF platform

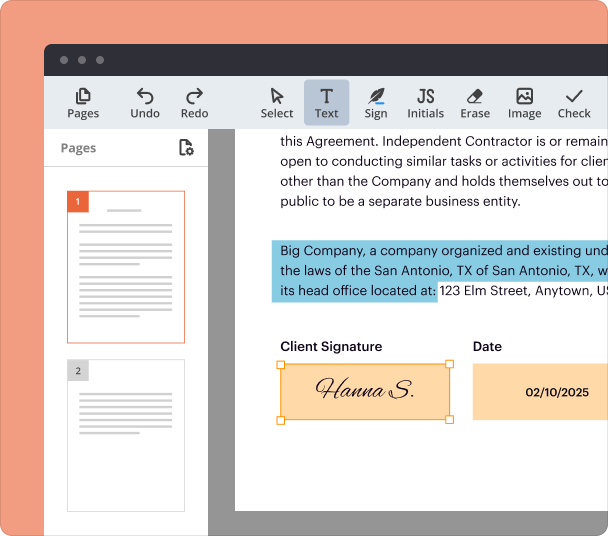

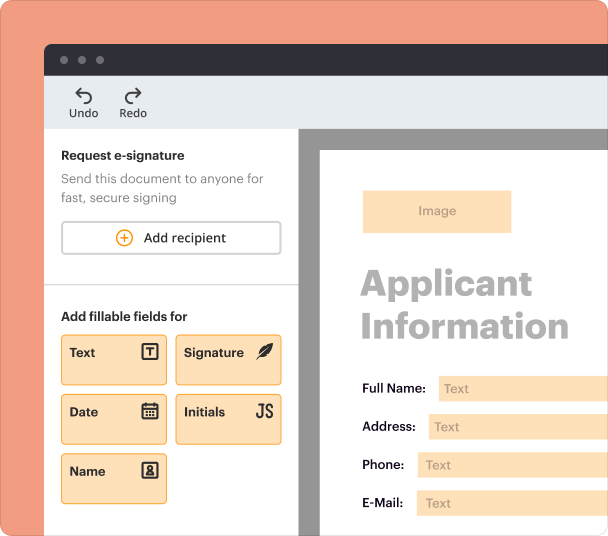

Edit and sign in one place

Create professional forms

Simplify data collection

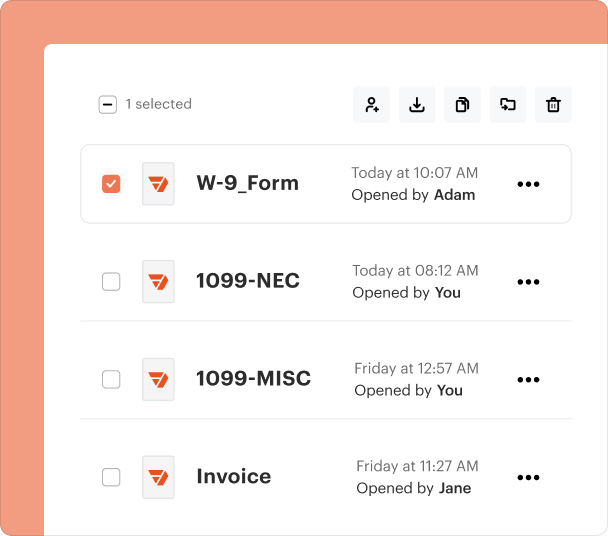

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to Grantor Letters: Example Forms and Instructions

What is a grantor letter?

A grantor letter is an essential document used in tax reporting, detailing specific financial information related to trusts. It serves as a formal notification to beneficiaries about the income they may need to report on their tax returns. This form plays a critical role in ensuring compliance with tax laws and maintaining clarity in financial matters.

Why are grantor letters important for tax reporting?

Grantor letters are important for tax reporting as they help clarify a grantor's fiduciary responsibilities. They ensure beneficiaries are accurately informed about the trust's income, allowing for proper tax reporting. Additionally, these letters can help prevent misunderstandings or disputes regarding income distribution.

What key components should be included in a grantor letter?

-

The individual or entity that established the trust.

-

Details regarding the individuals or entities entitled to income from the trust.

-

The period for which the income is being reported.

-

A breakdown of the income generated by the trust.

-

Any applicable deductions that can reduce taxable income.

How do you fill out a grantor tax information letter?

Filling out a grantor tax information letter can be straightforward if you follow a logical sequence. Start by gathering all necessary details such as trust name, beneficiaries, and income data. Ensure accuracy to avoid common mistakes that could delay processing.

-

Fill in the grantor and beneficiary information, ensuring that all names and contact details are correct.

-

Enter the total income generated by the trust for the year under the specified section.

-

List any deductions that apply, following IRS guidelines to ensure compliance.

-

Double-check all entries against original documents before submission.

What are the tax implications and reporting procedures for grantors?

Understanding tax implications is crucial for grantors. They must comply with specific reporting requirements to ensure that all income and deductions are accurately documented. Failure to adhere to these requirements can lead to penalties or audits.

-

Utilize the appropriate IRS schedules for income and expense reporting to ensure accuracy.

-

Review common pitfalls such as misreporting income, which can lead to significant processing delays.

-

Expect processing times to vary, often influenced by the complexity of the information reported.

How can pdfFiller help in managing your grantor letters?

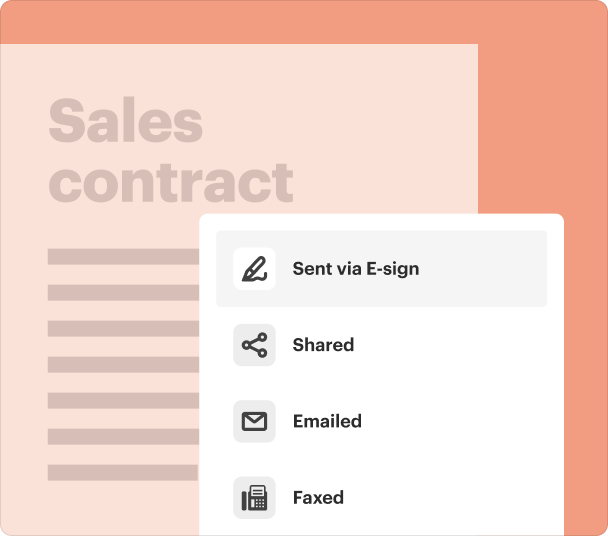

pdfFiller provides users with tools to edit grantor letters easily and efficiently. From online editing features to eSignature capabilities, pdfFiller streamlines the document management process. This platform facilitates collaborative editing, allowing teams to work together seamlessly from different locations.

-

Utilize pdfFiller's simple tools to modify text and fields in your grantor letters.

-

Ensure compliance by adding eSignatures, which help maintain the integrity of the document.

-

Engage with team members in real-time to complete documents.

-

Store all documents in the cloud, making them accessible from any device.

What should you know about regional compliance for grantor letters?

Each region may have specific regulations regarding the use of grantor letters. Understanding these regulations ensures that grantors remain compliant and avoid potential penalties.

-

Be aware of any unique filing requirements based on your state’s regulations.

-

Consult local tax experts to ensure your grantor letters meet all necessary requirements.

-

Follow best practices in documentation to maintain clarity and compliance.

Frequently Asked Questions about grantor letter form

What is the primary purpose of a grantor letter?

The primary purpose of a grantor letter is to inform beneficiaries about the income generated by a trust, ensuring they can accurately report it for tax purposes. This letter helps to clarify the grantor's responsibilities and the financial obligations of the beneficiaries.

How often should grantor letters be updated?

Grantor letters should be updated at least annually, in conjunction with the end of the tax year. Additionally, updates may be necessary if there are significant changes in trust income or beneficiary information.

What happens if there are discrepancies in the grantor letter?

If discrepancies are found in the grantor letter, it is crucial to address them immediately. Both the grantor and the beneficiaries should consult with tax advisors to rectify any inaccuracies to avoid potential tax implications or complications.

Who can benefit from using a grantor letter?

Both grantors and beneficiaries can benefit from using a grantor letter. Grantors can manage their tax obligations more effectively, while beneficiaries receive clear information about their income, aiding in accurate tax reporting.

Are there specific forms required in addition to the grantor letter?

Yes, specific IRS forms and schedules may be required for comprehensive reporting of income and deductions. It is essential to consult the IRS guidelines or a tax professional for the correct documentation.

pdfFiller scores top ratings on review platforms