Get the free BUSINESS CREDIT REPORT - bcofaceservicesbbjpb

Show details

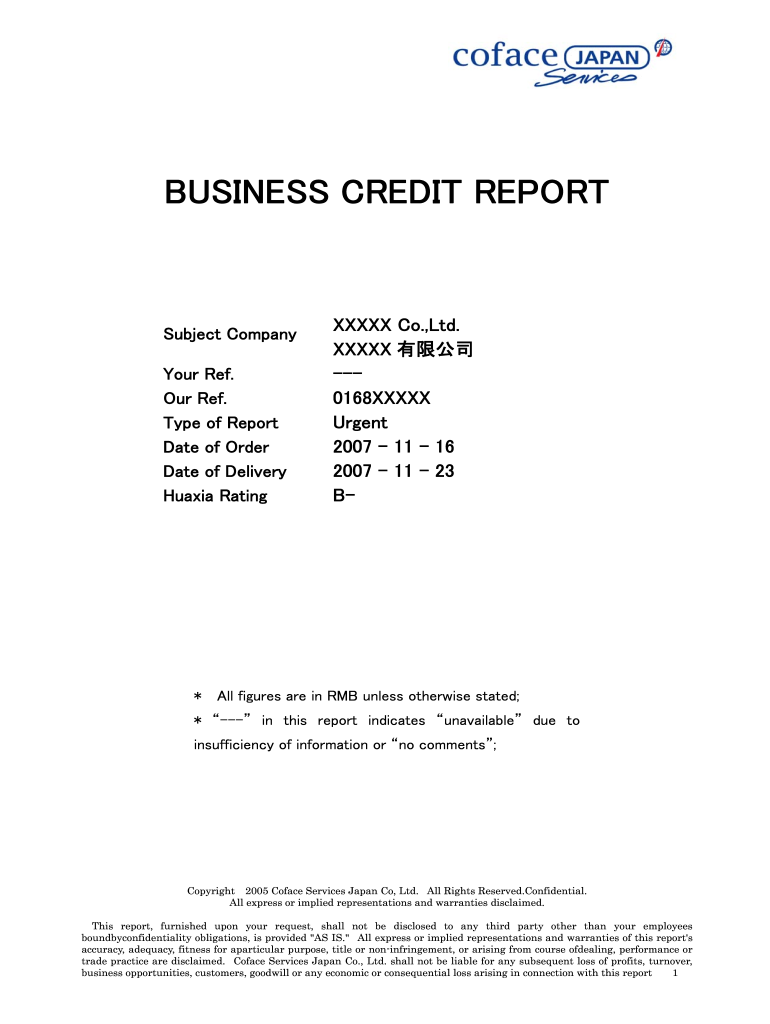

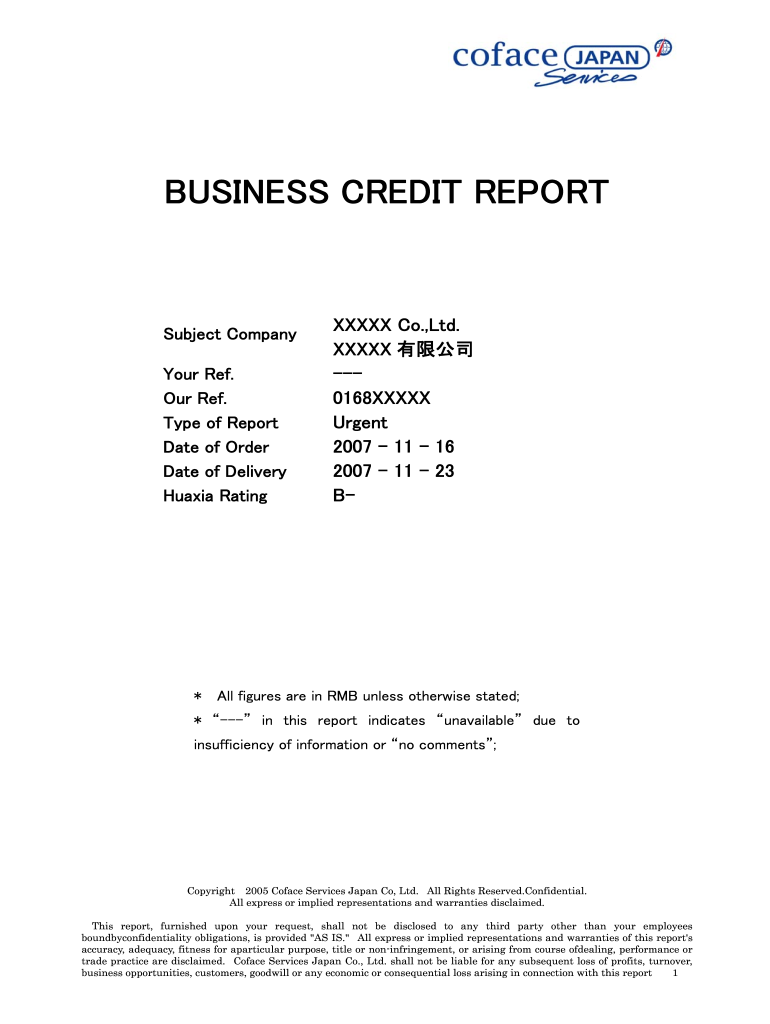

BUSINESS CREDIT REPORT Subject Company Your Ref. Our Ref. Type of Report Date of Order Date of Delivery Ataxia Rating XXXIX Co., Ltd. XXXIX 0168XXXXX Urgent 2007 11 16 2007 11 23 B * All figures are

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit report

Edit your business credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credit report online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business credit report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit report

How to fill out a business credit report:

01

Gather all necessary information: Begin by collecting all relevant information about your business, such as legal business name, address, contact details, and taxpayer identification number (TIN).

02

Review financial statements: Take a look at your company's financial statements, including balance sheets, profit and loss statements, and cash flow statements. These documents will provide crucial information about your business's financial health.

03

Provide trade references: Include a list of your business's trade references, which are other companies or suppliers you have done business with. These references should include their contact information and details about the business relationship you have with them.

04

Fill in payment history: Indicate your business's payment history for credit accounts, loans, and other financial obligations. Include details such as the creditor's name, account number, payment terms, and any late or missed payments.

05

Provide business details: Fill out sections about the nature of your business, including its industry, products or services offered, and number of employees. This information helps credit agencies understand your business's operations and risk profile.

06

Include public records: Disclose any relevant public records related to your business, such as bankruptcies, liens, or judgments. This information will be used to assess the financial stability and risk associated with your business.

Who needs a business credit report:

01

Business owners and entrepreneurs: Having a business credit report is crucial for business owners and entrepreneurs who want to establish and obtain credit for their companies. It helps lenders, suppliers, and other stakeholders assess the financial stability and creditworthiness of the business.

02

Financial institutions and lenders: Lenders and financial institutions use business credit reports to evaluate the creditworthiness of the businesses seeking loans or credit facilities. These reports provide valuable insight into a company's financial health and repayment history.

03

Suppliers and vendors: Suppliers and vendors often review business credit reports to determine whether to extend credit terms or trade agreements to a company. This allows them to assess the likelihood of on-time payments and the business's overall financial risk.

04

Investors and partners: Investors and potential business partners may also request business credit reports to evaluate the financial stability and risk profile of a company before making investment decisions or entering into partnerships.

In summary, filling out a business credit report involves gathering and providing comprehensive information about your business and its financial health. This report is essential for business owners, financial institutions, suppliers, and investors to assess a company's creditworthiness and determine its financial stability.

Fill

form

: Try Risk Free

People Also Ask about

How do I find out my business credit score?

You can check your Paydex score (and three other ratings) for free with Dun & Bradstreet's CreditSignal package, which includes alerts for score changes and business credit inquiries.

What is business risk grade B?

BB. A Less than Satisfactory rating – financial standing prone to be affected by the economy. B. Much Less than Satisfactory – financial standing very unsteady.

What does risk grade B mean for business?

The credit rating given to a company or government can impact on its ability to borrow money. Those with highly speculative ratings, like B, are deemed riskier for investors compared to investment-grade companies.

What is your business credit score when you first start?

The Experian Intelliscore and the D&B Paydex score both start at 0 and go up to 100. Other scores may start at a different number. If your business hasn't established credit, you may have a low credit score or no credit score at all. This is very common, even for companies that have been operating for many years.

What does B mean in credit rating?

'B' ratings indicate that material default risk is present, but a limited margin of safety remains. Financial commitments are currently being met; however, capacity for continued payment is vulnerable to deterioration in the business and economic environment.

What is included in a business credit report?

A business credit report allows creditors, like banks or other kinds of lenders, to assess a company's creditworthiness. It includes background information and payment history about the company, as well as information pulled from public records, such as liens and judgments filed against the company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business credit report?

A business credit report is a detailed profile of a company's credit history.

Who is required to file business credit report?

Businesses that extend credit or provide financial services are required to file business credit reports.

How to fill out business credit report?

Businesses can fill out a business credit report by providing detailed information about their financial history, credit accounts, and payment behavior.

What is the purpose of business credit report?

The purpose of a business credit report is to assess a company's creditworthiness and financial stability.

What information must be reported on business credit report?

Information such as credit accounts, payment history, financial transactions, and legal filings must be reported on a business credit report.

How can I manage my business credit report directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your business credit report and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit business credit report in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your business credit report, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit business credit report on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing business credit report.

Fill out your business credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.