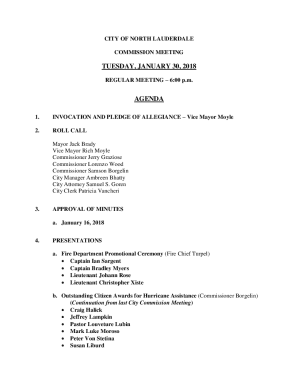

Get the free Investor Account Form

Show details

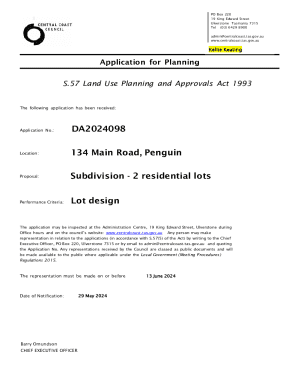

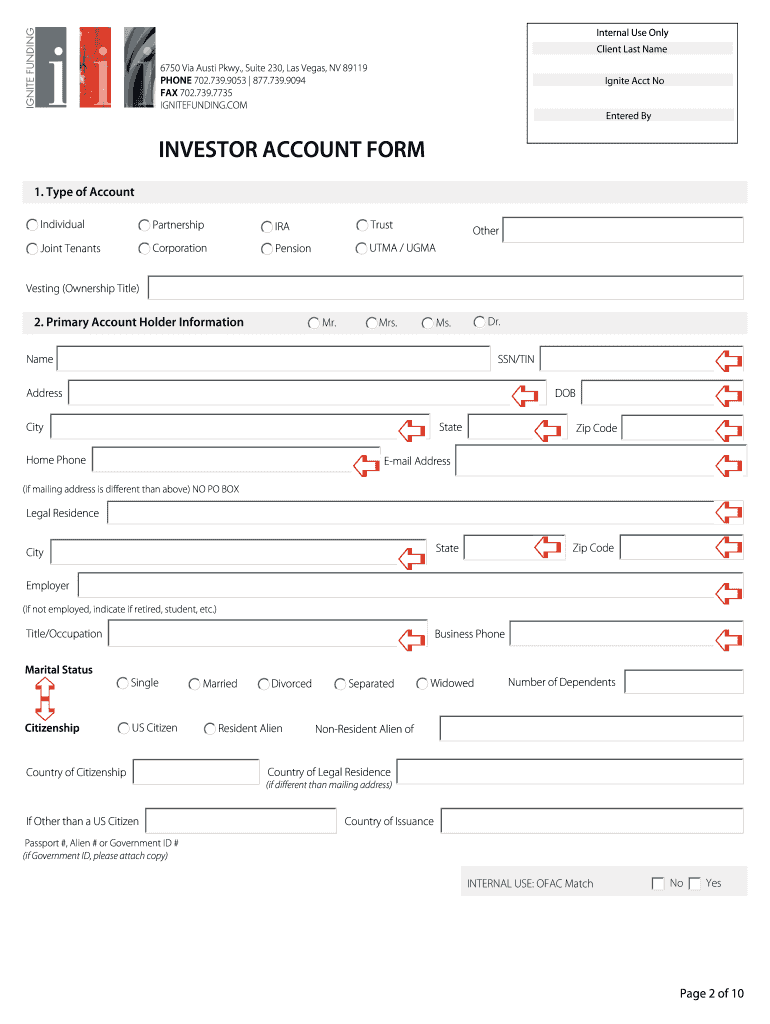

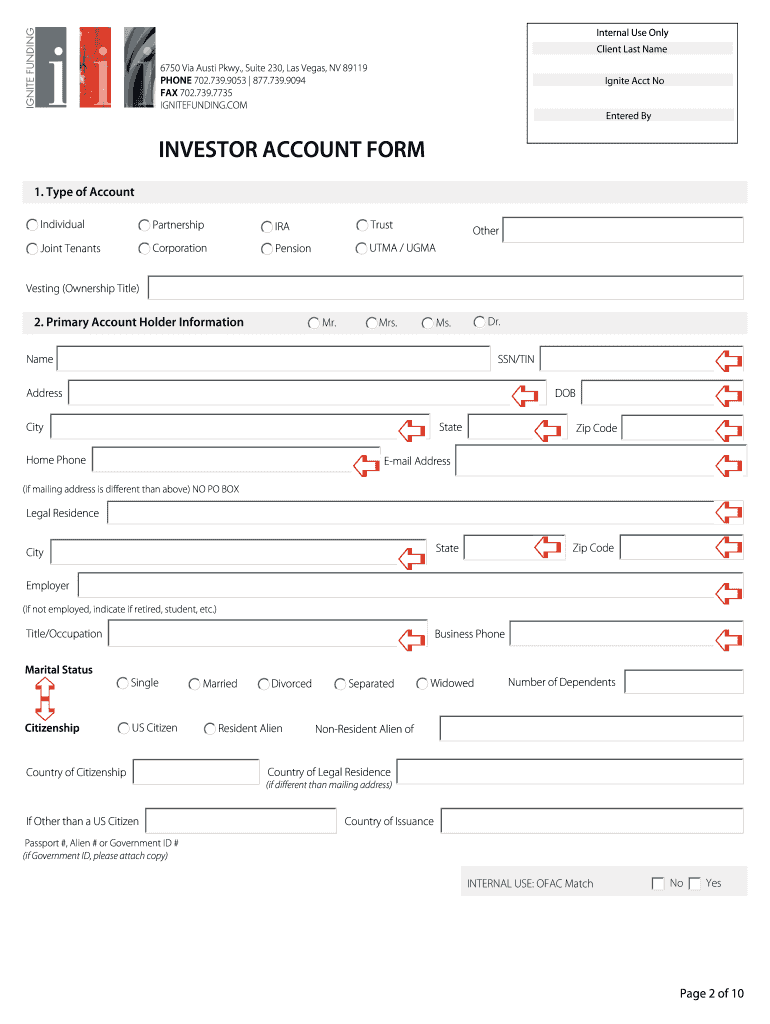

This document is used to collect information from individual and joint investors for account setup at Ignite Funding, including personal details, investment requirements, and legal agreements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investor account form

Edit your investor account form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investor account form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investor account form online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit investor account form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investor account form

How to fill out Investor Account Form

01

Obtain the Investor Account Form from the relevant financial institution or their website.

02

Fill in your personal information, including your full name, address, and contact details.

03

Provide your social security number or tax identification number as required.

04

Indicate your investment objectives and risk tolerance on the form.

05

Review the terms and conditions associated with the account and acknowledge them.

06

Sign and date the form to confirm your application.

07

Submit the completed form as instructed, either online or by mail.

Who needs Investor Account Form?

01

Individuals looking to invest in stocks, bonds, or mutual funds.

02

Business entities wanting to open investment accounts for corporate purposes.

03

Persons needing to establish a brokerage account for trading purposes.

04

Clients wishing to participate in managed investment services.

Fill

form

: Try Risk Free

People Also Ask about

What is an investment account in English?

Investment accounts hold stocks, bonds, funds and other securities, as well as cash. Unlike a bank account, the value of assets in an investment account fluctuates and can decline. Assets with a greater risk of loss tend to offer the potential for greater reward.

What is a personal investor account?

A brokerage account is a standard nonretirement investing account. You can hold mutual funds, ETFs (exchange-traded funds), stocks, bonds, and more, which can generate returns and help you grow your savings. Use it to save for any goal, and take your money out anytime with no early withdrawal penalty.

Can I withdraw money from an investment account?

There are no tax "penalties" for withdrawing money from an investment account. This is because investment accounts do not receive the same tax-sheltered treatment as retirement accounts like an IRA or a 403(b). There are also no age restrictions on when you can withdraw from your investment account.

What is the meaning of investment account?

Investment accounts hold stocks, bonds, funds and other securities, as well as cash. Unlike a bank account, the value of assets in an investment account fluctuates and can decline. Assets with a greater risk of loss tend to offer the potential for greater reward.

What are the three types of investment accounts?

Three of the Most Common Investment Account Types General Investing Accounts. A general investing account offers access to a wide range of potential investment choices, including stocks and bonds. Retirement Accounts. Education Savings Accounts.

What are the 4 types of investments?

Bonds, stocks, mutual funds and exchange-traded funds, or ETFs, are four basic types of investment options. They have the potential to earn a higher return, but they also carry a greater potential for loss if sold when the market is lower.

How do I open an investor account?

Open your Sahulat Account and Start Trading Select Brokerage House. Connect with your chosen brokerage firm and request for account opening. Fill account opening form & attach your copy of your CNIC. Submit your form to brokerage house for processing & account opening.

How to fill demat account opening form?

Choose a Depository Participant (DP) Select a SEBI-registered broker or financial. Visit the Website or App. Go to the DP's official platform and click on “Open Demat Account” Fill the Application Form. Upload Documents. Complete e-KYC and In-Person Verification (IPV) Sign Using Aadhaar OTP. Account Activation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Investor Account Form?

The Investor Account Form is a document used to collect necessary information about an investor's financial background, transaction details, and account preferences, enabling firms to manage investments effectively.

Who is required to file Investor Account Form?

Anyone who wishes to open an investment account with a financial institution or investment firm is required to file the Investor Account Form.

How to fill out Investor Account Form?

To fill out the Investor Account Form, provide personal information such as name, address, social security number, financial status, investment objectives, and sign the form to certify the accuracy of the information.

What is the purpose of Investor Account Form?

The purpose of the Investor Account Form is to ensure that financial institutions have the necessary information to evaluate the investor’s eligibility, investment goals, and provide suitable investment services.

What information must be reported on Investor Account Form?

Information that must be reported typically includes personal identification details, contact information, financial conditions, investment experience, risk tolerance, and any other specifics required by the institution.

Fill out your investor account form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investor Account Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.