TD Ameritrade TDAI 2423 2010 free printable template

Show details

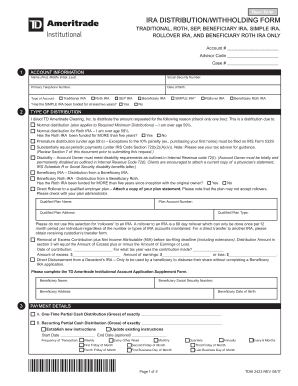

Reset Form IRA DISTRIBUTION/WITHHOLDING FORM TRADITIONAL, ROTH, SEP AND SIMPLE IRA ONLY Account # Advisor # 1 ACCOUNT OWNER INFORMATION Name (First, Middle Initial, Last): Social Security Number:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TD Ameritrade TDAI 2423

Edit your TD Ameritrade TDAI 2423 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TD Ameritrade TDAI 2423 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TD Ameritrade TDAI 2423 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TD Ameritrade TDAI 2423. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TD Ameritrade TDAI 2423 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TD Ameritrade TDAI 2423

How to fill out TD Ameritrade TDAI 2423

01

Obtain the TD Ameritrade TDAI 2423 form from their official website or your account portal.

02

Ensure you have all necessary information at hand, such as personal identification and financial details.

03

Start by filling out your basic personal information at the top of the form, including your name, address, and contact details.

04

Provide your account number or the relevant investment account information required.

05

Follow the instructions for each section carefully, supplying details as requested, and double-check for accuracy.

06

If applicable, include any supporting documentation that may be required for your submission.

07

Review the completed form for any errors or missing information.

08

Sign and date the form at the required section.

09

Submit the form according to the instructions provided, either electronically or via mail.

Who needs TD Ameritrade TDAI 2423?

01

Individuals looking to invest in the stock market and need to open an account with TD Ameritrade.

02

Existing TD Ameritrade customers who need to update their account information or make changes to their investment profile.

03

People looking to gain access to TD Ameritrade's trading services and tools.

Fill

form

: Try Risk Free

People Also Ask about

Are there terms of withdrawal for IRA accounts?

You can take distributions from your IRA (including your SEP-IRA or SIMPLE-IRA) at any time. There is no need to show a hardship to take a distribution. However, your distribution will be includible in your taxable income and it may be subject to a 10% additional tax if you're under age 59 1/2.

What are the terms of withdrawal for Ameritrade IRA?

Withdrawals of earnings are free from federal income tax, provided the Roth IRA has been in existence for five years and you are at least 59½. Contributions can be withdrawn anytime without federal income taxes or penalties. RMDs (Required Minimum Distribution) are not required.

What are the terms of withdrawal for TD Ameritrade IRA?

Withdrawals of earnings are free from federal income tax, provided the Roth IRA has been in existence for five years and you are at least 59½. Contributions can be withdrawn anytime without federal income taxes or penalties. RMDs (Required Minimum Distribution) are not required.

How do I get my RMD?

Required minimum distributions (RMDs) are the minimum amounts you must withdraw from your retirement accounts each year. You generally must start taking withdrawals from your traditional IRA, SEP IRA, SIMPLE IRA, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after Dec. 31, 2022).

What is the IRA withdrawal fee for TD Ameritrade?

Qualified distributions from Traditional IRAs are taxed as income and withdrawals before age 59½ may also be subject to a 10% penalty. Qualified distributions from a Roth IRA are tax free and withdrawals from accounts held less than five years or before age 59½ may be subject to taxes and a 10% penalty.

How do I determine the taxable amount of an IRA distribution?

When you take a distribution from a traditional IRA, the IRS considers it 100% taxable income. That means you'll owe ordinary income taxes on the entire distribution amount. In addition, you must subtract your federal and state income tax percentages from the total distribution.

How do I determine how much of my IRA distribution is taxable?

If it's a traditional IRA, SEP IRA, Simple IRA, or SARSEP IRA, you will owe taxes at your current tax rate on the amount you withdraw. For example, if you are in the 22% tax bracket, your withdrawal will be taxed at 22%.

What is the backup withholding for TD Ameritrade?

Otherwise, Internal Revenue Code section 3406(a)(1)(B), will require us to begin federal backup withholding at a rate of 28% on all taxable dividends, interest, sales proceeds, and other reportable distributions credited to your account after that date.

How do I take RMD from TD Ameritrade?

1:24 2:50 Taking Required Minimum Distributions - YouTube YouTube Start of suggested clip End of suggested clip Process go to planning and retirement. And select IRA then select either distributions on the leftMoreProcess go to planning and retirement. And select IRA then select either distributions on the left side menu or you can select manage distributions. From there select take a distribution. Here. You

What portion of a traditional IRA is taxable?

Traditional IRAs Any deductible contributions and earnings you withdraw or that are distributed from your traditional IRA are taxable. Also, if you are under age 59 ½ you may have to pay an additional 10% tax for early withdrawals unless you qualify for an exception.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TD Ameritrade TDAI 2423 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your TD Ameritrade TDAI 2423 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find TD Ameritrade TDAI 2423?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the TD Ameritrade TDAI 2423 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out the TD Ameritrade TDAI 2423 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign TD Ameritrade TDAI 2423 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is TD Ameritrade TDAI 2423?

TD Ameritrade TDAI 2423 is a tax form used by TD Ameritrade clients to report certain investment income and transactions to the IRS.

Who is required to file TD Ameritrade TDAI 2423?

Clients of TD Ameritrade who have earned investment income or made specific transactions that need to be reported for tax purposes are required to file TD Ameritrade TDAI 2423.

How to fill out TD Ameritrade TDAI 2423?

To fill out TD Ameritrade TDAI 2423, clients should gather all necessary information regarding their investment income and transactions, and accurately enter this information into the designated sections of the form, following the provided instructions.

What is the purpose of TD Ameritrade TDAI 2423?

The purpose of TD Ameritrade TDAI 2423 is to report taxable income from investments, ensuring compliance with IRS regulations and facilitating the accurate calculation of taxes owed.

What information must be reported on TD Ameritrade TDAI 2423?

Information required to be reported on TD Ameritrade TDAI 2423 includes details of dividends, interest income, capital gains, transaction dates, and the corresponding amounts related to securities held or traded through TD Ameritrade.

Fill out your TD Ameritrade TDAI 2423 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TD Ameritrade TDAI 2423 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.