Get the free General Liability Application

Show details

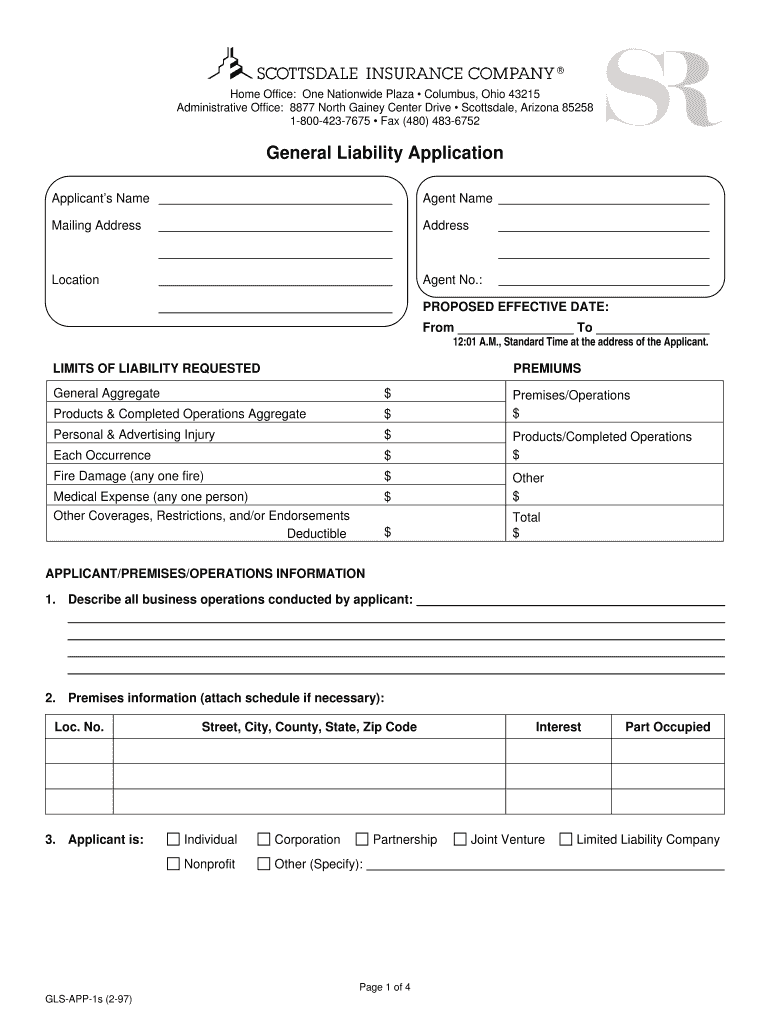

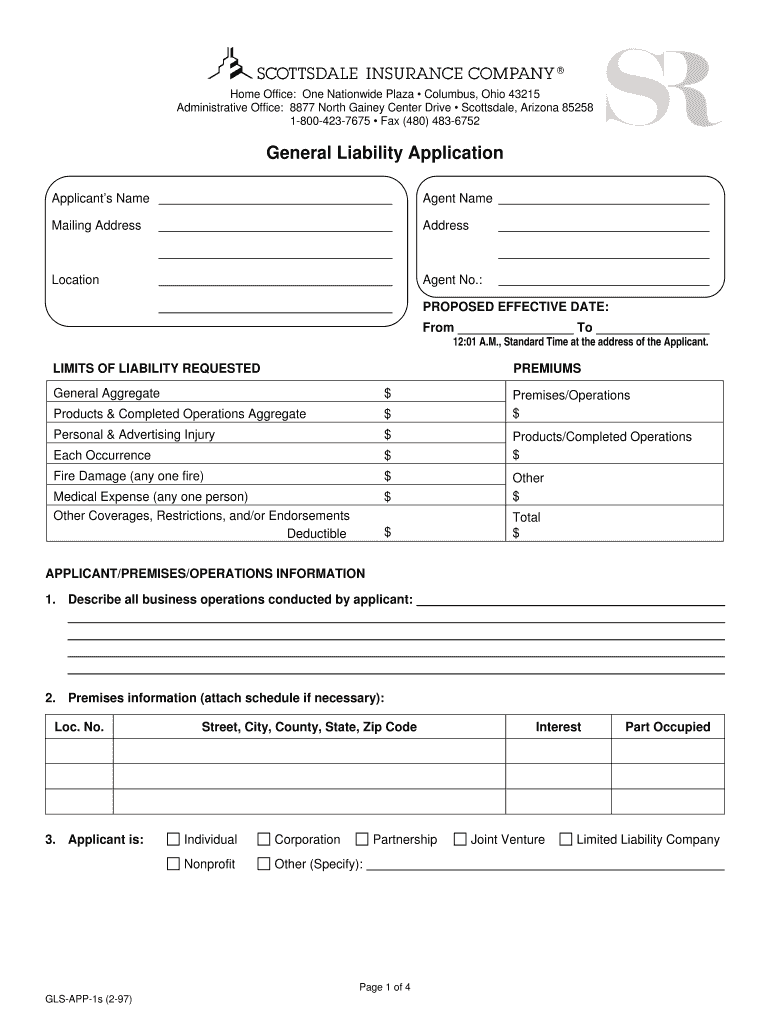

This document is used to apply for general liability insurance, gathering information about the applicant's business operations, risks, and coverage desires.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general liability application

Edit your general liability application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general liability application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general liability application online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit general liability application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general liability application

How to fill out General Liability Application

01

Begin with the applicant's information: Provide the business name, address, and contact details.

02

Specify the type of business: Indicate the industry and nature of the business activities.

03

Select coverage limits: Choose the desired limits of liability coverage based on business needs.

04

Detail payroll and sales figures: Enter estimated annual payroll and gross sales to assess risk.

05

List additional insured parties: Identify any contractors or partners that should be covered.

06

Answer risk assessment questions: Provide information on safety practices, prior claims, and contracts.

07

Review exclusions: Understand and acknowledge any exclusions in the policies offered.

08

Sign and date: Ensure the application is signed by an authorized representative of the business.

Who needs General Liability Application?

01

Businesses of all sizes, including sole proprietors, partnerships, and corporations.

02

Contractors and construction companies working on job sites.

03

Retailers and service providers interacting with customers.

04

Nonprofits and organizations hosting events or activities.

05

Any business engaged in activities that could lead to third-party bodily injury or property damage.

Fill

form

: Try Risk Free

People Also Ask about

What do you say when making an insurance claim?

When you file a claim, you'll be asked to provide some basic details, such as where and when the accident or incident took place, contact information for everyone involved and a description of what happened. You might also be asked to give an estimated cost of the damage from the accident — if you have that available.

What is an example of a liability claim?

The truck causes severe property damage to the brick on the exterior of the building. Mike's Company is now liable for the damages caused to the building by his truck. Mikes liability insurance policy would protect him from these types of damages caused by his company's negligence.

What is the procedure of making an insurance claim?

Give your name, address, policy number, and the date and time of your loss. Make sure to tell your insurance agent where you can be reached, especially if you are unable to stay in your home. Follow up the call with a letter detailing the problem. Keep a copy of the letter.

What is a claims-made general liability policy?

What is a claims-made policy? With a claims-made policy, your coverage only kicks in when you file a claim during the policy period. As long as an insurable event happened after the policy's retroactive date, your insurer should provide coverage. A claims-made policy covers claims filed while your insurance is active.

How to make a general liability claim?

How To File a General Liability Claim Contact Your Insurance Agent or Insurance Carrier. When you find out about an incident or if there's an injury at your business, contact your insurance agent or carrier as soon as you can. Collect Information. Document Everything. Decide How To Resolve the Claim.

What does CGL mean?

Commercial general liability insurance, or CGL insurance, helps protect your business from claims that it caused bodily injuries or damage to another person's property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is General Liability Application?

The General Liability Application is a form used by businesses to apply for general liability insurance, which provides coverage for claims related to bodily injury, property damage, and personal injury.

Who is required to file General Liability Application?

Any business or individual seeking general liability insurance coverage is required to file a General Liability Application.

How to fill out General Liability Application?

To fill out a General Liability Application, one must provide accurate information regarding the business operations, types of services offered, location, number of employees, and previous insurance history.

What is the purpose of General Liability Application?

The purpose of the General Liability Application is to assess the risk associated with a business and to determine the appropriate coverage and premiums for their liability insurance.

What information must be reported on General Liability Application?

The information that must be reported on a General Liability Application includes details about the business, types of services provided, the number of employees, annual revenue, prior claims history, and any existing insurance policies.

Fill out your general liability application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Liability Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.