Get the free Home Business Insurance Application

Show details

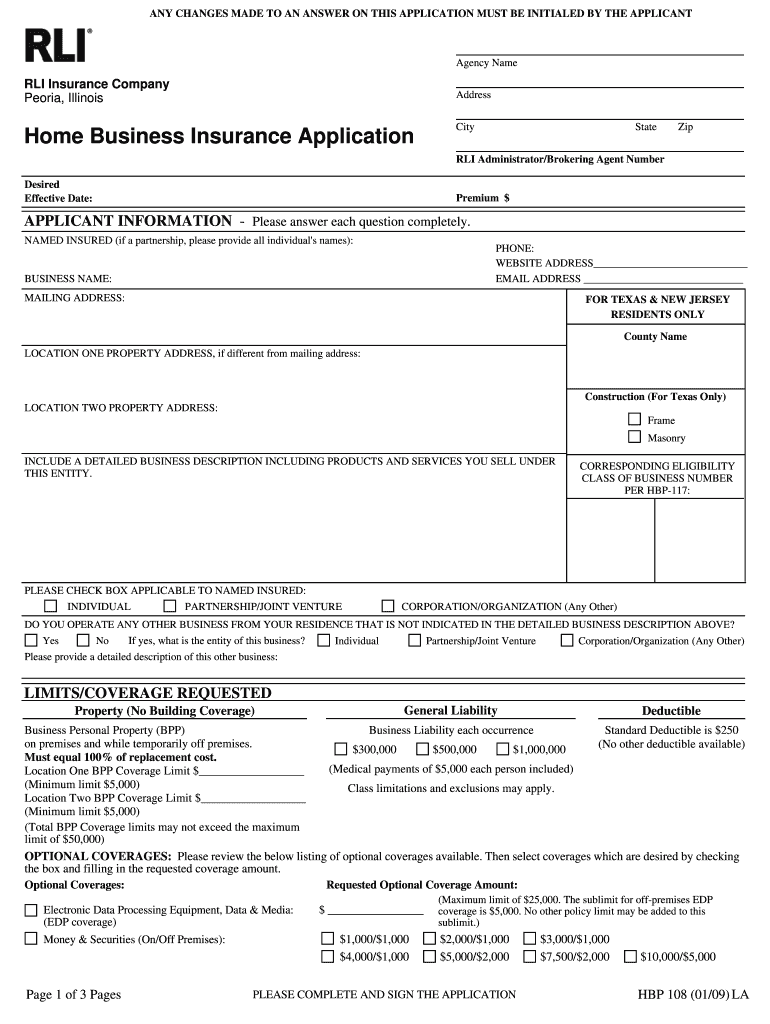

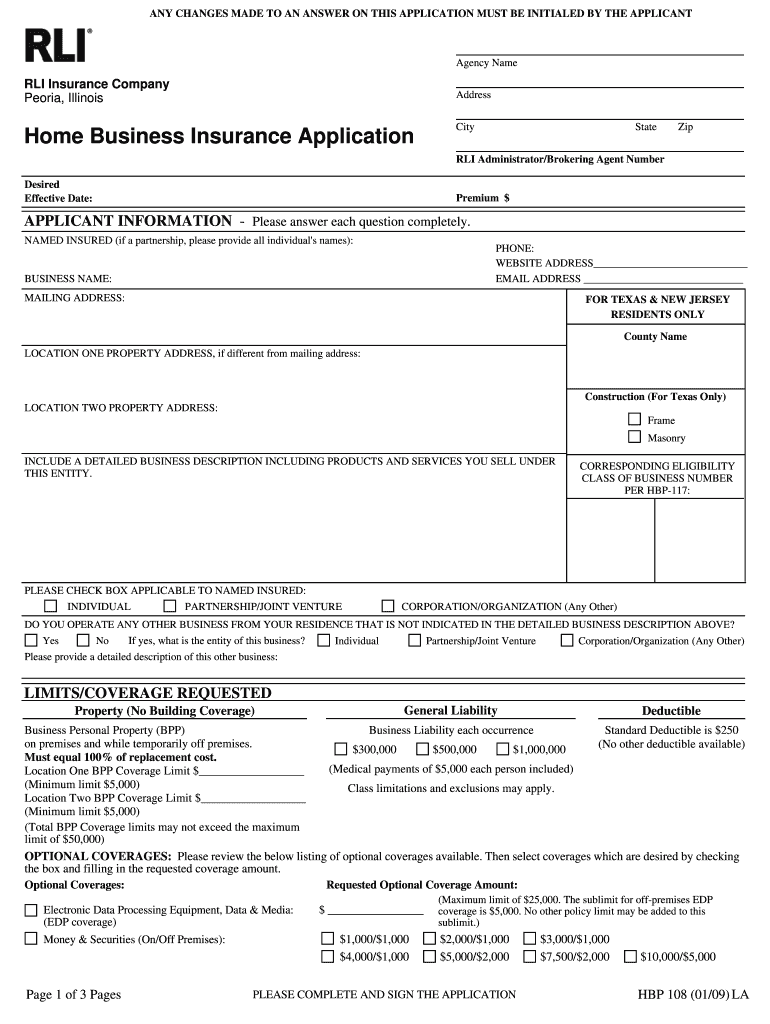

This document is an application for home business insurance that collects information about the applicant's business, coverage needs, and eligibility.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home business insurance application

Edit your home business insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home business insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home business insurance application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit home business insurance application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home business insurance application

How to fill out Home Business Insurance Application

01

Gather necessary information about your home business, including business name, address, and type of business.

02

Collect details about your products or services offered and any relevant liabilities.

03

List your business assets, such as equipment, inventory, and office space.

04

Determine the number of employees or contractors you have, if any.

05

Review the coverage options available and choose the ones that fit your needs.

06

Fill in the application form with accurate information, ensuring all fields are completed.

07

Provide any requested documentation, like financial statements or business licenses.

08

Review the application for accuracy before submitting.

09

Submit the application to your chosen insurance provider along with any required payment.

Who needs Home Business Insurance Application?

01

Small business owners running their operations from home.

02

Freelancers and self-employed individuals who use their home for business purposes.

03

Individuals operating e-commerce businesses from their residence.

04

Consultants or service providers who conduct business meetings at home.

05

Home-based businesses with inventory or physical assets.

Fill

form

: Try Risk Free

People Also Ask about

What business does not need insurance?

Almost all businesses have some insurance. Depending on state law, sole proprietors with no employees or contractors may not need insurance.

Do you need insurance for a small home business?

Yes, it's advisable to have insurance for your home-based small business in America. Different types of insurance, such as liability or business property insurance, can help protect you financially in case of accidents, damages, or other unexpected events related to your business activities.

Does homeowner's insurance cover a business if it is within your home?

A standard homeowners insurance policy may provide limited coverage for business property that is stored in your home. Not every homeowners insurance policy provides coverage for business property, however, and even if yours does, the coverage limits may not be high enough to protect it.

Can you legally run a business without insurance?

While it may be technically possible to operate a business without insurance, it's not advisable, and in many cases, it may be illegal. Insurance serves as a safety net, protecting your business from several risks and liabilities that could have severe financial consequences.

How to insure a home-based business?

What are some ways to insure your home business? A homeowners policy with increased business property limits. Your homeowners policy may cover up to $1,500 worth of personal property, such as a desk or merchandise held as samples, e.g., Mary Kay Cosmetics. An in-home business policy. A business owner policy.

Does my small business need insurance?

As a general rule, you should insure against things you wouldn't be able to pay for on your own. This coverage protects against financial loss as the result of bodily injury, property damage, medical expenses, libel, slander, defending lawsuits, and settlement bonds or judgments.

Do home-based businesses need insurance?

Business insurance for home based businesses is essential. It can cover unforeseen costs that might be incurred by a business. Without it, a company might have to pay out of pocket costs associated with: Property damage.

How much is insurance for a home business?

How much does business insurance cost? Business Insurance PolicyMedian CostAverage Cost General Liability $59/month $80/month Business Owners Policy (BOP) $63/month $106/month Workers' Compensation $67/month $119/month Professional Liability $42/month $64/month

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Home Business Insurance Application?

Home Business Insurance Application is a document that individuals or businesses use to apply for insurance coverage specifically tailored for operations run from a residential address, including coverage for property, liability, and business interruptions.

Who is required to file Home Business Insurance Application?

Individuals who operate a business from their home, including freelancers, consultants, and small business owners, are typically required to file a Home Business Insurance Application to ensure they have appropriate coverage.

How to fill out Home Business Insurance Application?

To fill out a Home Business Insurance Application, you need to provide detailed information about your business, including its structure, operations, revenue, types of products or services offered, and any existing insurance coverage. Review the application carefully and provide accurate and complete information.

What is the purpose of Home Business Insurance Application?

The purpose of the Home Business Insurance Application is to assess the risk associated with the business operations conducted from home and to provide a means for obtaining the necessary insurance coverage to protect the business and its assets.

What information must be reported on Home Business Insurance Application?

The information required on a Home Business Insurance Application typically includes business name, address, owner details, type of business, number of employees, estimated revenue, description of services or products, and any prior insurance claims.

Fill out your home business insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Business Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.