Get the free BOB MUTUAL FUND

Show details

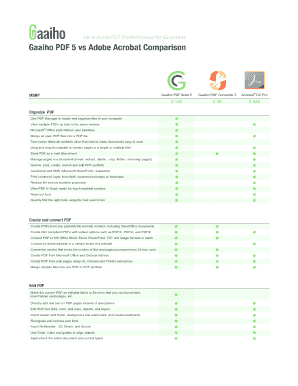

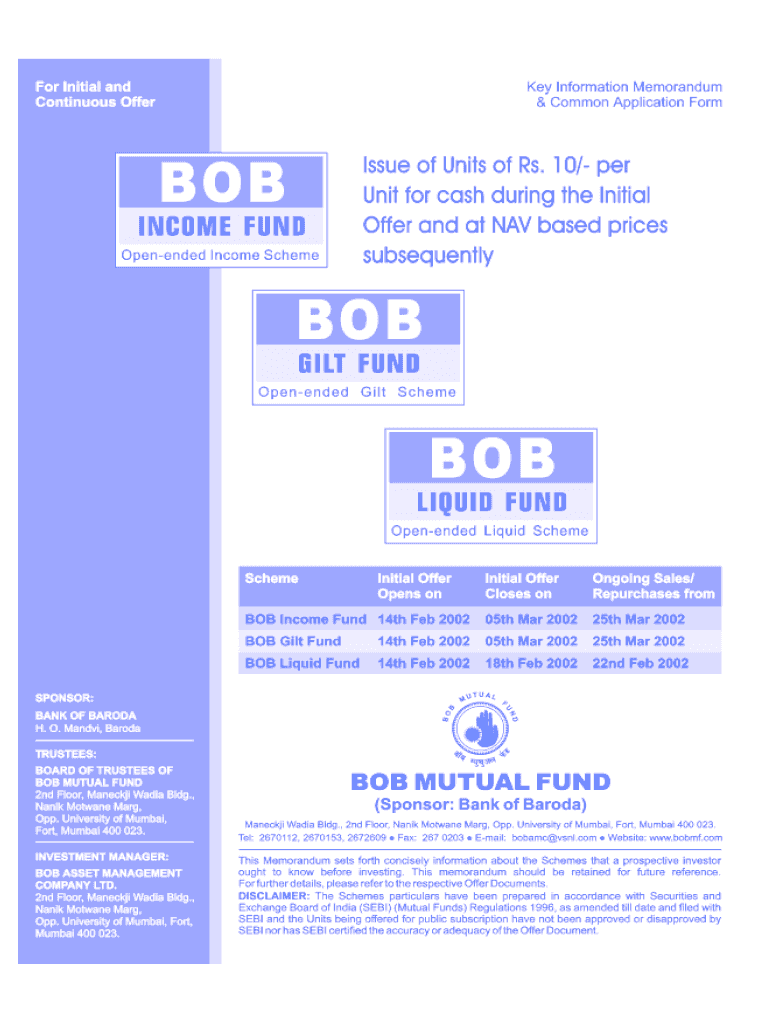

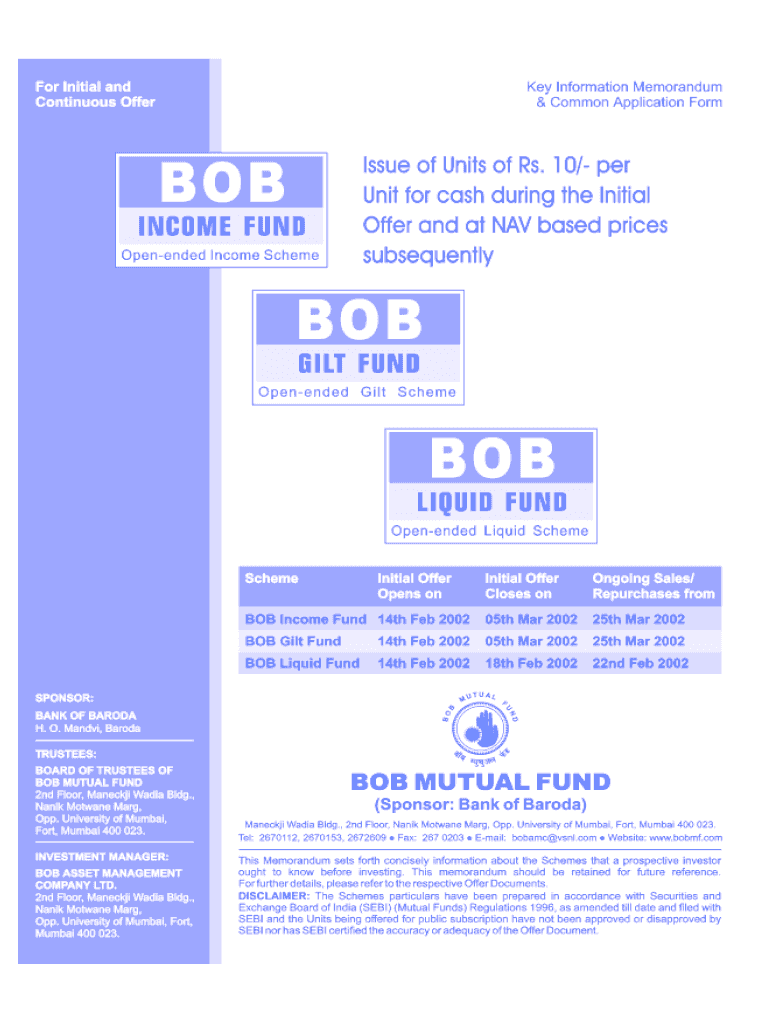

This document outlines the risk factors associated with BOB Mutual Fund schemes including risk profiles, market risks, and various investment schemes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bob mutual fund

Edit your bob mutual fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bob mutual fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bob mutual fund online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bob mutual fund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

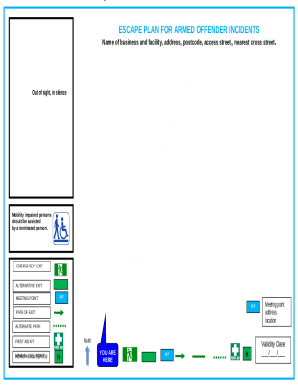

How to fill out bob mutual fund

How to fill out BOB MUTUAL FUND

01

Obtain the BOB Mutual Fund application form from the official website or nearest branch.

02

Fill in your personal details such as name, address, contact information, and PAN number.

03

Choose the type of mutual fund scheme you want to invest in.

04

Decide the investment amount and specify if it's a lump sum or SIP (Systematic Investment Plan).

05

Provide your bank account details for the transaction.

06

Attach the necessary KYC documents such as identity proof and address proof.

07

Review all filled information for accuracy.

08

Submit the completed form either online or at a local branch.

09

Wait for confirmation and details of your investment.

Who needs BOB MUTUAL FUND?

01

Individuals looking to grow their wealth through mutual fund investments.

02

Investors seeking to diversify their investment portfolio.

03

People planning for long-term financial goals such as retirement or children's education.

04

Those needing professional management of their investments.

05

Individuals who want to invest with relatively lower risk compared to direct stock market investments.

Fill

form

: Try Risk Free

People Also Ask about

What is the old name of BNP Paribas mutual fund?

Further Baroda MF has been renamed as “Baroda BNP Paribas Mutual Fund”, with the Surviving AMC acting as the asset management company of the Surviving MF and the Surviving TC acting as the trustee of the Surviving MF.

How to invest in Bob mutual fund?

Transact in top performing Mutual Funds through BOB World mobile application, Internet Banking or through a simple transaction request form. Invest systematically by setting up SIPs, STPs or Standing Instructions through any of the channels mentioned above. Get access to Baroda Select - curated shortlist of funds.

What are the top 5 performing mutual funds?

Top 10 Best-Performing Mutual Funds: 10-Year Analysis SymbolName10 Year Total NAV Returns (As of: January 31, 2025) VITAX Vanguard Information Technology Index Fund Admiral 577.8% CSGZX Columbia Seligman Global Technology Fund I 554.1% PGTYX Putnam Global Technology Fund Y 563.0% WWNPX Kinetics Paradigm Fund No Load 484.1%6 more rows • May 21, 2025

Which mutual fund gives 12% return?

Value funds Value funds10-year-returns Canara Robeco Bluechip Equity Fund 12.87 HDFC Large Cap Fund 12.00 ICICI Prudential Bluechip Fund 13.21 Mirae Asset Large Cap Fund 12.582 more rows • Feb 10, 2025

What is the new name of Bob mutual fund?

Baroda BNP Paribas Multi Asset Fund Direct Growth Fund Performance: The Baroda BNP Paribas Multi Asset Fund comes under the Hybrid category of Baroda BNP Paribas Mutual Funds.

What is the new name of Baroda mutual fund?

Key information about BNP Paribas Asset Management India Private Limited Mutual fund nameBaroda BNP Paribas Mutual Fund Asset management company name BNP Paribas Asset Management India Private Limited AMC Setup Date 24 November 1994 AMC Incorporation Date 5 November 1994 Sponsor name Bank of Baroda5 more rows

What is the new fund offer of BNP Paribas?

Baroda BNP Paribas Gold ETF FoF Reg Gr – NFO Details This NFO will be open for subscription from August 4, 2025, and closes on August 14, 2025. Units are offered at a fixed price of ₹10 during the NFO period, with a minimum initial investment of ₹1,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BOB MUTUAL FUND?

BOB Mutual Fund is an investment scheme offered by Bank of Baroda that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, and other assets.

Who is required to file BOB MUTUAL FUND?

Individuals and entities who wish to invest in the BOB Mutual Fund or those who have certain tax obligations related to their investments are required to file the appropriate forms related to BOB Mutual Fund.

How to fill out BOB MUTUAL FUND?

To fill out the BOB Mutual Fund application, investors need to provide their personal details, investment amount, KYC (Know Your Customer) documents, and select the mutual fund scheme they wish to invest in.

What is the purpose of BOB MUTUAL FUND?

The purpose of BOB Mutual Fund is to provide investors with a platform to invest in a professionally managed portfolio of securities, aiming to generate better returns compared to traditional savings methods.

What information must be reported on BOB MUTUAL FUND?

Investors must report their personal details, investment amount, scheme selection, and any changes to their KYC information when investing in or managing their BOB Mutual Fund accounts.

Fill out your bob mutual fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bob Mutual Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.