Get the free CRA FORM

Show details

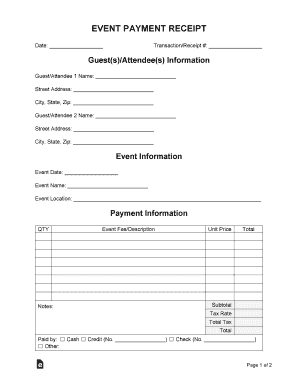

This form is used to assess the likelihood of experiencing new dental decay within the next 12 months through patient-reported risk factors and a bacterial screening test.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cra form

Edit your cra form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cra form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cra form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cra form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cra form

How to fill out CRA FORM

01

Gather all necessary documentation, including income statements, receipts for deductions, and identification.

02

Download the CRA FORM from the official Canada Revenue Agency website or obtain a physical copy.

03

Fill out your personal information at the top of the form, including your name, address, and Social Insurance Number (SIN).

04

Report your total income in the designated section, ensuring accuracy with your income statements.

05

Complete the deductions and credits section by inputting the appropriate amounts supported by your documentation.

06

Review each section for accuracy and ensure all numbers are correct.

07

Sign and date the form, confirming that the information provided is true and complete.

08

Choose your submission method: online through CRA My Account, by mail, or by using a tax software program.

09

Keep a copy of the completed form for your records.

Who needs CRA FORM?

01

Individuals earning income in Canada.

02

Self-employed individuals or freelancers.

03

Students claiming education credits.

04

Families applying for benefits such as the Canada Child Benefit.

05

Non-residents of Canada with income in the country.

06

Any taxpayer who meets the minimum income threshold.

Fill

form

: Try Risk Free

People Also Ask about

What's in CRA?

The Community Reinvestment Act of 1977 (CRA) encourages certain insured depository institutions to help meet the credit needs of the communities in which they are chartered, including low- and moderate-income (LMI) neighborhoods, consistent with the safe and sound operation of such institutions.

What is the US version of CRA?

The Canada Revenue Agency (CRA) is the equivalent of the U.S. Internal Revenue Service (IRS).

What does "CRA" stand for?

Canada Revenue Agency (CRA) - Canada.ca.

What is the CRA form?

The Customs Receipt Audit (CRA) wing is responsible for audit of customs revenue and the functions of the Customs Department under the Customs Act, 1962. It also audits the offices of DGFT and Development Commissioners under the jurisdiction of Gujarat.

What is CRA in the USA?

Community Reinvestment Act of 1977 ch. 30). The CRA was passed as a result of national pressure to address the deteriorating conditions of American cities — particularly lower-income and minority neighborhoods.

What documents do I need for CRA?

Supporting documents a copy of your information slips such as a T4, T4A, T5, and NR4, and provincial slips such as the Relevé 1, if applicable. your completed forms and schedules, when instructed.

What does the CRA stand for?

The Canada Revenue Agency (CRA) administers tax laws for the Government of Canada and for most provinces and territories. The CRA also administers social and economic benefit, and incentive programs delivered through the tax system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CRA FORM?

CRA FORM refers to forms filed with the Canada Revenue Agency (CRA) for various tax purposes, including tax returns, deductions, and credits.

Who is required to file CRA FORM?

Individuals, corporations, and other entities that earn income in Canada are required to file CRA FORM, depending on their tax situation and income level.

How to fill out CRA FORM?

To fill out CRA FORM, individuals must gather their income information, deductions, and credits, and complete the form either online through CRA's e-filing service or by using paper forms, ensuring all fields are accurately filled in.

What is the purpose of CRA FORM?

The purpose of CRA FORM is to report income, claim deductions and credits, and determine the amount of tax payable or refund due to the taxpayer.

What information must be reported on CRA FORM?

The information that must be reported on CRA FORM includes personal details, income sources, deductions claimed, tax credits, and any other relevant financial information regarding the individual's or entity's fiscal year.

Fill out your cra form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cra Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.