Income and Employment Verification Form Letter 2007-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

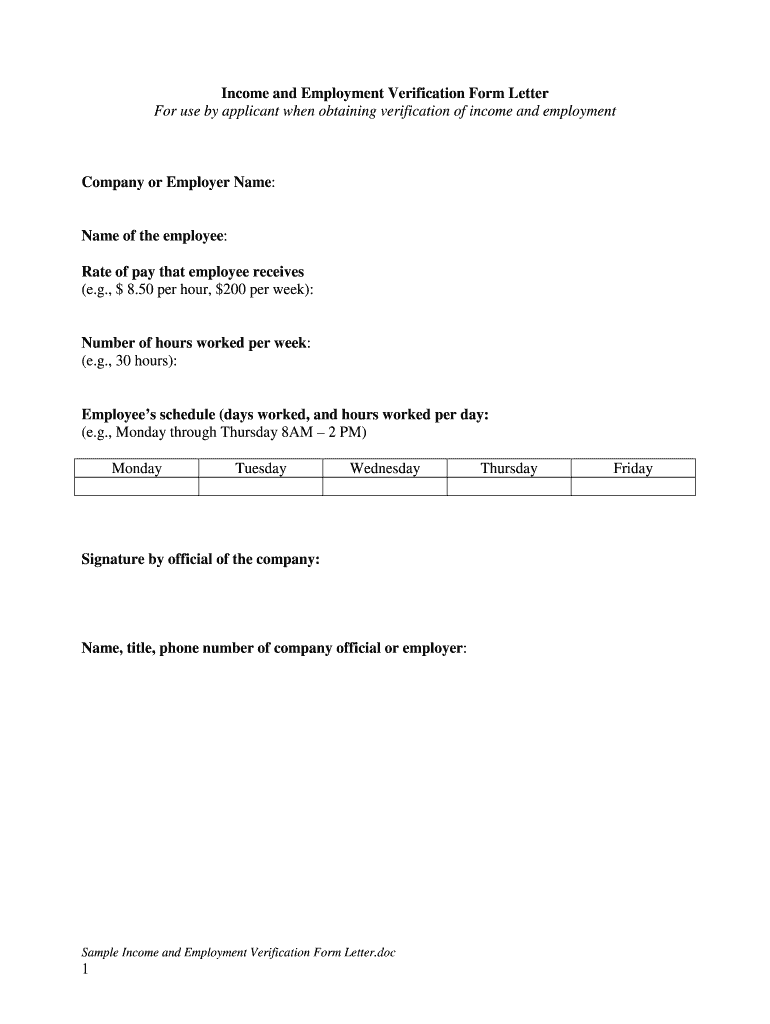

Edit and sign in one place

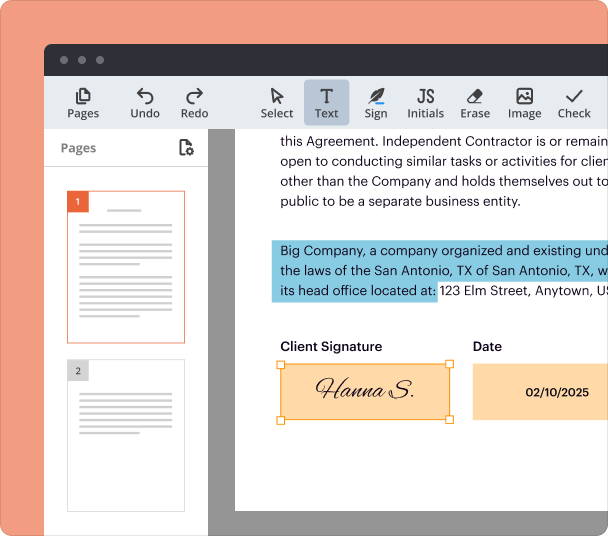

Create professional forms

Simplify data collection

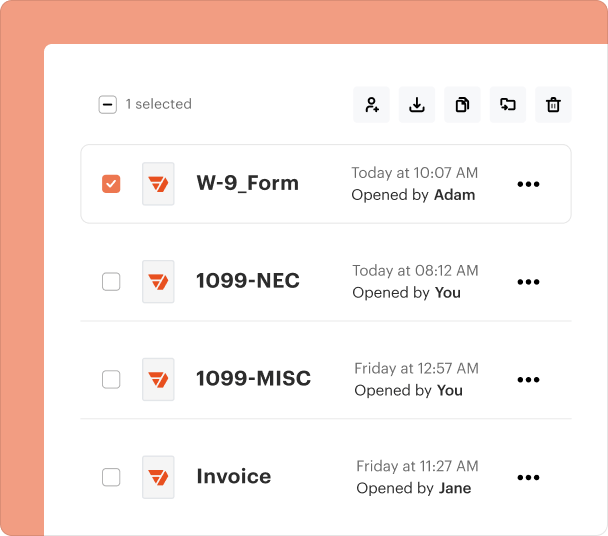

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

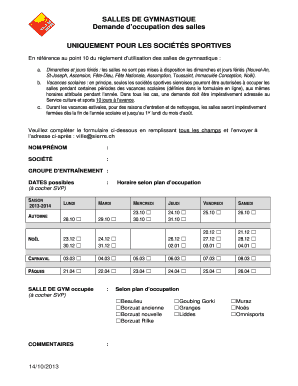

Understanding the Income and Employment Verification Form

What is the income and employment verification form?

The income and employment verification form is a crucial document used to confirm an individual’s financial capacity and job status. It is often required by lenders, landlords, and other institutions to assess an applicant's financial reliability. This form provides necessary details regarding the employee's income, employment duration, and work schedule.

Key features of the income and employment verification form

Common features of this form include clear sections for employee and employer information, details of employment status, and the employee’s earnings. It may also request the number of hours worked and the employee’s schedule to provide a complete picture of the individual’s financial situation.

Required documents and information

To complete the income and employment verification form effectively, certain information is essential. This includes the employee's name, employer's name, pay rate, frequency of pay, hours worked per week, and the official’s signature. Additional documentation may include recent pay stubs or tax forms to supplement the information provided.

How to fill out the income and employment verification form

Filling out the income and employment verification form requires careful attention to detail. Start by entering the employee’s name and identifying the employer’s name. Accurately state the rate and frequency of pay, followed by the average number of hours worked. Include specifics about the employee's schedule to provide context. Finally, the designated company official should sign and date the form to validate it.

Common errors and troubleshooting

When completing the income and employment verification form, common errors may include inaccurate or incomplete information, such as mismatched names or missing signatures. Review all details carefully and ensure that all necessary fields are filled out. If the form is returned for corrections, promptly address any issues to avoid delays in processing the request.

Benefits of using the income and employment verification form

Utilizing the income and employment verification form offers numerous benefits. It streamlines the verification process for both employees and employers by providing a standardized format. This uniformity helps ensure all necessary information is captured accurately, facilitating faster approval for loans, lease agreements, or other financial transactions.

Frequently Asked Questions about income verification form

Who usually requires an income and employment verification form?

Lenders, landlords, and insurance companies typically require this form to assess an individual's financial reliability.

Can the income and employment verification form be completed digitally?

Yes, the form can be easily filled out and signed electronically, which simplifies the submission process and reduces paperwork.

pdfFiller scores top ratings on review platforms