Get the free Local Government Pension Scheme Monthly Remittance Advice

Show details

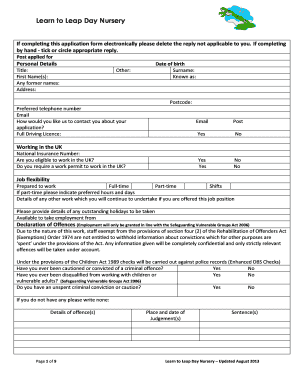

This document is used for remitting contributions to the Local Government Pension Scheme, detailing employer and employee contributions, payment methods, and necessary confirmations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local government pension scheme

Edit your local government pension scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local government pension scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local government pension scheme online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit local government pension scheme. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local government pension scheme

How to fill out Local Government Pension Scheme Monthly Remittance Advice

01

Gather necessary employee information, including names, National Insurance numbers, and contribution amounts.

02

Log in to the Local Government Pension Scheme portal or use the appropriate form template.

03

Fill in the month and year for which the remittance advice is being submitted.

04

Enter the total contributions from all employees for the designated period.

05

Include any employer contributions that need to be reported.

06

Ensure that all figures are accurate and tally with payroll records.

07

Review the completed remittance advice for any errors or omissions.

08

Submit the remittance advice according to the guidelines provided by the pension scheme.

09

Keep a copy of the submitted remittance advice for your records.

Who needs Local Government Pension Scheme Monthly Remittance Advice?

01

Local authorities and employers who are part of the Local Government Pension Scheme.

02

Payroll departments responsible for managing employee contributions.

03

Finance teams that handle pension fund management.

04

Employees participating in the Local Government Pension Scheme who require confirmation of their contributions.

Fill

form

: Try Risk Free

People Also Ask about

How does a local government pension scheme work?

The LGPS is a career average revalued earnings (CARE) scheme, which means your benefits are based on your salary for each year you are in the scheme and each year it is revalued in line with Pensions Act increases. When can I retire?

Are local government pensions paid monthly?

Your pension is paid on the last working day of each month and in order to do this, we need to prepare the records for processing. This means that any changes to your address or bank details received after the 16th of the month (or after the 4 December) will not be updated until the following month.

Is a local government pension good?

Paying into the Local Government Pension Scheme (LGPS) can be one of the best ways to safeguard your future. The LGPS is amongst the largest pension schemes in the UK and offers many unique benefits.

Do local government employees get a pension?

Governmental Employee Pension Benefits. State and Local Governments Sponsor “Defined Benefit” Plans for Their Employees. As part of employment, the state provides defined benefit pension plans for its employees and for those of public schools and community colleges.

How long will my local government pension last?

What the 85-year rule means for you depends on your age, the date you meet the 85-year and the date you take your LGPS benefits. If you are protected: and you take your benefits after you satisfy the 85-year rule, some or all of your benefits will be paid without reduction.

How much is a local government pension?

Both you and your employer pay contributions to pay for your LGPS pension. How much you pay depends on how much you earn. You will pay between 5.5% and 12.5% of your pensionable pay. Every April your employer will decide your contribution rate.

How much is the local government pension scheme?

Local Government Pension Scheme Your contribution rate is based on how much you are paid. It's currently between 5.5% and 12.5% of your pensionable pay. If you join the 50/50 section of the Scheme, you would pay half the rates shown in the table below.

Is local government pension paid for life?

As an LGPS member, you build up a pension that will increase in line with the cost of living for the rest of your life after you take it. You can exchange part of your pension for a tax-free lump sum that is paid when you take your benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Local Government Pension Scheme Monthly Remittance Advice?

The Local Government Pension Scheme Monthly Remittance Advice is a document that employers submit to inform the pension fund of the contributions deducted from employees' salaries and the employer's contributions for a specific month.

Who is required to file Local Government Pension Scheme Monthly Remittance Advice?

Employers who participate in the Local Government Pension Scheme and are responsible for deducting pension contributions from their employees' salaries are required to file the Monthly Remittance Advice.

How to fill out Local Government Pension Scheme Monthly Remittance Advice?

To fill out the Monthly Remittance Advice, employers need to provide details such as the employer and employee contribution amounts, member identification details, and the total payroll figures for the month.

What is the purpose of Local Government Pension Scheme Monthly Remittance Advice?

The purpose of the Monthly Remittance Advice is to ensure accurate accounting of pension contributions, maintain compliance with pension regulations, and facilitate the timely processing of pension benefits for employees.

What information must be reported on Local Government Pension Scheme Monthly Remittance Advice?

The information that must be reported includes employee names, National Insurance numbers, contribution amounts due for both employer and employee, and any adjustments or corrections from previous months.

Fill out your local government pension scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Government Pension Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.