Get the free Gift Transfer Form

Show details

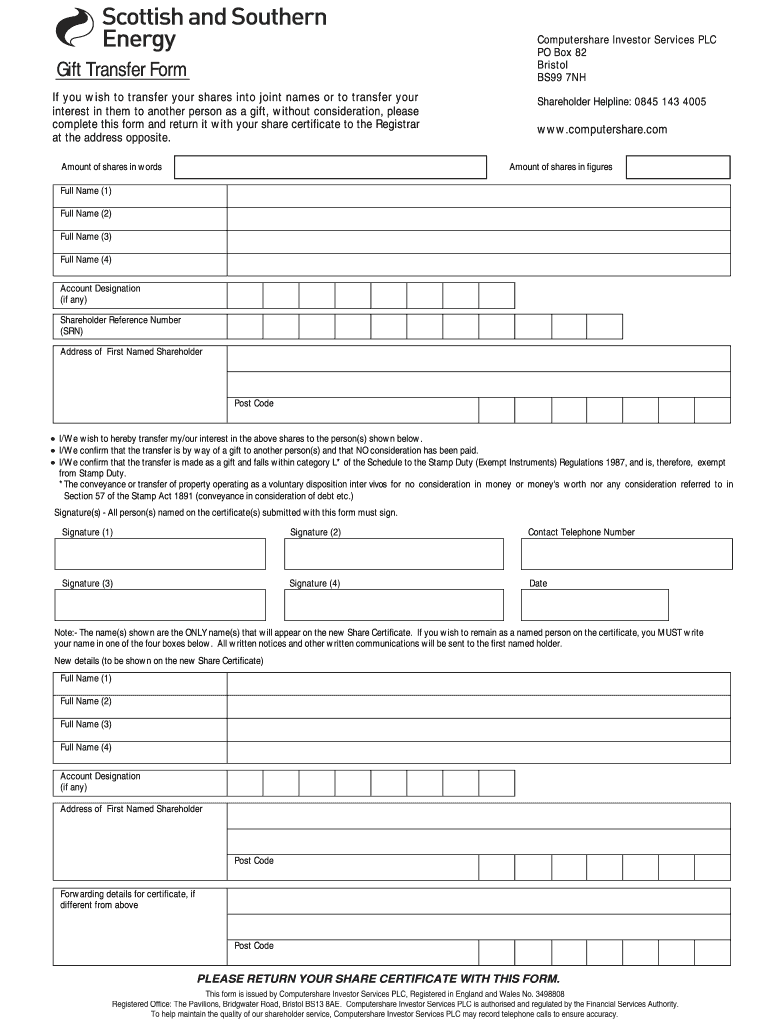

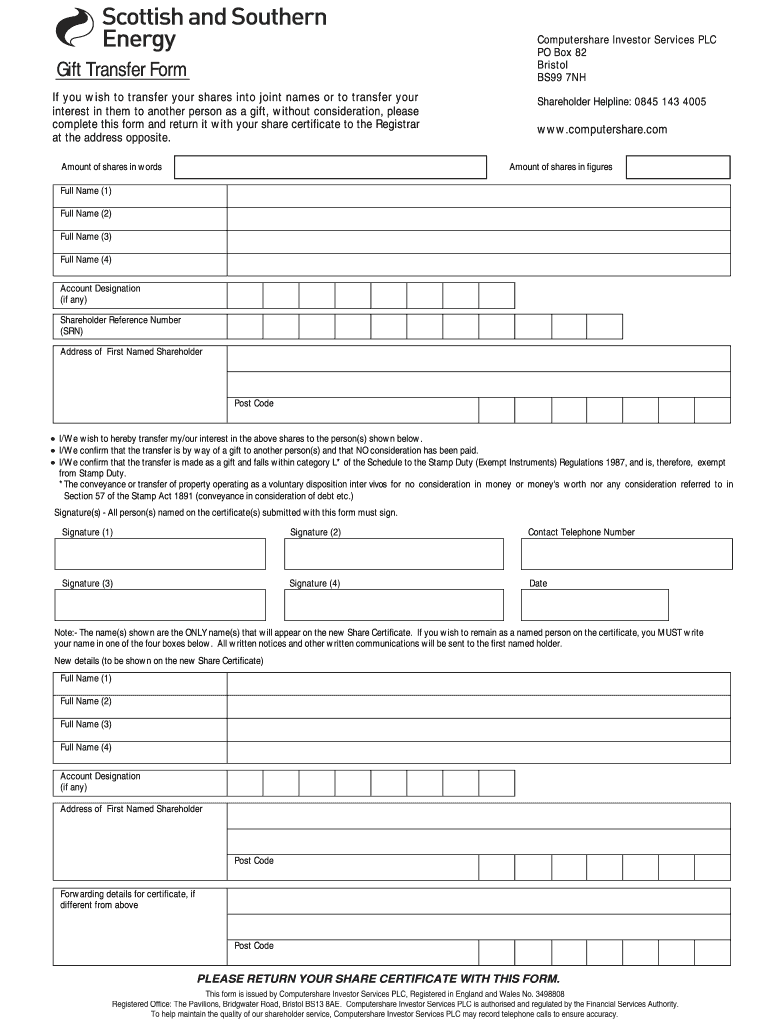

This form is used to transfer shares into joint names or to transfer interest in them as a gift without consideration, and must be returned with a share certificate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift transfer form

Edit your gift transfer form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift transfer form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift transfer form online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift transfer form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift transfer form

How to fill out Gift Transfer Form

01

Obtain the Gift Transfer Form from the relevant authority or website.

02

Fill in the date at the top of the form.

03

Provide the full name and contact information of the donor.

04

Enter the full name and contact information of the recipient.

05

Describe the item(s) being transferred as a gift, including any relevant details (e.g., serial numbers, condition).

06

Include the estimated value of the gift in the appropriate section.

07

Sign and date the form to confirm the accuracy of the information provided.

08

Submit the completed form to the appropriate office or department.

Who needs Gift Transfer Form?

01

Individuals who are gifting assets such as property, vehicles, or high-value items.

02

People required to document a gift for tax or legal purposes.

03

Anyone wishing to formally transfer ownership of a gift to another person.

Fill

form

: Try Risk Free

People Also Ask about

How much money can be gifted tax free in the USA?

Staying under the annual gift tax exclusion means you don't have to worry about paying tax when gifting money for birthdays, holidays, and special occasions. This is a per-person limit, so you can give $19,000 to your child, another $19,000 to a niece, and another $19,000 to a neighbor, all tax-free.

What is form 130-u texas?

Form 130-U, Application for Texas Title and/or Registration (PDF) (application), documents the Texas Department of Motor Vehicles (TxDMV) title application information for motor vehicles and off-highway vehicles (OHVs).

What gifts are reported on Form 709?

If you were an NRNC of the United States for the entire calendar year who made a gift subject to U.S. gift tax, you must file Form 709-NA when any of the following apply. You gave any gifts of future interests. Your gifts of present interests to any donee other than your spouse total more than $18,000.

How much foreign gift is tax free in the USA?

US persons must file Form 3520 to report foreign gifts when: Total gifts received from nonresident alien individuals or foreign estates exceed $100,000 in a calendar tax year. Gifts received from foreign corporations or foreign partnerships exceed $19,570 during the taxable year (adjusted annually).

What is the gift form for Texas registration?

In addition to completing Form 130-U, Application for Texas Title and/or Registration (PDF), both the donor and person receiving the motor vehicle must complete a required joint notarized Form 14-317, Affidavit of Motor Vehicle Gift Transfer, describing the transaction and the relationship between the donor and

What is the best way to gift a vehicle to a family member?

Verify ownership and ensure all liens are cleared before transferring a gifted or inherited car to avoid legal complications. Draft a bill of sale and transfer the title at your local DMV to legally document the change in ownership and fulfill state requirements.

Which of the following gifts is not required to be reported on Form 709?

Gifts to Spouse Typically, a Form 709 will not need to be filed to record gifts to a spouse. Gifts to a spouse are not subject to federal gift tax provided that the spouse is a U.S. citizen. Between U.S. citizen spouses, gifts of both present and future interests qualify for the unlimited marital deduction.

What is a form 709 for gifting?

If you are a US citizen or green card holder and you give large gifts to family, friends, or others, you may be required to file Form 709. This form is used to report gifts that exceed the annual exclusion limit, and it also covers generation skipping transfers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Gift Transfer Form?

The Gift Transfer Form is a legal document used to report the transfer of assets or property from one individual to another as a gift. This document provides details about the gift and helps ensure compliance with tax regulations.

Who is required to file Gift Transfer Form?

Individuals who give gifts that exceed a certain monetary threshold are required to file a Gift Transfer Form. This may also include organizations that handle donations exceeding the allowable limit.

How to fill out Gift Transfer Form?

To fill out the Gift Transfer Form, provide the donor's and recipient's details, describe the gift, indicate the value of the gift, and sign the form. Ensure all required fields are completed accurately to avoid delays.

What is the purpose of Gift Transfer Form?

The purpose of the Gift Transfer Form is to document the transfer of ownership of a gift for tax purposes and to provide evidence of the transaction to the tax authorities.

What information must be reported on Gift Transfer Form?

The Gift Transfer Form must report information including the donor's name and address, recipient's name and address, description of the gift, fair market value of the gift, date of the transfer, and signatures of the parties involved.

Fill out your gift transfer form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Transfer Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.