Get the free Accidental Death & Dismemberment Insurance Enrollment

Show details

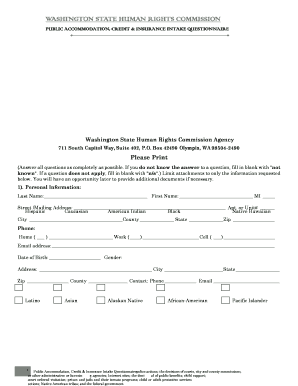

This document is for applying for Personal Accident Insurance to provide coverage for accidental death and dismemberment. It includes sections for personal information, beneficiary details, and automatic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accidental death dismemberment insurance

Edit your accidental death dismemberment insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accidental death dismemberment insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accidental death dismemberment insurance online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit accidental death dismemberment insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accidental death dismemberment insurance

How to fill out Accidental Death & Dismemberment Insurance Enrollment

01

Obtain the Accidental Death & Dismemberment Insurance Enrollment form from your employer or insurance provider.

02

Read the instructions carefully to understand the coverage options and requirements.

03

Fill in your personal information correctly, including your name, address, and social security number.

04

Indicate your selected coverage amount based on your personal needs and preferences.

05

Provide information about your beneficiaries, including their names and relationship to you.

06

Review the terms and conditions of the policy, including any exclusions or limitations.

07

Sign and date the enrollment form to validate your application.

08

Submit the completed form to your employer or designated insurance representative.

Who needs Accidental Death & Dismemberment Insurance Enrollment?

01

Individuals who want added financial protection for their families in case of accidental death.

02

People involved in high-risk jobs or activities that may increase the likelihood of accidents.

03

Families seeking to supplement existing life insurance policies with additional benefits.

04

Those looking for affordable insurance options to cover medical and funeral expenses in case of accidents.

Fill

form

: Try Risk Free

People Also Ask about

Do I really need accidental death and dismemberment insurance?

You may want both life insurance and AD&D insurance depending on your personal needs. For individuals in high-risk jobs or for parents of young children who cannot afford a gap in income due to an accident, AD&D insurance may be particularly important.

Is it worth getting accidental death and dismemberment insurance?

AD&D insurance may be a worthwhile policy if you have a high-risk job or lifestyle or want to boost your overall death benefit for financial protection. Aflac offers life insurance for individuals and families with an accidental-death benefit rider that can help give you additional peace of mind.

What is covered under accidental death and dismemberment?

AD&D Covers Loss of Limbs or Vital Functions The qualifying coverage under an AD&D policy is always very clearly specified; it's only applicable to an injury that results in the loss of some vital function like speech or hearing, a limb like a leg, or a vital part of the body, such as a hand.

Who should consider ad&d insurance?

To protect your income in case you become ill or injured and can't work, look into disability insurance. If your employer offers AD&D insurance at no charge, it's worth opting into that perk. Otherwise, you may want to buy an AD&D policy only if you have a risky job or hobby and are prone to accidents as a result.

What is accidental death and dismemberment insurance?

An accidental death and dismemberment (AD&D) insurance policy or rider includes coverage for certain accidental injuries (as well as accidental death), while standard life insurance only pays out for death.

Do I need both life insurance and ad&d?

You may want both life insurance and AD&D insurance depending on your personal needs. For individuals in high-risk jobs or for parents of young children who cannot afford a gap in income due to an accident, AD&D insurance may be particularly important.

What is not covered under AD&D?

AD&D policies provide financial protection against accidental death or injury, but can have a variety of exclusions. These can include intentional self-inflicted injuries, deaths resulting from natural causes, and injuries from illegal activities.

What qualifies as an accidental death?

An accidental death is an unnatural death that is caused by an accident, such as a slip and fall, traffic collision, or accidental poisoning. Accidental deaths are distinguished from death by natural causes, disease, and from intentional homicides and suicide.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Accidental Death & Dismemberment Insurance Enrollment?

Accidental Death & Dismemberment Insurance Enrollment is the process by which individuals enroll in a specific type of insurance policy that provides financial benefits in the case of accidental death or loss of limbs as a result of an accident.

Who is required to file Accidental Death & Dismemberment Insurance Enrollment?

Typically, employees or individuals who are offered this type of insurance through their employer or as part of a personal insurance plan are required to file for Accidental Death & Dismemberment Insurance Enrollment.

How to fill out Accidental Death & Dismemberment Insurance Enrollment?

To fill out the Accidental Death & Dismemberment Insurance Enrollment form, individuals need to provide personal information, select the coverage amount, and may need to answer health-related questions as required by the insurance provider.

What is the purpose of Accidental Death & Dismemberment Insurance Enrollment?

The purpose of Accidental Death & Dismemberment Insurance Enrollment is to ensure that individuals have financial protection in the event of an accidental death or significant injury that results in dismemberment, thereby providing peace of mind.

What information must be reported on Accidental Death & Dismemberment Insurance Enrollment?

The information that must be reported typically includes the applicant's name, date of birth, contact information, employment details, beneficiary designation, and any health history questions as requested by the insurer.

Fill out your accidental death dismemberment insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accidental Death Dismemberment Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.