Get the free Group Term Life Application

Show details

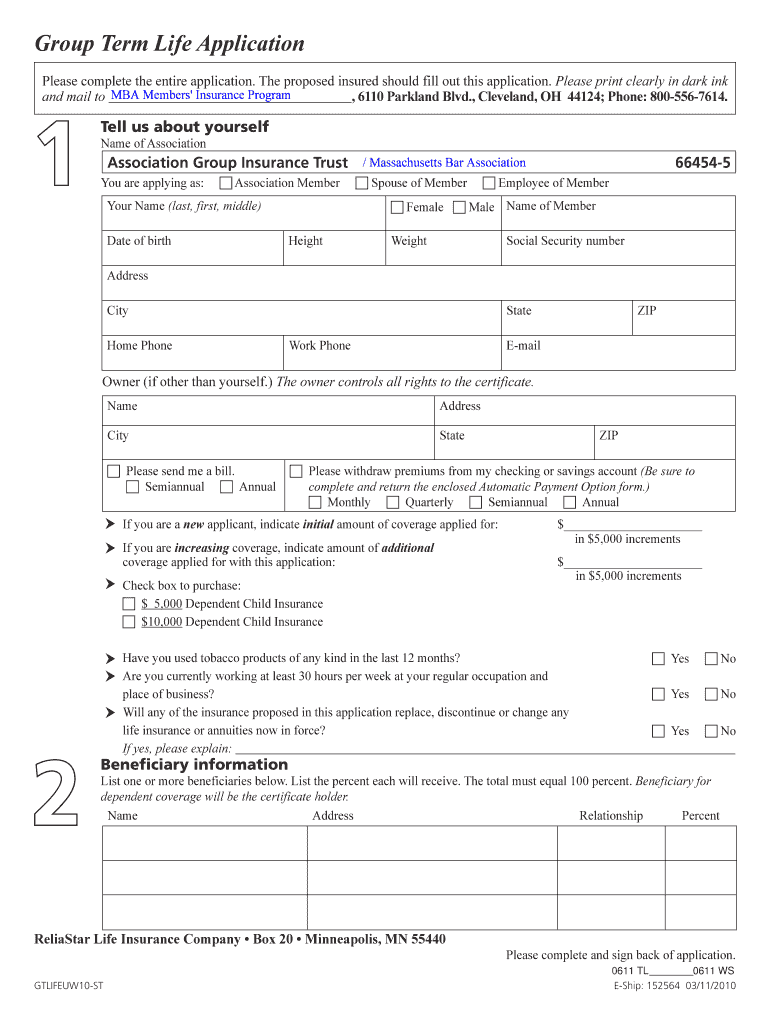

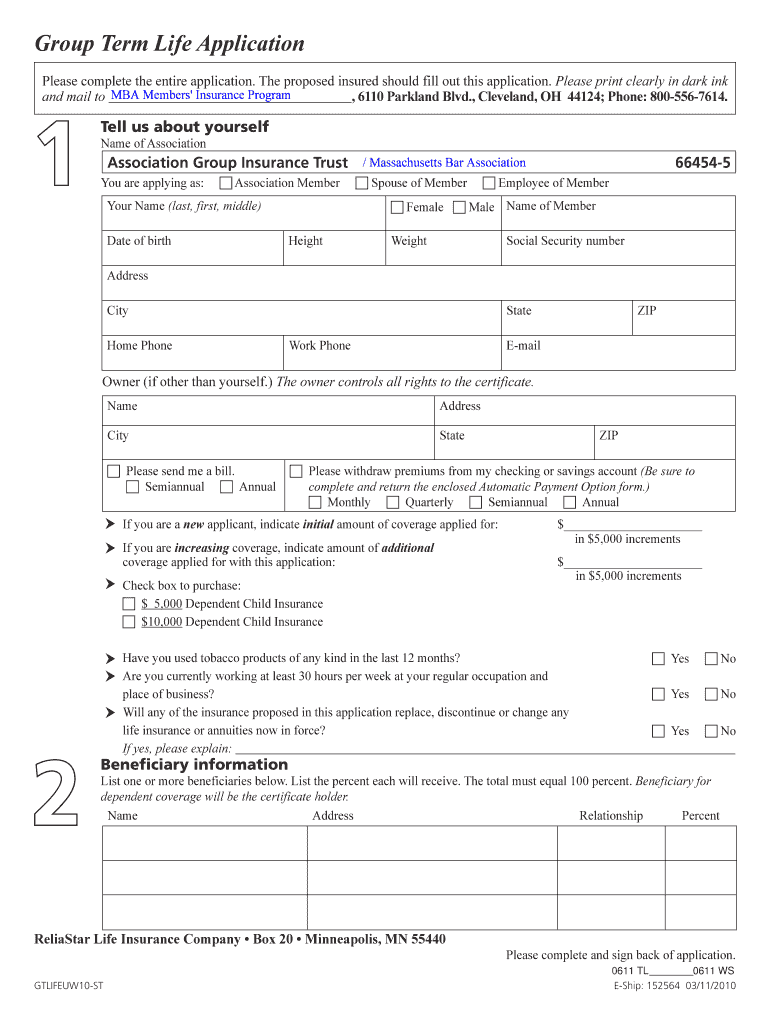

This document is an application form for Group Term Life Insurance, requiring personal and health information to assess eligibility for coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group term life application

Edit your group term life application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group term life application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit group term life application online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit group term life application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group term life application

How to fill out Group Term Life Application

01

Start by gathering necessary personal information such as name, address, date of birth, and Social Security number.

02

Provide details about your employment, including your job title, employer's name, and employment start date.

03

Specify the coverage amount you are seeking and any additional riders or features you may want.

04

Disclose your health history, including any pre-existing conditions, recent illnesses, or treatments.

05

Answer questions regarding lifestyle habits, such as smoking, alcohol use, and participation in high-risk activities.

06

List the beneficiaries who will receive the life insurance benefits in case of your passing.

07

Review and sign the application, certifying that all provided information is accurate and complete.

Who needs Group Term Life Application?

01

Individuals who want to provide financial security for their loved ones in the event of their death.

02

Employees whose companies offer Group Term Life Insurance as part of their benefits package.

03

Those looking for a cost-effective life insurance option through their employer.

04

People with dependents who may rely on their income or support.

Fill

form

: Try Risk Free

People Also Ask about

Is group term life over $50,000 taxable?

10, the coverage is considered carried by the employer. Therefore, each employee is subject to Social Security and Medicare tax on the cost of coverage over $50,000.

What are the disadvantages of term life insurance?

Term Life Insurance: Term life insurance policies generally do not have a cash value. If you surrender a term policy, you usually will not receive any money back, as these policies are designed to provide coverage for a specific period without accumulating cash value.

What is term life insurance in English?

A term life insurance policy is the simplest, purest form of life insurance : You pay a premium for a period of time – typically between 10 and 30 years – and if you die during that time a death benefit is paid to your family (or anyone else you name as your beneficiary).

Do you get your money back after a term life insurance?

Term life insurance is a relatively inexpensive way to provide a lump sum to your dependents if something happens to you. It can be a good option if you are young and healthy and support a family.

What does group term life mean on my paycheck?

Group term life insurance protects your loved ones by paying them a death benefit if you die while your coverage is active. Many employers offer group term life insurance coverage as a benefit to their employees.

How does the term life insurance work?

The main disadvantages of a term plan include no cash value accumulation, temporary coverage, higher premiums with age, and no payout if the policyholder survives the term. These factors can limit its long-term benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Term Life Application?

Group Term Life Application is a form used to apply for group term life insurance coverage, which provides life insurance benefits to a group of individuals, typically employees of a company.

Who is required to file Group Term Life Application?

Typically, the employer or organization sponsoring the group plan is required to file the Group Term Life Application on behalf of eligible employees or members.

How to fill out Group Term Life Application?

To fill out a Group Term Life Application, provide all required personal information such as names, dates of birth, and any health-related questions. Ensure accuracy in reporting to avoid coverage issues.

What is the purpose of Group Term Life Application?

The purpose of the Group Term Life Application is to formally request life insurance coverage for a group, ensuring that information is accurately captured for underwriting and policy issuance.

What information must be reported on Group Term Life Application?

Information that must be reported includes personal details of the individuals covered, such as full names, social security numbers, health history, and any other relevant information necessary for coverage determination.

Fill out your group term life application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Term Life Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.