Get the free LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION

Show details

Esta es una solicitud para el seguro de responsabilidad profesional locum tenens, que incluye información sobre el solicitante, historial médico y de seguros, y requisitos para la licencia médica.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign locum tenens professional liability

Edit your locum tenens professional liability form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your locum tenens professional liability form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing locum tenens professional liability online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit locum tenens professional liability. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out locum tenens professional liability

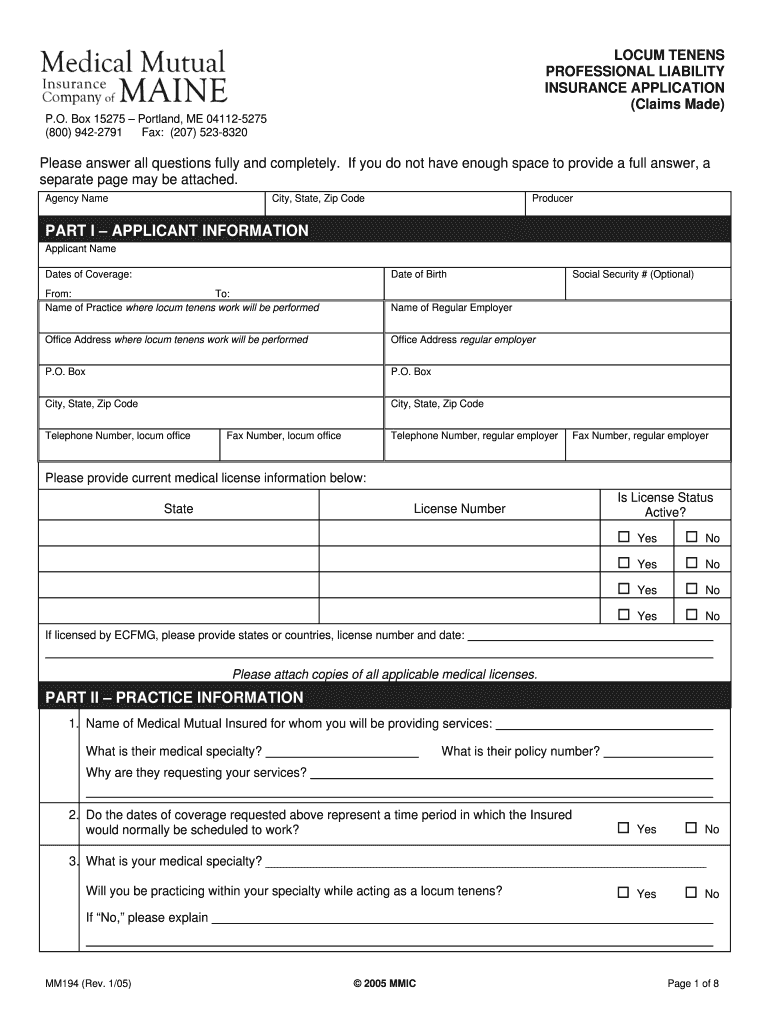

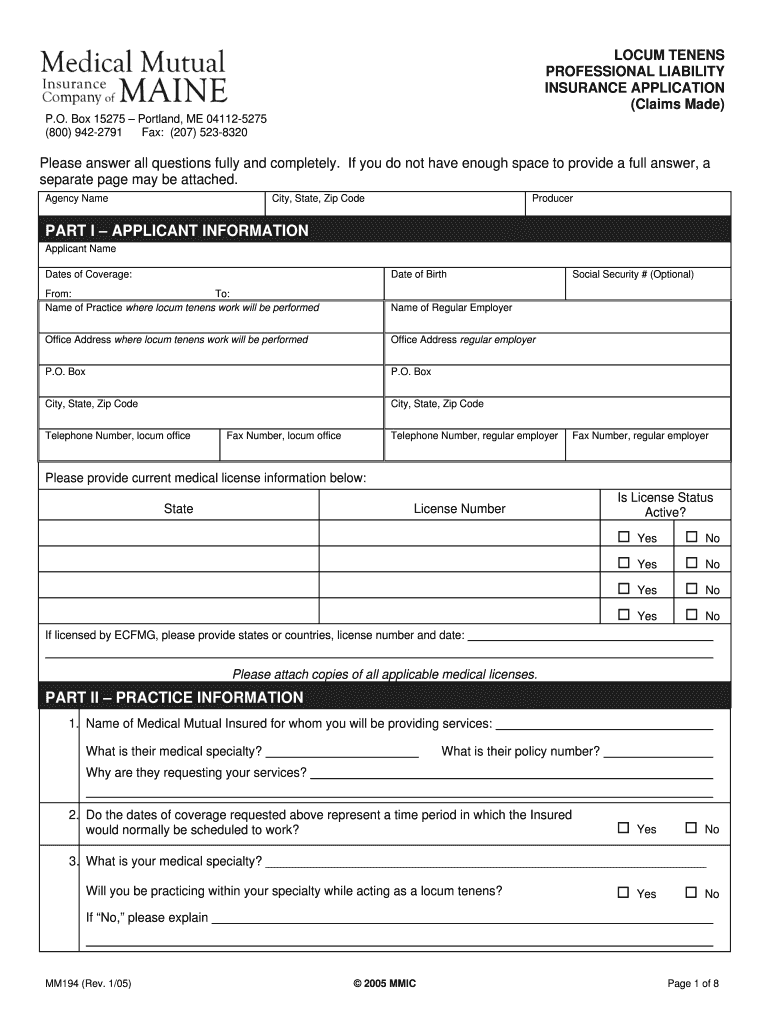

How to fill out LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION

01

Start by gathering all necessary personal information, including your full name, contact details, and Social Security number.

02

Provide your medical specialty and details about your current medical license, including the state it was issued from.

03

List any previous locum tenens assignments along with the duration and location of each assignment.

04

Detail any malpractice claims or disciplinary actions you've faced in the past.

05

Indicate the desired coverage limits and any additional endorsements you may want.

06

Review the application for completeness and accuracy before submitting it.

Who needs LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

01

Locum tenens professionals including physicians, nurse practitioners, physician assistants, and other healthcare providers who work temporary assignments.

02

Healthcare providers transitioning between jobs or looking for flexible work arrangements.

03

Any medical providers who may face liability during temporary placements in different medical facilities.

Fill

form

: Try Risk Free

People Also Ask about

What is the other name of liability insurance?

Liability insurance is also called third-party insurance. For instance, most states require that vehicle owners have liability insurance under their automotive insurance policies to cover injury to other people and property in the event of accidents.

What is another name for professional liability insurance?

Professional liability insurance (PLI), also called professional indemnity insurance (PII) and commonly known as errors & omissions (E&O) in the US, is a form of liability insurance which helps protect professional advising, consulting, and service-providing individuals and companies from bearing the full cost of

Is pi the same as pl?

Simply put, professional indemnity insurance covers claims made by clients for alleged professional negligence or mistakes that have caused the client to suffer a financial loss, whereas public liability insurance cover claims made by members of the public for injury or damage.

What is the difference between GL and PL?

GL coverage is triggered by bodily injury or property damage. PL coverage is triggered by bodily injury, property damage, or economic (consequential) damages. GL is typically written on an “occurrence” basis. PL is written on a “claims made” basis.

What is the locum tenens basis?

To go by the literal locum tenens definition, translated from Latin, it means "to hold the place of, to substitute for." Locum tenens providers work at healthcare facilities on a temporary basis to fill gaps in care or occupy vacant positions until a full-time provider can be found.

Which is another name for professional liability insurance?

Is errors and omissions (E&O) insurance the same as professional liability? Errors and omissions insurance is another name for professional liability insurance. It can help protect business professionals from claims of mistakes in providing their professional services.

What are claims made professional liability insurance?

The two basic types of malpractice insurance are "claims-made" and "occurrence-made." "Claims-made" insurance protects you from malpractice claims only if the company that insured you at the time of the alleged "occurrence" is the same company at the time the claim is filed in court.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION is a form used by healthcare professionals who temporarily fill in for other practitioners to apply for liability insurance that protects them against claims of medical malpractice during their locum tenens assignments.

Who is required to file LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

Healthcare providers, such as physicians and nurse practitioners, who intend to work in a temporary capacity or locum tenens position are required to file this application to ensure they have appropriate liability coverage.

How to fill out LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

To fill out the application, the applicant should provide personal and professional information, including their medical license details, nature of locum tenens service, previous malpractice history, and other pertinent qualifications and experiences.

What is the purpose of LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

The purpose of the application is to obtain malpractice insurance specifically tailored for temporary medical practitioners to safeguard against potential legal claims arising from their professional activities during locum tenens assignments.

What information must be reported on LOCUM TENENS PROFESSIONAL LIABILITY INSURANCE APPLICATION?

The application generally requires reporting personal identification details, medical education and training, state licensing information, work history, any prior malpractice claims or settlements, and relevant specialties or practice areas.

Fill out your locum tenens professional liability online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Locum Tenens Professional Liability is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.