Get the free APPLICATION FOR TAX SHELTER

Show details

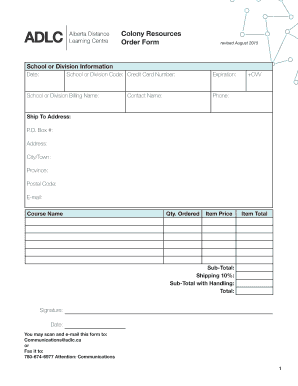

This document is an application form for obtaining a tax shelter identification number, including instructions and requirements for maintaining records necessary for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for tax shelter

Edit your application for tax shelter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for tax shelter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for tax shelter online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for tax shelter. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for tax shelter

How to fill out APPLICATION FOR TAX SHELTER

01

Obtain the APPLICATION FOR TAX SHELTER form, either online or from your tax advisor.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Specify the type of income or investment that you wish to shelter.

05

Provide details about the tax shelter arrangement and the relevant financial information.

06

Include any necessary supporting documentation, such as previous tax returns or proof of income.

07

Review the completed application for accuracy.

08

Sign and date the application where required.

09

Submit the application to the appropriate tax authority, either by mail or online.

Who needs APPLICATION FOR TAX SHELTER?

01

Individuals looking to reduce their taxable income.

02

Investors who want to maximize their tax advantages.

03

Retirement savers seeking to shelter income from taxes.

04

Business owners taking advantage of available tax shelters.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a tax shelter in Canada?

Tax Shelter Questions A tax shelter is any kind of legal investment that reduces your taxable income, and therefore the amount you owe the CRA. Some, like registered investments (RRSPs, RESPs, and TFSAs) and income splitting are open to all Canadians, while others make more sense for high net-worth individuals.

Why is my bank asking for tax residency in Canada?

CRS requires financial institutions to identify clients who are residents of foreign countries other than the United States. CIBC identifies such clients by obtaining client attestation of foreign tax residency as part of the account open process. CIBC reports client information and account details to the CRA.

What is the penalty for tax shelter?

The penalty is for a promoter of an abusive tax shelter and is generally equal to $1,000 for each organization or sale of an abusive plan or arrangement (or, if lesser, 100 percent of the income derived from the activity).

What is the best tax shelter?

Legal Tax Shelters Retirement Accounts. One way to reduce your tax liability is to invest in a tax-advantaged retirement account, such as a 401(k) or individual retirement account. Charitable Contributions. Medical and Dental Expenses. Real Estate. Business Deductions. 529 Plans. Capital losses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR TAX SHELTER?

An APPLICATION FOR TAX SHELTER is a formal request submitted to tax authorities to seek approval for a specific tax shelter strategy, which aims to reduce tax liabilities through legal means.

Who is required to file APPLICATION FOR TAX SHELTER?

Taxpayers who wish to utilize specific tax shelter strategies must file an APPLICATION FOR TAX SHELTER, which may include individuals, businesses, or investors depending on the nature of the investment or strategy.

How to fill out APPLICATION FOR TAX SHELTER?

To fill out an APPLICATION FOR TAX SHELTER, taxpayers should gather required documentation, complete the designated forms with accurate information, including details of the tax shelter strategy, and submit it to the appropriate tax authority.

What is the purpose of APPLICATION FOR TAX SHELTER?

The purpose of the APPLICATION FOR TAX SHELTER is to obtain formal approval from tax authorities for a proposed tax shelter strategy, ensuring compliance with tax laws while aiming to minimize tax liabilities.

What information must be reported on APPLICATION FOR TAX SHELTER?

The APPLICATION FOR TAX SHELTER typically requires reporting of detailed information such as taxpayer identification, description of the tax shelter, expected tax benefits, financial projections, and relevant supporting documentation.

Fill out your application for tax shelter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Tax Shelter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.