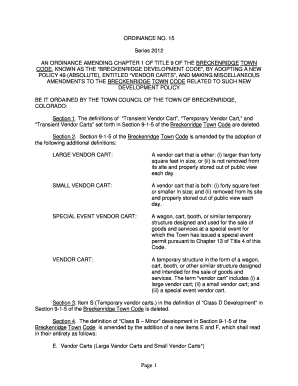

Get the free 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS

Show details

This document provides instructions and information for individuals who made excess contributions to a registered retirement savings plan (RRSP) in 2010 and need to file a tax return regarding these

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2010 simplified individual tax

Edit your 2010 simplified individual tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010 simplified individual tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

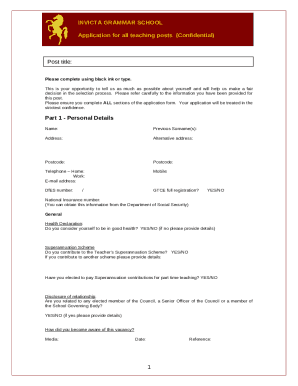

Editing 2010 simplified individual tax online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2010 simplified individual tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2010 simplified individual tax

How to fill out 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS

01

Gather all relevant financial documents, including RRSP contribution receipts.

02

Determine the total amount of RRSP contributions made for the 2010 tax year.

03

Calculate your RRSP contribution room for 2010, considering any unused contribution room from previous years.

04

Compare your total contributions to your contribution room to identify any excess contributions.

05

Complete the 2010 Simplified Individual Tax Return form, ensuring to accurately report excess contributions.

06

Input your personal information in the required sections of the form.

07

Provide details of your excess contributions in the designated area of the form.

08

Calculate any applicable penalties for excess contributions as per CRA guidelines.

09

Review the form for accuracy and completeness.

10

Submit the completed form to the CRA by the deadline.

Who needs 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS?

01

Individuals who contributed more to their RRSP than their allowable contribution limit for the 2010 tax year.

02

Taxpayers who are subject to penalties due to excess RRSP contributions.

03

Individuals seeking to correct their tax situation by reporting excess contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for excess RRSP contributions?

You will not receive a tax deduction for these excess contributions. If you have mistakenly over-contributed to your RRSP, fill out a T3012A form and submit it to the CRA. It explains your overcontribution and makes a request to withdraw the excess amount.

What happens if RRSP over-contribution is not claimed?

If you are not able to claim a deduction for the over-contribution, you will be taxed twice on this amount. This is because you were denied a deduction when you first contributed the funds to your RRSP, and you will pay tax on the receipt of the funds when you withdraw them from your RRIF.

How to complete the T1 OVP form?

Complete the T1-OVP form Download the T1-OVP form from the CRA website. Calculate your excess contributions. Fill out the form with your personal information and contribution details.

What is the tax on excess RRSP contributions?

Generally, you have to pay a tax of 1% per month on your unused contributions that exceed your RRSP deduction limit by more than $2,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS?

The 2010 Simplified Individual Tax Return for RRSP Excess Contributions is a specific tax form used by individuals in Canada to report and rectify excess contributions made to their Registered Retirement Savings Plans (RRSPs) for the tax year 2010.

Who is required to file 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS?

Individuals who have contributed more to their RRSP than the allowable limit set by the Canada Revenue Agency (CRA) and are facing penalties for those excess contributions are required to file this form.

How to fill out 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS?

To fill out the form, individuals must provide their personal information, detail the amounts of excess contributions, and calculate any applicable penalties. It is advisable to refer to CRA guidelines and instructions for accuracy.

What is the purpose of 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS?

The purpose of this tax return is to help individuals rectify their excess RRSP contributions, report the amounts to the CRA, and pay any penalties if applicable, ensuring compliance with tax regulations.

What information must be reported on 2010 SIMPLIFIED INDIVIDUAL TAX RETURN FOR RRSP EXCESS CONTRIBUTIONS?

Individuals must report their total RRSP contributions, any excess contributions over the allowable limit, personal identification details, and any penalties incurred due to the excess contributions.

Fill out your 2010 simplified individual tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2010 Simplified Individual Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.