Get the free CREDIT AND SECURITY AGREEMENT

Show details

This document outlines the terms and conditions of a credit and security agreement with Sample Credit Union, detailing repayment methods, security interests, and borrower responsibilities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit and security agreement

Edit your credit and security agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit and security agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit and security agreement online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit and security agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

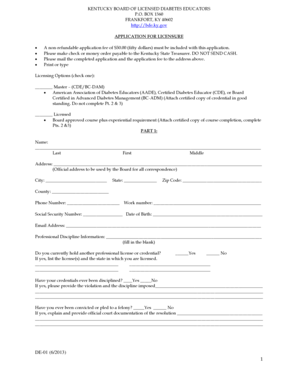

How to fill out credit and security agreement

How to fill out CREDIT AND SECURITY AGREEMENT

01

Begin by reading the entire CREDIT AND SECURITY AGREEMENT to understand its purpose and terms.

02

Fill in your personal information, including your name, address, and contact details in the designated sections.

03

Provide information about the credit amount you are requesting and outline the purpose for the loan if required.

04

Specify the collateral that will secure the credit, detailing any assets you are pledging.

05

Review the terms and conditions related to repayment schedules, interest rates, and any fees associated.

06

Ensure all parties involved have signed and dated the agreement, including witnesses if needed.

07

Keep a copy of the signed agreement for your records.

Who needs CREDIT AND SECURITY AGREEMENT?

01

Individuals or businesses looking to obtain credit while offering collateral as security.

02

Lenders requiring assurance for the repayment of a credit obligation.

03

Companies seeking to formalize a borrowing arrangement with specific terms.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a credit agreement?

The main transaction document for a loan financing between one or more lenders and a borrower. It sets out the: Terms of the loan. Borrowing and repayment procedures and the calculation of interest and fees.

What does pledge and security agreement mean?

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

What is a secured credit agreement?

Secured Credit Agreement means any credit agreement, note purchase agreement or other documentation evidencing Debt borrowed from institutional investors or banks which is secured by Liens on assets or properties of the Company or any Subsidiary of the Company; PROVIDED that if the only security for such Debt is a

What is the credit agreement?

Also known as a loan agreement. The main transaction document for a loan financing between one or more lenders and a borrower. It sets out the: Terms of the loan. Borrowing and repayment procedures and the calculation of interest and fees.

What is a credit protection agreement?

credit protection agreement means any over-the-counter arrangement designed to transfer credit risk from one party to another, including credit default swaps (including, without limitation, single name, basket and first-to-default swaps), total return swaps and credit-linked notes.

How to write a security agreement?

What should a security agreement template include? Identification of parties. Description of collateral. Loan amount and repayment terms. Rights of the lender. Duration of agreement. Default. Termination clause. Dispute resolution.

What is a credit and security agreement?

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

What is the purpose of a security agreement?

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT AND SECURITY AGREEMENT?

A Credit and Security Agreement is a legal document between a lender and a borrower that outlines the terms of a loan and the security interests the lender has in the borrower's collateral.

Who is required to file CREDIT AND SECURITY AGREEMENT?

Typically, the borrower is required to file a Credit and Security Agreement as part of the loan process to secure the lender's interest in the assets used as collateral.

How to fill out CREDIT AND SECURITY AGREEMENT?

To fill out a Credit and Security Agreement, parties should provide detailed information about the loan terms, collateral, borrower and lender identities, payment structure, and any covenants or obligations.

What is the purpose of CREDIT AND SECURITY AGREEMENT?

The purpose of a Credit and Security Agreement is to protect the lender's investment by establishing the rights and responsibilities of both parties and to specify the collateral securing the loan.

What information must be reported on CREDIT AND SECURITY AGREEMENT?

Essential information includes the names and addresses of the borrower and lender, loan amount, interest rate, payment terms, description of the collateral, and any default provisions.

Fill out your credit and security agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit And Security Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.