Get the free Taxpayer bAbatementb Procedure bFormb Page 1 - Town of Upton bMAb

Show details

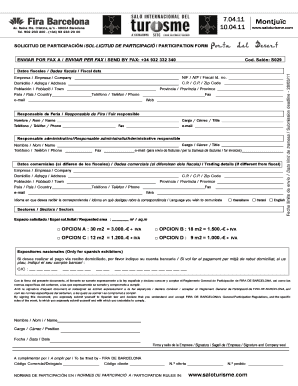

TOWN OF UPTON BOARD OF ASSESSORS TAXPAYER INFORMATION GUIDE ABATEMENT PROCEDURE FISCAL YEAR FILING DEADLINE February 1 This explains the procedure for applying for an abatement of property tax. Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxpayer babatementb procedure bformb

Edit your taxpayer babatementb procedure bformb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayer babatementb procedure bformb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxpayer babatementb procedure bformb online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxpayer babatementb procedure bformb. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxpayer babatementb procedure bformb

How to fill out taxpayer abatement procedure form:

01

Start by gathering all the necessary information and documents that will be required to complete the form. This may include personal identification information, financial records, and any supporting documents relevant to your case.

02

Carefully read through the form and instructions provided by the tax authority. It is important to understand all the sections and requirements before proceeding. If there are any terms or concepts that you are unfamiliar with, consider seeking assistance from a tax professional or contacting the tax authority for clarification.

03

Begin filling out the form, paying close attention to each section and providing accurate information. Ensure that you write legibly and use black or blue ink as instructed.

04

Provide your personal details in the designated section. This may include your full name, address, Social Security number or taxpayer identification number, and any other relevant information required.

05

If applicable, indicate the tax year or period for which you are requesting the abatement.

06

In the sections requesting information about the tax or penalty being abated, carefully review your tax records and enter the necessary information accurately. This may include the tax amount, penalty amount, and any related interest.

07

If you are contesting the tax or penalty, provide a detailed explanation in the designated section, clearly stating your reasons for seeking abatement. Provide any supporting documentation that may help substantiate your claim.

08

Review the completed form for any errors or omissions. Double-check that all required fields have been filled out correctly. It can be helpful to have someone else review the form as well to ensure accuracy.

09

Sign and date the form. If you are filling out the form on behalf of someone else, make sure to include your name and relationship to the taxpayer.

10

Make a copy of the completed form for your records before submitting it to the appropriate tax authority. Check if there are any additional documents or forms that need to be included with your submission.

Who needs taxpayer abatement procedure form?

01

Individuals who believe they have been assessed an incorrect amount of tax or penalty.

02

Businesses that have been charged an excessive amount of tax or penalty.

03

Taxpayers who can provide evidence or compelling reasons to request abatement of their tax or penalty.

04

Anyone seeking relief from a tax or penalty due to extenuating circumstances, such as financial hardship or significant life events.

Remember, it is always advisable to consult with a tax professional or seek guidance from the tax authority itself for specific instructions and requirements related to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is taxpayer abatement procedure form?

Taxpayer abatement procedure form is a formal request submitted to the tax authorities to reduce or eliminate a tax penalty or interest.

Who is required to file taxpayer abatement procedure form?

Taxpayers who believe they have reasonable cause for not complying with tax laws or regulations may be required to file taxpayer abatement procedure form.

How to fill out taxpayer abatement procedure form?

Taxpayers need to provide details of the tax penalty or interest being disputed, along with supporting documentation and a written explanation of why they believe the penalty or interest should be reduced or eliminated.

What is the purpose of taxpayer abatement procedure form?

The purpose of taxpayer abatement procedure form is to give taxpayers an opportunity to request relief from tax penalties or interest under certain circumstances.

What information must be reported on taxpayer abatement procedure form?

The information that must be reported on taxpayer abatement procedure form includes the taxpayer's identifying information, details of the penalty or interest being disputed, supporting documentation, and a written explanation.

Where do I find taxpayer babatementb procedure bformb?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific taxpayer babatementb procedure bformb and other forms. Find the template you need and change it using powerful tools.

How do I execute taxpayer babatementb procedure bformb online?

Filling out and eSigning taxpayer babatementb procedure bformb is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the taxpayer babatementb procedure bformb in Gmail?

Create your eSignature using pdfFiller and then eSign your taxpayer babatementb procedure bformb immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your taxpayer babatementb procedure bformb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayer Babatementb Procedure Bformb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.