Get the free 125-1

Show details

This document is a brief filed in the United States Court of Appeals for the Fourth Circuit in the case of Commonwealth of Virginia v. Kathleen Sebelius, focusing on arguments related to the constitutionality

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 125-1

Edit your 125-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 125-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 125-1 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 125-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 125-1

How to fill out 125-1

01

Gather all necessary information such as your income details and personal identification.

02

Download or obtain a copy of the 125-1 form from the relevant authority.

03

Fill in your personal information at the top of the form, including name, address, and identification number.

04

Provide details of your income sources in the designated sections.

05

Double-check the accuracy of your information to avoid any errors.

06

Sign and date the form at the bottom, confirming the provided information is correct.

07

Submit the completed form according to the specified instructions, whether online or by mail.

Who needs 125-1?

01

Individuals who are reporting their income, such as freelancers, contractors, or employees who have a unique income situation.

02

Anyone who needs to declare their earnings for tax purposes or eligibility for benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the commentary of Psalm 125 1?

(1) The permanent standing of the people of God. Those who trust in the LORD: What follows is a promise made to those who put their trust in the LORD. We can't properly put our trust in Him until we remove our trust in other things. He alone is our refuge and strength.

What does it mean those who trust in the Lord are like Mount Zion?

Mount Zion is the mountain where Jerusalem sits, and for the people of God this was the ultimate symbol of stability. The psalmist wants those who trust in the Lord to know that a position of trust is a position of stability. Those who trust in the Lord cannot be moved (Ps. 46:4-7; 1 Peter 2:4-10)

What is Psalm 125 1 in English?

Psalm 125 1 The scepter of the wicked will not remain over the land allotted to the righteous, for then the righteous might use their hands to do evil. Do good, O LORD, to those who are good, to those who are upright in heart. But those who turn to crooked ways the LORD will banish with the evildoers.

How do you write 125 in English?

Therefore, 125 in English can be read as “One Hundred Twenty-Five”.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

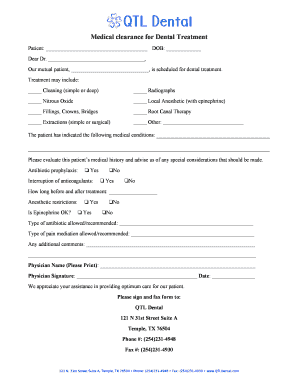

What is 125-1?

125-1 is a form used for reporting specific tax-related information, often related to employee benefits or compensation.

Who is required to file 125-1?

Employers or organizations that provide certain benefits to employees may be required to file 125-1.

How to fill out 125-1?

Fill out 125-1 by providing the required information in the designated fields, ensuring all data is accurate and complete.

What is the purpose of 125-1?

The purpose of 125-1 is to report information related to employee benefits or compensation for tax purposes.

What information must be reported on 125-1?

Information reported on 125-1 typically includes details about benefit types, amounts, employee identification, and employer information.

Fill out your 125-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

125-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.