Get the free DCPIF Essential Homeowners Insurance Inspection and Placement

Show details

This document serves as an application for homeowners insurance, detailing necessary information for applicants, required documentation, coverage options, and risk assessment protocols.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dcpif essential homeowners insurance

Edit your dcpif essential homeowners insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dcpif essential homeowners insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dcpif essential homeowners insurance online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dcpif essential homeowners insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dcpif essential homeowners insurance

How to fill out DCPIF Essential Homeowners Insurance Inspection and Placement

01

Gather all necessary documents, such as your homeowner's policy and property details.

02

Review the DCPIF Essential Homeowners Insurance Inspection and Placement form.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide accurate details about your property, including its age, type, and current condition.

05

Note any existing safety features, such as smoke detectors or security systems.

06

Indicate any previous claims or relevant insurance history.

07

Double-check all provided information for accuracy.

08

Submit the completed form as instructed, either online or through mail.

Who needs DCPIF Essential Homeowners Insurance Inspection and Placement?

01

Homeowners seeking insurance coverage for their properties.

02

Individuals purchasing a new home who require insurance before closing.

03

Anyone looking to reassess their current homeowner's insurance policy.

Fill

form

: Try Risk Free

People Also Ask about

What is the most important thing in homeowners insurance?

What Your Homeowners Insurance Should Include Truly Comprehensive Coverage. First and foremost, you want a comprehensive perils policy for your homeowners insurance. The Right Price. A Single, Easy-to-Understand Deductible. Personal Injury Liability. Guaranteed Replacement Cost on Dwelling. A Good Agent Behind the Plan.

What is the most important part of insurance?

Premium. An insurance premium is one of the most important places to look when choosing your insurance. The premium is what you have to pay on an ongoing basis to have an insurance policy. You may pay monthly, pay your entire premium upfront or choose another schedule within your policy's guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

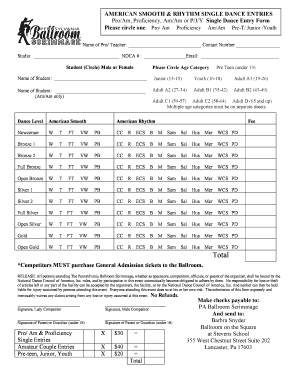

What is DCPIF Essential Homeowners Insurance Inspection and Placement?

DCPIF Essential Homeowners Insurance Inspection and Placement is a program designed to facilitate the assessment and placement of homeowners insurance policies based on specific criteria to ensure proper coverage and risk management.

Who is required to file DCPIF Essential Homeowners Insurance Inspection and Placement?

Insurance agents, brokers, and property owners seeking homeowners insurance are generally required to file DCPIF Essential Homeowners Insurance Inspection and Placement.

How to fill out DCPIF Essential Homeowners Insurance Inspection and Placement?

To fill out the DCPIF Essential Homeowners Insurance Inspection and Placement, individuals should provide accurate information regarding the property, including its location, structure details, and any prior claims, ensuring all sections are completed as per the guidelines.

What is the purpose of DCPIF Essential Homeowners Insurance Inspection and Placement?

The purpose of DCPIF Essential Homeowners Insurance Inspection and Placement is to ensure that homeowners have adequate insurance coverage that reflects the specific risks associated with their property, thereby protecting them from potential financial loss.

What information must be reported on DCPIF Essential Homeowners Insurance Inspection and Placement?

The information that must be reported includes the property address, details of the structure, any existing damages, ownership history, and relevant underwriting information required for risk assessment.

Fill out your dcpif essential homeowners insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dcpif Essential Homeowners Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.