Get the free College Savings Plans of Maryland - b65bb36bb246bb229b - 65 36 246

Show details

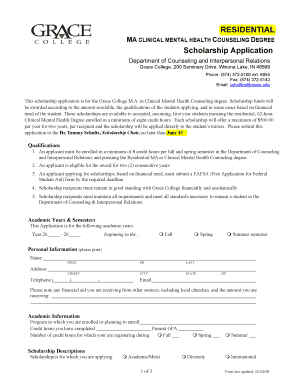

College Savings Plans of Maryland Automatic Payment Authorization Instructions for Automatic Payment Authorization Form 1. Use this form to request and authorize the College Savings Plans of Maryland

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign college savings plans of

Edit your college savings plans of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your college savings plans of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing college savings plans of online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit college savings plans of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out college savings plans of

How to fill out college savings plans of:

01

Research different college savings plans: Start by researching and understanding the different types of college savings plans available, such as 529 plans, Coverdell Education Savings Accounts (ESA), and custodial accounts. Each plan has its own benefits, limitations, and tax advantages, so it's important to understand the options before making a decision.

02

Set a savings goal: Determine how much money you would like to save for your child's college education. Consider factors such as the cost of tuition, room and board, books, and other expenses. Setting a specific savings goal will help you stay focused and motivated.

03

Create a budget: Evaluate your current financial situation and create a budget that allows for regular contributions to your college savings plan. Look for areas where you can cut expenses or increase your income to free up more money for savings.

04

Choose a college savings plan: Based on your research and financial goals, select the college savings plan that best suits your needs. Consider factors such as investment options, fees, minimum contribution requirements, and flexibility.

05

Open an account: Once you have chosen a college savings plan, you will need to open an account. This typically involves completing an application, providing necessary identification documents, and making an initial contribution.

06

Make regular contributions: Commit to making regular contributions to your college savings plan. This can be done on a monthly or quarterly basis, depending on your financial situation. Automating your contributions can help ensure consistent savings.

07

Monitor and adjust: Regularly review the performance of your college savings plan and make any necessary adjustments. Keep track of the account balance, investment performance, and any changes in your financial goals.

Who needs college savings plans:

01

Parents: Parents who want to financially prepare for their child's college education find college savings plans beneficial. These plans can help save for tuition, books, housing, and other expenses associated with higher education.

02

Grandparents: Grandparents who want to contribute to their grandchildren's education can also utilize college savings plans. By opening a 529 plan or contributing to an existing one, grandparents can provide a valuable gift for their grandchildren's future.

03

Guardians or legal custodians: In cases where a child is under the care of a guardian or legal custodian, they may also opt for a college savings plan. This helps ensure that funds are set aside specifically for the child's education and can be accessed when needed.

In summary, filling out college savings plans involves researching different options, setting a savings goal, creating a budget, choosing the appropriate plan, opening an account, making regular contributions, and monitoring and adjusting as needed. College savings plans are beneficial for parents, grandparents, and guardians or legal custodians who want to financially prepare for a child's higher education.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is college savings plans of?

College savings plans are investment accounts designed to help families save and invest for future college expenses.

Who is required to file college savings plans of?

Parents or guardians of a child or the account owner of the savings plan are required to file college savings plans.

How to fill out college savings plans of?

College savings plans can be filled out online through the designated platform provided by the financial institution managing the account.

What is the purpose of college savings plans of?

The purpose of college savings plans is to help families save and invest money for educational expenses, such as tuition, books, and room and board.

What information must be reported on college savings plans of?

Information such as account holder details, contributions made, investment earnings, and withdrawals must be reported on college savings plans.

How can I send college savings plans of for eSignature?

Once your college savings plans of is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit college savings plans of online?

With pdfFiller, it's easy to make changes. Open your college savings plans of in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I fill out college savings plans of on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your college savings plans of. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your college savings plans of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

College Savings Plans Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.