Get the free Application For Housing/Personal Term Loan/Personal Overdraft

Show details

This document is an application form for housing, personal term loans, and personal overdrafts through Bank of China (Malaysia) Berhad. It includes sections for personal particulars, employment details,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for housingpersonal term

Edit your application for housingpersonal term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for housingpersonal term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for housingpersonal term online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for housingpersonal term. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

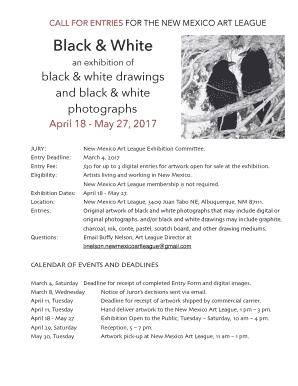

How to fill out application for housingpersonal term

How to fill out Application For Housing/Personal Term Loan/Personal Overdraft

01

Begin by downloading the Application for Housing/Personal Term Loan/Personal Overdraft form from the financial institution's website or obtain a physical copy from their branch.

02

Fill out your personal details including your full name, address, contact number, and email address in the designated sections.

03

Provide your employment information such as your job title, employer's name, length of employment, and monthly income.

04

Specify the type of loan you are applying for and the amount you wish to borrow.

05

Include any additional financial details required, such as existing debts, loans, and assets.

06

Review the application form for completeness and accuracy before signing it.

07

Submit the completed application form either online or in person at the financial institution's branch.

Who needs Application For Housing/Personal Term Loan/Personal Overdraft?

01

Individuals looking to purchase a home or property through a housing loan.

02

People in need of financial assistance for personal expenses through a personal term loan.

03

Anyone seeking to maintain liquidity and flexibility in their finances using a personal overdraft facility.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between personal term loan and personal overdraft?

A personal loan and a personal overdraft loan are different lending instruments that make your financial life more manageable. While personal loans are apt for salaried individuals with a fixed monthly income, a personal overdraft loan is an overdraft facility that your bank extends to your account.

What is an overdraft application?

Arranged overdrafts are pre-arranged with your bank – you can apply for one either when you set the account up or once it's already open. It has a limit that you can borrow up to if there isn't enough money in your account.

What is a personal loan overdraft?

A personal overdraft is a type of credit that is linked to your personal transaction account. It means you have access to additional funds when your bank account balance dips below zero. When your overdraft is initially set up with your bank, you'll set a limit and this is the amount you have access to when necessary.

How does a personal overdraft work?

A personal arranged overdraft is a short-term way to borrow money up to an arranged limit which you arrange with us in advance, on your current account. This gives you access to money when you need it. This type of borrowing is most suited for smaller sums of money and to cover short-term expenses or emergencies.

How do I write a letter requesting an overdraft?

Explain the purpose: Clearly state the reason for writing the letter, which is to request an advance on overdraft. Mention the specific period, such as Christmas, New Year, or Thanksgiving, for which the advance is needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application For Housing/Personal Term Loan/Personal Overdraft?

It is a formal request submitted to a financial institution seeking approval for a loan designed to assist individuals in purchasing a home, obtaining personal financing, or accessing an overdraft facility.

Who is required to file Application For Housing/Personal Term Loan/Personal Overdraft?

Individuals or entities seeking financial assistance for housing, personal expenses, or a temporary loan solution from a bank or financial institution.

How to fill out Application For Housing/Personal Term Loan/Personal Overdraft?

The application form should be completed by providing personal details, financial information, loan amount sought, purpose of the loan, and any necessary documentation as required by the financial institution.

What is the purpose of Application For Housing/Personal Term Loan/Personal Overdraft?

The purpose is to request financial support for housing, meet personal financial needs, or provide a safety net through overdraft services.

What information must be reported on Application For Housing/Personal Term Loan/Personal Overdraft?

Applicants must provide personal identification, income details, employment information, loan amount requested, purpose of the loan, and any existing debts or financial obligations.

Fill out your application for housingpersonal term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Housingpersonal Term is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.