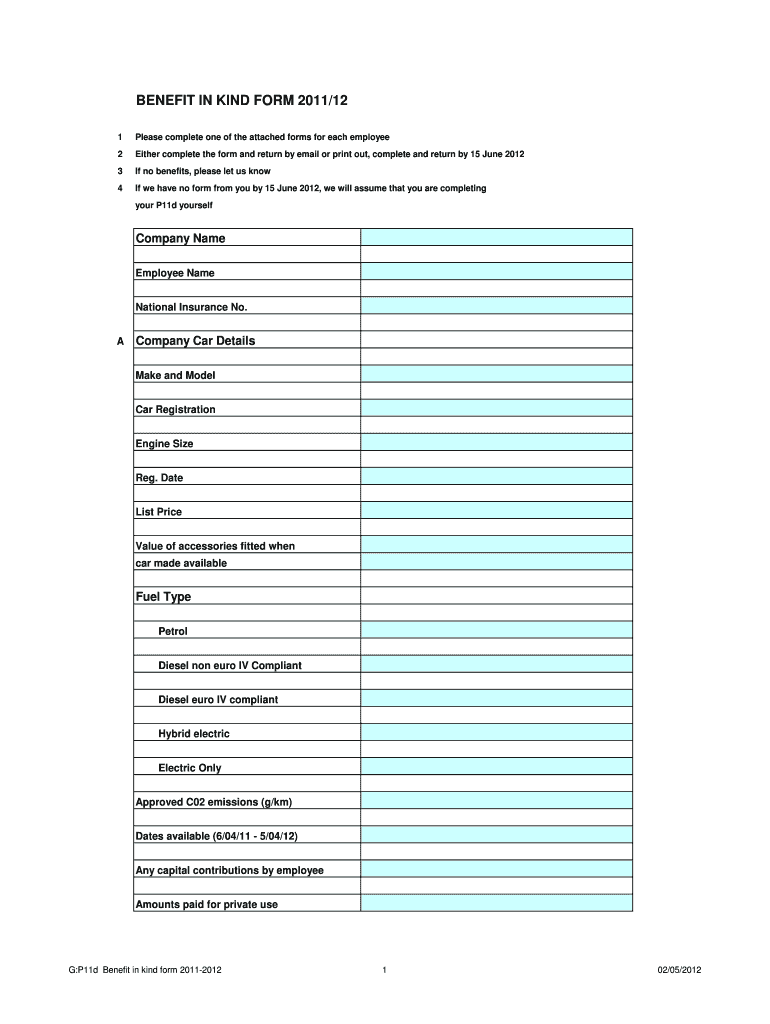

Get the free BENEFIT IN KIND FORM 2011/12

Show details

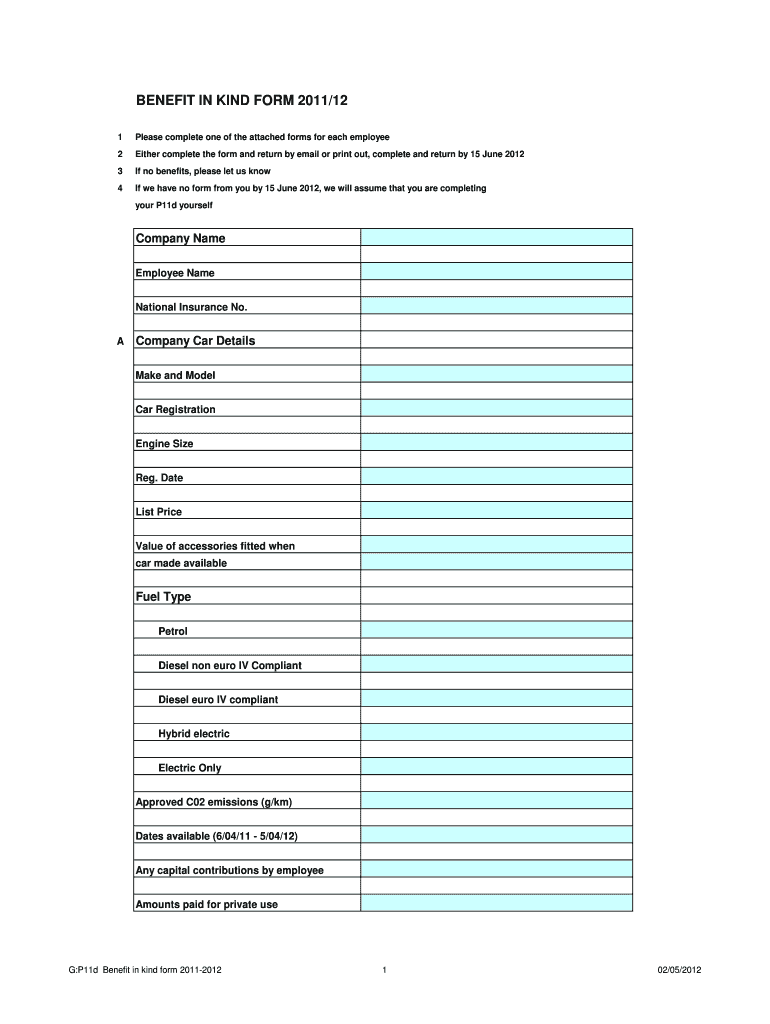

This document is designed for employers to report benefits provided to employees for the tax year 2011/12, including company car details, private fuel, loan information, and other benefits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign benefit in kind form

Edit your benefit in kind form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your benefit in kind form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing benefit in kind form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit benefit in kind form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out benefit in kind form

How to fill out BENEFIT IN KIND FORM 2011/12

01

Obtain the BENEFIT IN KIND FORM 2011/12 from the official website or relevant authority.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal details, including your name, address, and National Insurance number.

04

Identify and list the benefits you received during the tax year (e.g., company car, health insurance).

05

Accurately calculate the value of each benefit received and the total value.

06

Complete any additional sections required, such as declaration and signature fields.

07

Review the form for any errors or missing information.

08

Submit the completed form to the appropriate tax authority by the deadline.

Who needs BENEFIT IN KIND FORM 2011/12?

01

Individuals who receive non-cash benefits from employers.

02

Employees who are required to report these benefits for tax purposes.

03

Business owners who provide benefits to employees and need to declare them.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate benefit in kind in the UK?

How to work out BIK tax? Determine the value of the benefit: This is the published or market value of the item or benefit provided. Calculate the BIK percentage: The BIK percentage is set by the tax authorities and depends on the type of benefit. Calculate the BIK value: BIK Value = Benefit's Value × BIK Percentage.

How does benefit in kind work in the UK?

Benefits in kind (BiK) are goods and services provided to an employee for free or at greatly reduced costs. Employers are legally obliged to provide their employees details of relevant benefits in kind they have received in a tax year.

What is the P11 report for payroll?

The P11 (detailed) report displays payments and deductions you make to employees throughout the tax year and is a useful tool for reconciliation purposes, or for investigating any issues.

What is the bik rate in the uk?

Company Car BIK Rates 2024- 2028 The rates will be 3% for 2025/26, 4% for 2026/27 and 5% for 2027/28. The company car tax rates for ultra-low emission cars (non EVs) emitting less than 75g/km will also increase by 1% from April 2025 for 3 years, rising to a maximum of 21%.

How is BIK calculated on health insurance in the UK?

The tax is calculated based on the insurance premium cost paid by your employer and your personal income tax rate. For example, if you're a basic rate taxpayer and your employer pays £1,000 per year for your medical insurance, you would owe around £200 in taxes.

How to calculate benefit in kind tax in the UK?

How do I calculate my BIK tax? To calculate the company car - or BIK - tax, multiply the P11D value by the BIK percentage banding, then multiply that figure by your tax band - i.e. 20% or 40%. This will give you your annual tax. Divide by 12 to get your monthly outgoing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BENEFIT IN KIND FORM 2011/12?

The Benefit in Kind Form 2011/12 is a tax form used in the UK to report non-cash benefits provided to employees, such as company cars, health insurance, and other perks.

Who is required to file BENEFIT IN KIND FORM 2011/12?

Employers who provide taxable benefits to their employees must file the Benefit in Kind Form 2011/12 for each employee receiving such benefits.

How to fill out BENEFIT IN KIND FORM 2011/12?

To fill out the Benefit in Kind Form 2011/12, employers need to provide details about the employee, the type of benefits received, their value, and any exemptions that apply.

What is the purpose of BENEFIT IN KIND FORM 2011/12?

The purpose of the Benefit in Kind Form 2011/12 is to ensure that the tax authorities are informed about the non-cash benefits provided to employees, so they can properly assess tax liabilities.

What information must be reported on BENEFIT IN KIND FORM 2011/12?

The form requires reporting information such as the employee's name, National Insurance number, details of the benefits provided, their cash equivalent value, and any relevant tax codes.

Fill out your benefit in kind form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Benefit In Kind Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.