Get the free Secretary Book with 2016 Classifications - Squarespace

Show details

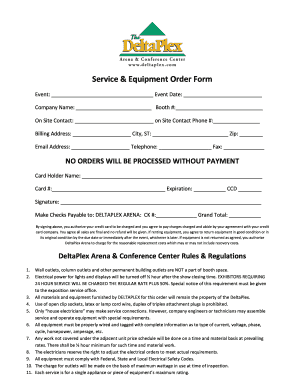

SecretaryBook Club Date Judge Secretary 2016 Show Classifications for Love Birds with Single Division Section 1 Rare Varieties (Three or more birds of the same variety in a class with other varieties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secretary book with 2016

Edit your secretary book with 2016 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secretary book with 2016 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit secretary book with 2016 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit secretary book with 2016. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secretary book with 2016

01

To fill out a secretary book with 2016 records, start by gathering all the necessary documents and information, such as invoices, receipts, and financial statements from the year 2016.

02

Open the secretary book and locate the section designated for the year 2016. It is usually labeled or marked for easy reference.

03

Begin entering the relevant information into the book, starting with the date of the transaction. Ensure that the dates are accurate and follow the chronological order.

04

Next, record the details of each transaction, including the name of the party involved, the nature of the transaction, and the amount. Be meticulous and precise while recording these details to maintain accuracy.

05

If there are any supporting documents for the transaction, such as receipts or invoices, attach or cross-reference them appropriately in the book. This helps to provide evidence and backup for the recorded transactions.

06

Compute the totals periodically, such as monthly or quarterly, depending on the bookkeeping requirements. This allows for a quick summary of the financial activities during the year.

07

Remember to include any closing entries or adjustments necessary to ensure the accurate portrayal of the financial statements.

Who needs a secretary book with 2016?

01

Entrepreneurs and small business owners: A secretary book with 2016 records is essential for entrepreneurs and small business owners to keep a track of their financial transactions and maintain proper bookkeeping.

02

Accountants and auditors: Accountants and auditors often require access to secretary books with previous years' records to analyze and verify financial information for tax purposes, audits, or financial assessments.

03

Legal or regulatory authorities: Many legal and regulatory bodies may require businesses to submit secretary books and financial records from previous years for compliance, tax filings, or audits. It is important to keep these records up-to-date and accurate.

04

Investors and lenders: Investors or lenders may request access to secretary books and historical financial records to assess the financial health and stability of a business before making investment decisions or extending credit.

05

Government authorities: Government authorities, such as tax departments or revenue agencies, may require businesses to provide historical financial records for tax audits or investigations.

By following these steps and maintaining a well-organized secretary book with 2016 records, businesses can ensure proper financial management, compliance with regulations, and a transparent record of their transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is secretary book with classifications?

The secretary book with classifications is a document where all information related to the company's classification records are recorded.

Who is required to file secretary book with classifications?

All businesses or organizations are required to file the secretary book with classifications, typically maintained by the company secretary.

How to fill out secretary book with classifications?

The secretary book with classifications should be filled out by recording all classifications, updates, and changes related to the company's records.

What is the purpose of secretary book with classifications?

The purpose of the secretary book with classifications is to keep track of all classification records and ensure accurate and organized documentation.

What information must be reported on secretary book with classifications?

The secretary book with classifications must include details of all classifications, changes, updates, and any relevant information related to the company's records.

How can I send secretary book with 2016 for eSignature?

When you're ready to share your secretary book with 2016, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete secretary book with 2016 online?

Completing and signing secretary book with 2016 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for the secretary book with 2016 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your secretary book with 2016 in seconds.

Fill out your secretary book with 2016 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secretary Book With 2016 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.