Get the free Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application - medicareaust...

Show details

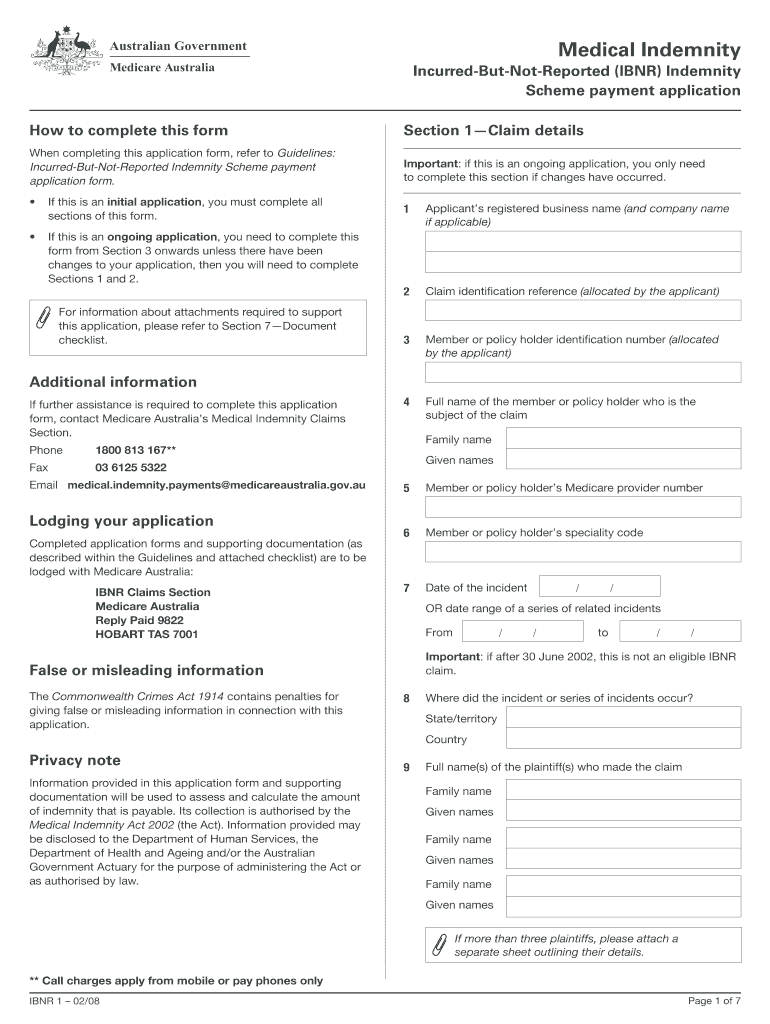

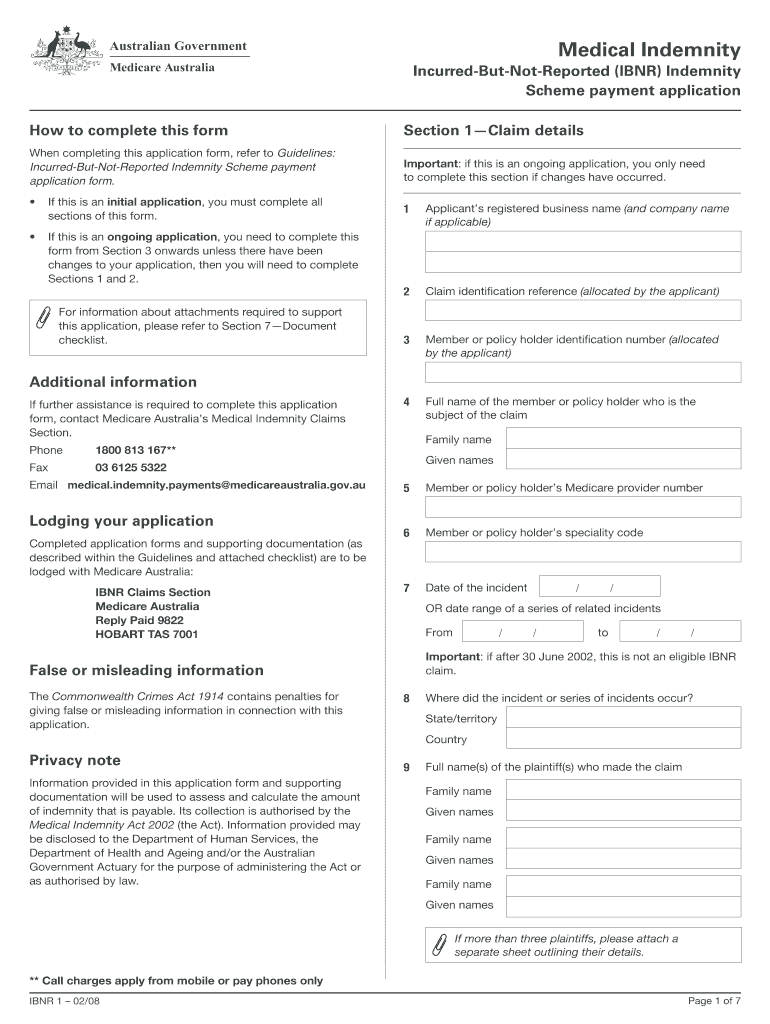

This document serves as an application form for making a claim under the Incurred-But-Not-Reported Indemnity Scheme, detailing required information for claim identification, eligibility, and necessary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign incurred-but-not-reported ibnr indemnity scheme

Edit your incurred-but-not-reported ibnr indemnity scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your incurred-but-not-reported ibnr indemnity scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing incurred-but-not-reported ibnr indemnity scheme online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit incurred-but-not-reported ibnr indemnity scheme. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out incurred-but-not-reported ibnr indemnity scheme

How to fill out Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application

01

Begin by obtaining the Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application form.

02

Fill out your personal details, including name, address, and contact information.

03

Provide relevant insurance policy information, including policy number and type of coverage.

04

Detail the claims that have been incurred but not yet reported, including amounts and descriptions.

05

Attach any necessary documentation or evidence to support your claims, such as invoices or physician statements.

06

Review the completed application for accuracy and completeness.

07

Submit the application to the appropriate authority by the specified deadline.

Who needs Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application?

01

Individuals who have incurred expenses or losses covered under an insurance policy that have not yet been reported to the insurer.

02

Policyholders seeking reimbursement for medical or other financial claims that have arisen but not yet formally filed.

03

Companies or entities who are eligible for indemnity under the Incurred-But-Not-Reported scheme.

Fill

form

: Try Risk Free

People Also Ask about

What is incurred loss vs reported loss?

Paid losses are the total losses actually paid during a policy period. Reported losses (also referred to as incurred losses) include paid losses plus any loss reserves for open claims. Reported losses are always greater than or equal to paid losses.

What does IBNR stand for in insurers set aside money for IBNR claims?

IBNR is Incurred But not Reported. It is the amount of claim which has incurred but not reported to the insurer yet.

What is the incurred but not reported IBNR loss reserve?

Incurred But Not Reported (IBNR) are reserves used by insurers to manage claims involving events that have occurred but are not yet reported. Actuaries calculate these reserves to allocate funds for potential losses, accounting for delays in reporting due to various factors like bureaucratic processes.

How is an IBNR claim calculated?

The amount of IBNR will be the estimated ultimate claims cost less amounts paid so far and amount provided as outstanding on the date of estimation.

What is the purpose of an IBNR report?

IBNR stands for Incurred But Not Reported, which refers to the estimate of the liability from claims that have taken place but have not yet been reported to an insurer. While carriers do their best to value incurred claims at the present-day amount, liability claims have the potential to adversely develop over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application?

The Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application is a process used to request compensation for claims that have occurred but have not yet been formally reported to the insurer. This scheme helps organizations account for potential liabilities and ensure they have sufficient reserves.

Who is required to file Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application?

Entities, typically insurers and self-insured organizations, that are liable for claims that have occurred but not reported are required to file the IBNR Indemnity Scheme payment application. This includes businesses in various industries that may experience delayed claims reporting.

How to fill out Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application?

To fill out the IBNR Indemnity Scheme payment application, an applicant needs to provide relevant information regarding the claims, including details of the incurred losses, estimates of claim amounts, and supporting documentation that justifies the claim.

What is the purpose of Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application?

The purpose of the IBNR Indemnity Scheme payment application is to allow organizations to receive financial assistance for liabilities that are recognized but not yet formally claimed. This ensures that they can manage their financial exposure and fulfill potential obligations.

What information must be reported on Incurred-But-Not-Reported (IBNR) Indemnity Scheme payment application?

The information that must be reported on the IBNR Indemnity Scheme payment application includes the nature of the claims, the estimated costs associated with these claims, a breakdown of incurred but unreported losses, and any relevant supporting documentation that confirms the legitimacy of the claims.

Fill out your incurred-but-not-reported ibnr indemnity scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Incurred-But-Not-Reported Ibnr Indemnity Scheme is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.