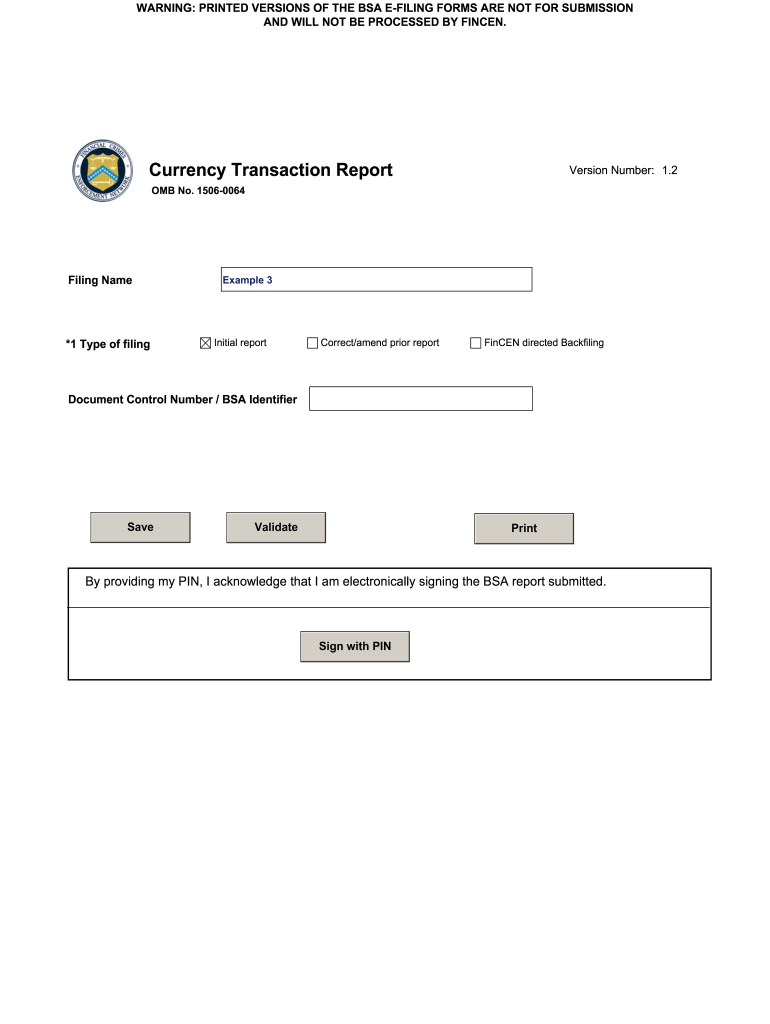

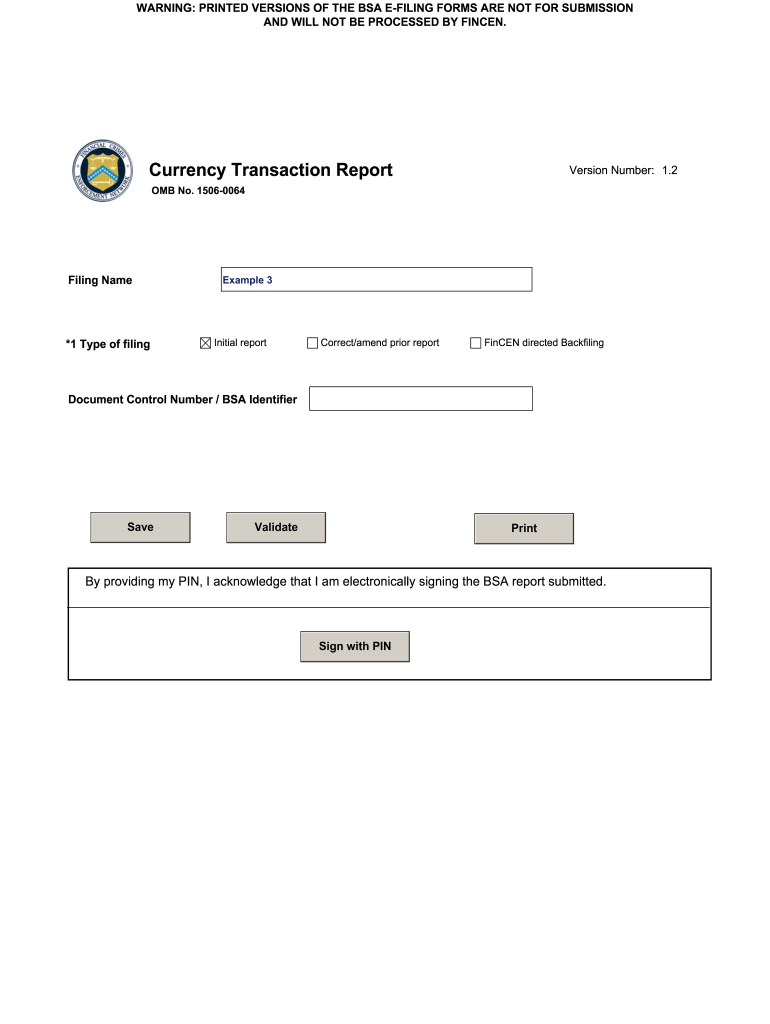

Get the free omb no 1506 0064

Show details

WARNING PRINTED VERSIONS OF THE BSA E-FILING FORMS ARE NOT FOR SUBMISSION AND WILL NOT BE PROCESSED BY FINCEN. Currency Transaction Report Version Number 1. 2 OMB No. 1506-0064 Filing Name 1 Type of filing Example 3 Initial report Correct/amend prior report FinCEN directed Backfiling Document Control Number / BSA Identifier Save Validate Print By providing my PIN I acknowledge that I am electronically signing the BSA report submitted. Sign with P...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign currency transaction report omb no 1506 0064 form

Edit your omb no 1506 0064 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your omb no 1506 0064 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing omb no 1506 0064 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit omb no 1506 0064. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a CTR form?

0:51 7:38 How to Fill Out a Crew Time Report (CTR) - YouTube YouTube Start of suggested clip End of suggested clip For the fire name. And block 5 the fire number. The information on the resource. Order needs to beMoreFor the fire name. And block 5 the fire number. The information on the resource. Order needs to be accurately transferred to the CTR.

When should a currency transaction report be filed?

A completed CTR must be electronically filed with FinCEN within 15 calendar days after the date of the transaction.

What transactions should a currency transaction report be filed on?

A bank must electronically file a Currency Transaction Report (CTR) for each transaction in currency1 (deposit, withdrawal, exchange of currency, or other payment or transfer) of more than $10,000 by, through, or to the bank.

Which of the following situations would require filing a currency transaction report?

A currency transaction report (CTR) is a bank form used in the United States to help prevent money laundering. This form must be filled out by a bank representative whenever a customer attempts a currency transaction of more than $10,000.

What is an example of a currency transaction report?

Transaction examples that necessitate a CTR A person deposits $11,000 in currency to his savings account and withdraws $3,000 in currency from his checking account. The CTR should be completed as – cash In $11,000 and no entry for Cash Out. This is because the $3,000 transaction does not meet the reporting threshold.

What happens when a currency transaction report is filed?

A currency transaction report (CTR) is used to report to regulators any currency transaction that exceeds $10,000. The CTR is part of anti-money laundering efforts to ensure that the money is not being used for illicit or regulated activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify omb no 1506 0064 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including omb no 1506 0064, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my omb no 1506 0064 in Gmail?

Create your eSignature using pdfFiller and then eSign your omb no 1506 0064 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete omb no 1506 0064 on an Android device?

Use the pdfFiller mobile app and complete your omb no 1506 0064 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is currency transaction report omb?

Currency Transaction Report (CTR) is a report form used by financial institutions to report certain cash transactions over $10,000 to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury. The Office of Management and Budget (OMB) assigns Control Numbers to government forms, including the currency transaction report form.

Who is required to file currency transaction report omb?

Financial institutions, such as banks, credit unions, and money services businesses, are required to file currency transaction reports (CTRs) with FinCEN for certain cash transactions over $10,000 conducted by their customers.

How to fill out currency transaction report omb?

To fill out a currency transaction report (CTR), financial institutions must properly identify the customer initiating the transaction, accurately record the details of the cash transaction, and include any other required information specified by FinCEN on the reporting form.

What is the purpose of currency transaction report omb?

The purpose of the currency transaction report (CTR) is to assist federal law enforcement agencies and intelligence agencies in detecting and preventing money laundering, terrorist financing, and other financial crimes.

What information must be reported on currency transaction report omb?

The currency transaction report (CTR) requires financial institutions to report information about the customer conducting the transaction, including their name, address, social security number or tax identification number, and details of the cash transaction, such as the amount, date, and nature of the transaction.

Fill out your omb no 1506 0064 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Omb No 1506 0064 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.