Get the free Business Direct Debit - SOCAR ENERGY Switzerland - socarenergy

Show details

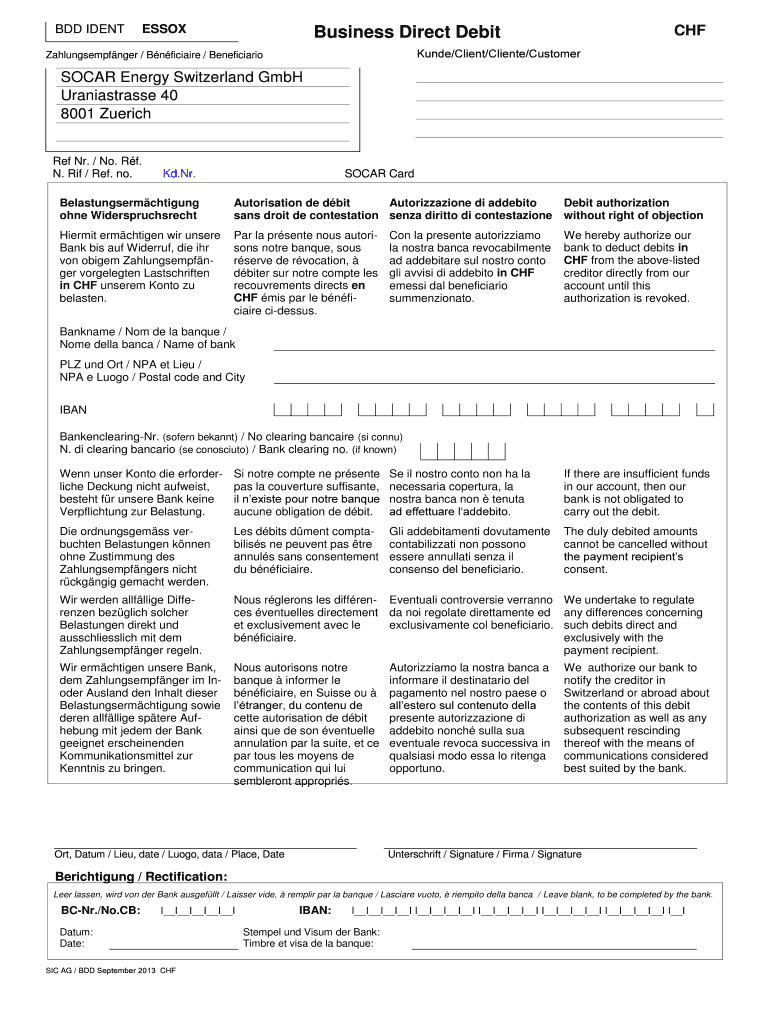

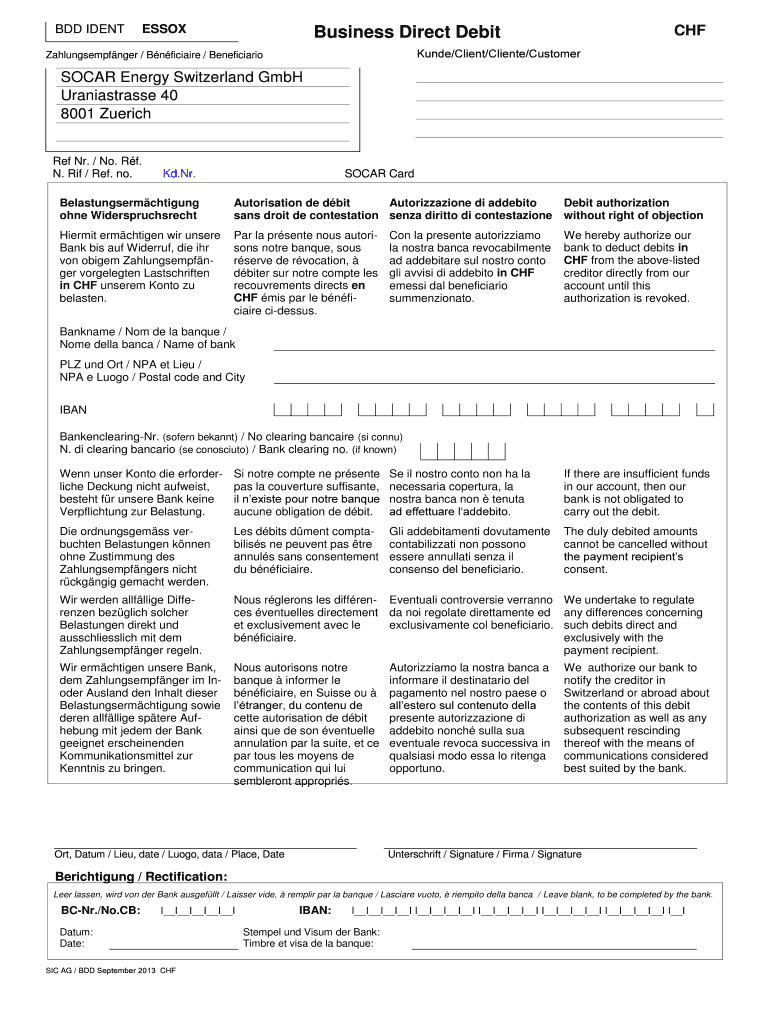

BDD DENT ESSEX CHF Business Direct Debit Under×Client×Client×Customer Zahlungsempfnger / Bnficiaire / Beneficiaries SOLAR Energy Switzerland GmbH Uraniastrasse 40 8001 Zurich Ref NR. / No. Rf.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business direct debit

Edit your business direct debit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business direct debit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business direct debit online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business direct debit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business direct debit

How to fill out business direct debit:

01

Gather necessary information: Obtain your business bank account details, including the account number and BSB (Bank-State-Branch) number. You will also need the name and contact details of your business.

02

Contact your bank: Get in touch with your bank to request the business direct debit form. They will provide you with the necessary form or guide you on how to access it online.

03

Understand the form: Familiarize yourself with the sections and requirements of the form. Take note of fields such as account details, authorization, and any specific instructions mentioned.

04

Fill in account details: Provide the relevant account details for your business bank account. Double-check the accuracy of these details to ensure a seamless direct debit process.

05

Authorization: Sign and date the direct debit authorization section. This indicates your consent for the bank to carry out direct debits from your business account. Read any terms and conditions associated with the authorization carefully.

06

Additional details: The form may require you to provide supplementary information about your business, such as trading name, ABN (Australian Business Number), or address. Fill in these details accurately.

07

Review and submit: Carefully review all the information you have provided on the form. Ensure that all the necessary sections are completed accurately. If submitting online, follow the instructions provided by your bank to complete the submission.

Who needs business direct debit:

01

Businesses that regularly receive payments from customers: If your business invoices customers and needs to collect payments on a regular basis, setting up a business direct debit can greatly streamline the payment collection process.

02

Subscription-based businesses: If your business operates on a subscription model, where customers are billed periodically, business direct debit can provide an efficient way to automatically collect recurring payments.

03

Service providers: Businesses offering ongoing services or contracts, such as consulting firms, maintenance services, or fitness centers, can benefit from business direct debit as it ensures a timely and automatic collection of payments.

04

Mitigating late payments: For businesses struggling with late payment issues, business direct debit can help mitigate this problem by allowing automatic deduction of funds from customer accounts on agreed-upon dates.

05

Improved cash flow: By implementing business direct debit, cash flow management becomes more predictable and efficient. Regular inflows of funds help enhance financial planning, allowing businesses to meet their obligations and make strategic decisions more effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business direct debit?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific business direct debit and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the business direct debit in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit business direct debit straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing business direct debit, you can start right away.

What is business direct debit?

Business direct debit is a payment method that allows businesses to automatically withdraw funds from a customer's account to pay for products or services.

Who is required to file business direct debit?

Businesses that want to offer direct debit as a payment option are required to file business direct debit.

How to fill out business direct debit?

To fill out a business direct debit, businesses need to provide their bank account information, customer details, and authorization to withdraw funds.

What is the purpose of business direct debit?

The purpose of business direct debit is to streamline the payment process for businesses and their customers by automating the payment collection.

What information must be reported on business direct debit?

Businesses must report their bank account information, customer details, and authorization to withdraw funds on a business direct debit form.

Fill out your business direct debit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Direct Debit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.